The Rise in Direct-to-Consumer Advertising of Prescription Drugs [News Roundup]

The Rise in Direct-to-Consumer Advertising of Prescription Drugs and other notes from around the interweb:

- The Rise in Direct-to-Consumer Advertising of Prescription Drugs. From the marketing of drugs with low-added benefit to manufacturers’ inability to follow FDA guidelines, direct-to-consumer advertising for prescription drugs has increased in the US and is beginning to raise alarms. “Under FDA guidelines, pharmaceutical companies are supposed to provide a balanced view of drugs in advertising in terms of their risks and benefits,” said Jenny Markell, BA, PhD Candidate of Health and Public Policy at the Johns Hopkins Bloomberg School of Public Health. “They’re supposed to avoid any misleading information. It’s illegal, for example, to overstate a drug’s benefits, misrepresent data from studies, or make claims that are not supported by adequate evidence.” However, even after FDA attempts of holding manufacturers accountable, drug companies continue to skew the country’s perceptions of specific prescription drugs.

- When middlemen own it all, patients pay the price. There’s mounting evidence that vertical integration drives up costs for patients and the government. A recent WSJ investigation showed PBMs are marking up the price of some specialty generic drugs dispensed at their specialty pharmacies by thousands of dollars. According to the FTC, pharmacies affiliated with the three largest PBMs made $1.6 billion on only two cancer drugs over the course of three years. Further, despite insurers and PBMs receiving significant rebates and discounts, often 50% or more, patients rarely benefit directly from these savings, according to the Congressional Budget Office’s Director of Health Analysis.

- Overcoming Biosimilar Utilization Barriers. “The opportunities with all of these biosimilars are that they have the ability to improve patient access, new starts, persistence and adherence,” said panelist Alex Mersch, PharmD, an assistant director of ambulatory specialty programs at University of Iowa Health Care, in Iowa City. “For many organizations, especially if we look at it from the inpatient side, there’s a lot of opportunity to decrease drug costs by [replacing the reference product with] the biosimilar.”

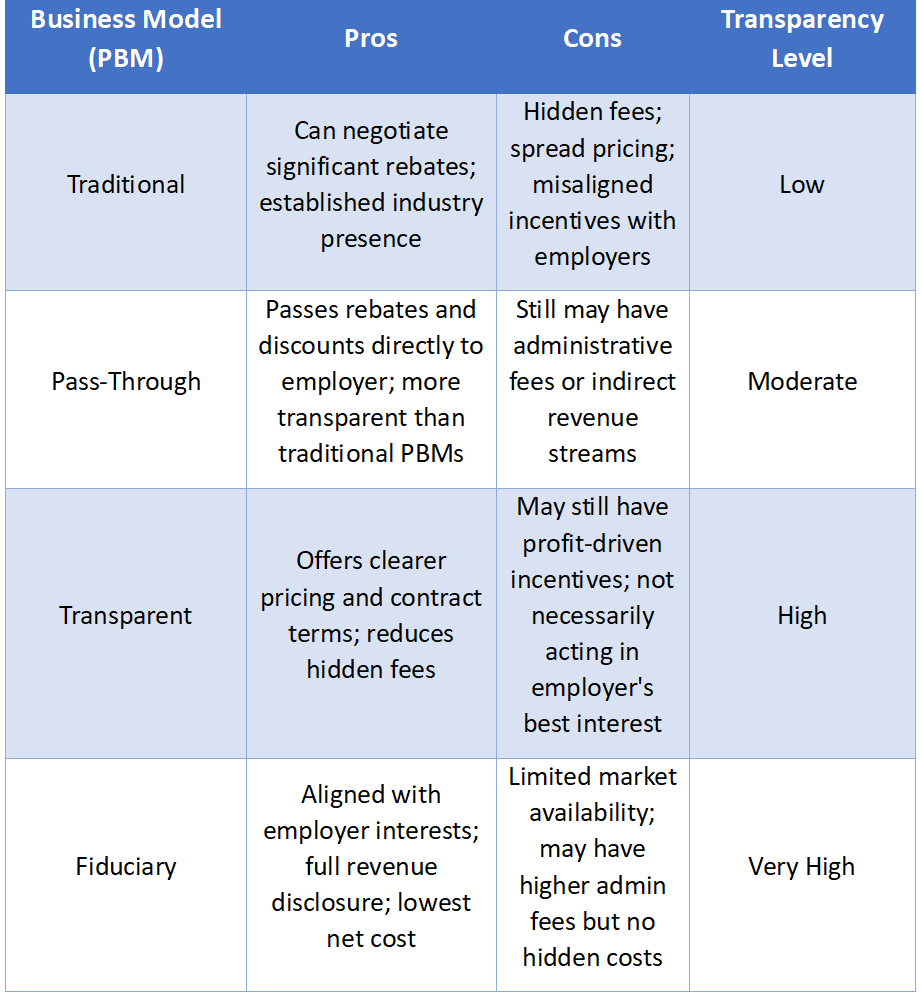

- Five ways to improve PBM procurement for clients. Nearly a decade ago, plan sponsors’ pharmacy benefit conversations focused mostly on member satisfaction and plan compliance. Today, fiduciary duty comes first, then member satisfaction, compliance and, of course, GLP-1s, which is why employers are counting on their benefit advisers more than ever to guide them through Rx matters. Times have changed, which begs the question, “What does it take to ensure plan sponsors meet their fiduciary duty?” Putting the pharmacy benefits manager (PBM) business “out to bid” every few years isn’t enough. Given heightened scrutiny of traditional PBMs and rising Employee Retirement Income Security Act (ERISA) liability risk, plan sponsors should regularly evaluate their PBM options, prioritizing strategies that lower total costs, improve member outcomes and safeguard long-term plan sustainability. However, issuing, evaluating, and managing requests for proposals (RFPs) from PBMs can be challenging.

Why TransparentRx Is Your Trusted Partner for Smarter Pharmacy Benefits

At TransparentRx, we specialize in delivering fiduciary pharmacy benefit management services that prioritize transparency, cost containment, and optimal patient outcomes. Our unique approach helps self-funded employers, benefits consultants, and health plan sponsors navigate the complexities of pharmacy benefits while reducing costs and enhancing care.

If you’re ready to take control of your pharmacy benefit strategy and eliminate hidden fees, contact TransparentRx today for a consultation. Let us help you achieve smarter, more effective benefits management.