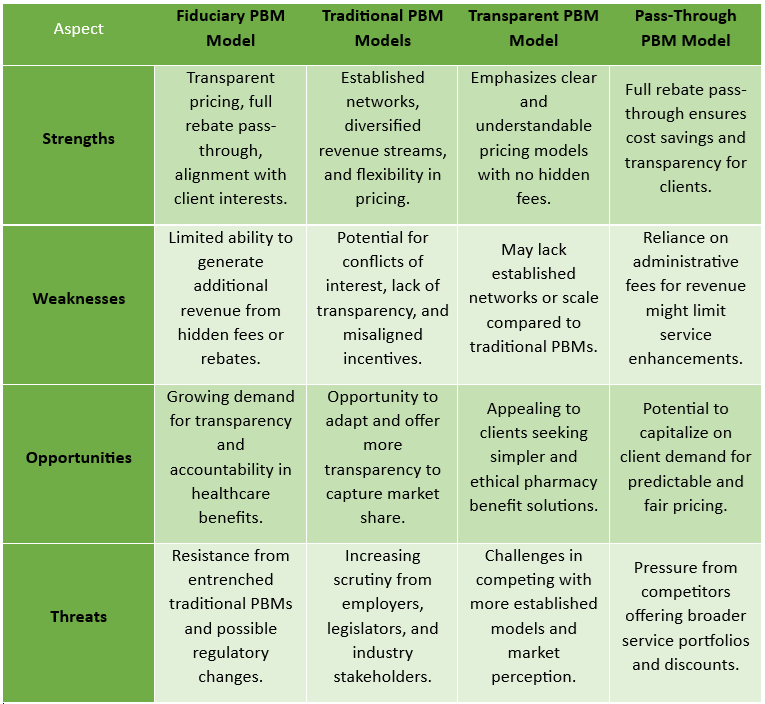

Mastering PBM Procurement to Control Costs and Maximize Value: A Guide for Directors of Benefits

The procurement of a Pharmacy Benefit Manager (PBM) is one of the most critical decisions a Director of Benefits can make. With pharmacy costs continuing to rise and PBM contracts often laden with opaque terms, a strategic and well-informed approach is essential. This playbook highlights key steps and common pitfalls to help employers align their pharmacy benefits with organizational goals while mastering PBM procurement to control costs and maximize value.

Recognizing the Signs of PBM Misalignment

A well-structured PBM arrangement should prioritize the employer’s financial interests and the health of plan members. However, many PBMs operate with conflicting incentives that drive up costs and limit transparency. Here are key warning signs that indicate your PBM may not be aligned with your organization’s goals:

- Failure to Uphold Fiduciary Responsibility – Instead of acting in the best interests of employers and plan members, some PBMs design contracts that maximize their own profits through hidden fees and opaque pricing structures.

- Rebate-Centric Decision-Making – Drug formularies should be designed around clinical value and cost-effectiveness. If your PBM prioritizes medications based on rebate potential rather than patient outcomes, you may be overpaying for high-cost drugs.

- Lack of Pricing Transparency – Employers should have a clear view of how much they are paying for each drug and where savings are generated. If your PBM makes it difficult to assess net drug costs or compare pricing across different drug classes, it may be time to reevaluate the contract.

- Inconsistent and Confusing Contract Terms – Without standardized language, comparing PBM contracts becomes difficult. Vague or complex terms often obscure key cost drivers and limit an employer’s ability to hold the PBM accountable.

- Rising Per Member Per Month (PMPM) Drug Costs – A well-managed pharmacy benefit should help control PMPM drug expenses. If your costs continue to rise without a clear justification, your PBM may not be actively working to manage spending effectively.

- No Consideration for Total Cost of Care – Pharmacy benefits should not be managed in isolation. A strong PBM strategy ensures that medication decisions contribute to overall healthcare cost reductions rather than simply shifting expenses to the medical side.

- Weak or Absent Utilization Management – Effective oversight of drug use is critical to prevent unnecessary spending. If your PBM lacks strong utilization controls or encourages higher-cost prescriptions without clinical justification, the plan may be paying more than necessary.

To secure a cost-effective and sustainable PBM partnership, Directors of Benefits must take a proactive, informed approach. A well-structured procurement process, combined with ongoing oversight, ensures that PBMs act in the employer’s best interest. Success in PBM procurement is about control. Employers must demand transparency, enforce accountability, and ensure that incentives are properly aligned. The question every benefits leader should ask is: Who is watching the watcher?

The Path Forward: A Smarter Approach to PBM Procurement

Directors of Benefits must take an active role in PBM selection and oversight to drive meaningful cost savings and improve outcomes for their organizations. By prioritizing transparency, eliminating misaligned incentives, and leveraging competition, employers can regain control over their pharmacy benefits and ensure their plan serves their employees—rather than their PBM.

If your PBM contract hasn’t been scrutinized recently, now is the time. The right approach can unlock millions in savings while ensuring better health outcomes for plan members.

Next Steps

- Review your current PBM contract for signs of misalignment.

- Engage an independent PBM expert to assess your pharmacy benefit strategy.

- Consider a revision of your RFP process to ensure your organization is getting the best value.

A well-structured PBM contract isn’t just about cost savings—it’s about protecting the financial health of your organization and ensuring employees have access to affordable, high-quality medications. Take charge today.

Partner with TransparentRx for a Fiduciary PBM Solution

At TransparentRx, we specialize in providing fiduciary PBM services that prioritize cost savings, transparency, and employer-aligned incentives. Our commitment to full financial disclosure, contract integrity, and proactive cost management ensures that your pharmacy benefit program delivers real value. Contact us today to learn how we can help you take control of your PBM strategy and achieve long-term savings without sacrificing quality of care.