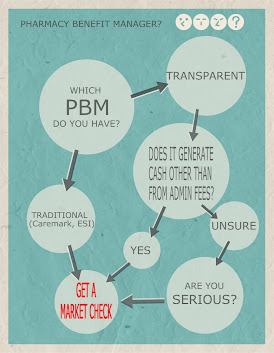

The PBM industry is saturated with different business models, each claiming to save plan sponsors money and improve pharmacy benefit plans. However, there is one crucial aspect that none of them openly share with employers: the amount of money they are making from their groups. Only fiduciary or radically transparent PBM models are willing to disclose this information. It’s time to face the reality that traditional, pass-through, and transparent PBM models are essentially the same, failing to reveal the true extent of the PBMs’ profits from servicing your group. A guide to identifying a pass-through pharmacy benefit manager (PBM) is provided below.

Consider this for a moment: the contracts between pharmacy benefit managers, pharmaceutical manufacturers and/or pharmacies are usually fixed. Unless a PBM significantly exceeds the terms of the contract, it remains unchanged until its expiration. For a PBM to outperform such a contract, it would require a substantial increase in the number of covered lives, for instance. This leads us to a crucial realization. When plan sponsors negotiate during renewal, they are essentially deciding how much of the secured discounts they will allow the PBM to retain.

The amount of revenue retained by the PBM is known as the service or management fee, which essentially represents the cost of the services provided by the PBM. These service fees heavily influence the per member per month (PMPM) or per employee per year (PEPY) costs. While rebates, and discount guarantees are important, they often serve as distractions, diverting purchasers’ attention from a key driver of their final plan costs—the PBM service fees. A trained eye is crucial as it possesses the expertise and discernment to recognize and interpret intricate contract details or nuances that may elude the untrained observer, leading to more accurate and insightful observations or judgments. Take our knowledge assessment to uncover where you stand.

It’s important not to confuse the service fee with the administrative fee. The service fee is the amount the PBM keeps as profit after settling its bills, while the administrative fee is usually a quantifiable fee per claim, per employee per month (PEPM), or per member per month (PMPM). However, the latter administrative fee I refer to is distinct from the manufacturer admin fee or rebate, which is a separate topic altogether. In many cases, non-fiduciary PBMs offer artificially low administrative fees, knowing well that accepting them essentially grants them a blank check for service fees.

Pass-through and transparent PBM models fail to disclose the actual amount of their service fees, which is a significant problem. Unlike administrative fees, service fees are not easily quantifiable, primarily because non-fiduciary PBMs intentionally keep this information hidden to conceal their impact on costs. On the other hand, PBMs that operate under a full-disclosure or fiduciary model willingly share the service fee or the portion of negotiated discounts they will retain with employers. The lower this fee, the less employers will pay—plain and simple. A fair PBM service fee can effectively curb cost trends. Non-fiduciary PBM companies have become adept at exploiting the purchasing power of unsophisticated plan sponsors to their financial advantage.

Many plan sponsors mistakenly focus on “AWP minus discount” and the “minimum rebate guarantee” as the key factors when evaluating PBM proposals. However, it is crucial for plan sponsors to examine the cash flows to the PBM. PBM cash flow, often overlooked, can have the most significant impact on final costs. Shifting the primary metric for evaluating PBM proposals to what employers pay the PBM, or the service fee, is a groundbreaking idea. A fiduciary PBM is willing to provide this level of transparency. If a PBM claims to be pass-through but fails to offer such transparency, it is, at the very least, presenting only half-truths. A guide to identifying a pass-through pharmacy benefit manager (PBM) must address the PBM earnings after cash disbursements or EACD.

There are two aspects that should be non-negotiable for purchasers of PBM services. First, full access to their own claims data, free of charge, via Secure File Transfer Protocol (SFTP). Additionally, it is imperative for employers to have full transparency regarding the fees they are paying to PBMs for the services they were hired to provide. In the words of Alvin Toffler, a renowned futurist, “The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn.” The Toffler quote emphasizes the significance of education as the logical and effective foundation for achieving exceptional outcomes in pharmacy benefit management services.