In an era where healthcare expenditures are skyrocketing, particularly due to the soaring prices of specialty medications, stakeholders across the spectrum are grappling with financial strategies to manage these burgeoning costs. This blog delves into the complexities surrounding the economics of healthcare, emphasizing the pivotal role of innovative insurance solutions in this ever-evolving landscape. Navigating the waters of stop-loss insurance requires a keen cost-management process and knowledgeable staff.

The healthcare industry is witnessing an unprecedented rise in the cost of specialty medications. These drugs, essential in combating various chronic and life-threatening conditions, demand extensive research and development, often targeting smaller patient populations. This necessity for intensive investment has led to these medications now representing a sizable portion of healthcare spending.

The Dilemma for Employers: Cost Containment Strategies

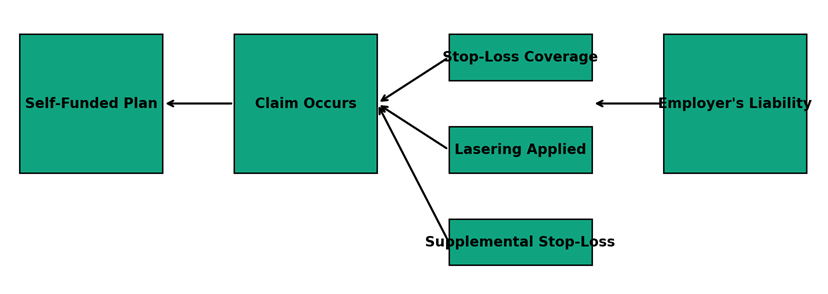

Employers, particularly those managing self-funded healthcare plans, face the daunting task of balancing quality healthcare provision with financial sustainability. Initiatives like patient assistance programs offer some respite, but the reliance on traditional stop-loss insurance reveals inherent shortcomings. This insurance, designed to mitigate large claim impacts, often falls short in offering long-term, comprehensive protection, particularly in managing the costs of specialty medications.

A critical aspect often overlooked in stop-loss insurance is ‘lasering’ – a practice where insurers exclude high-cost claims or claimants from coverage. This practice, while not directly affecting members due to continued benefits, leaves employers financially exposed. The implications are profound, especially when considering catastrophic drug claims that can escalate employer liabilities exponentially.

Imagine a company, XYZ Corp, operates a self-funded health plan for its employees. In a given year, an employee’s child is diagnosed with a rare illness requiring an expensive treatment costing $500,000. XYZ’s stop-loss insurance has a specific deductible of $200,000 per claimant, meaning the insurer will cover costs above this threshold.

However, mid-year, the insurer applies lasering to this claimant, increasing the specific deductible to $400,000 for the next policy year due to the high cost. Now, if the child’s treatment continues to be expensive, XYZ will be responsible for costs up to $400,000.

This is where supplemental stop-loss insurance comes in. It can provide coverage for the gap between the original specific deductible and the increased amount due to lasering. For example, it might cover costs between $200,000 and $400,000, protecting XYZ from bearing the full financial burden of this unexpected increase in healthcare costs.

Conclusion: Charting a Course through Complex Healthcare Financial Waters

As the healthcare industry continues to evolve, understanding and navigating the intricacies of healthcare economics becomes crucial. The rise in specialty medication costs and the challenges of traditional stop-loss insurance underscore the need for comprehensive, forward-thinking solutions. Supplemental stop-loss insurance stands out as a key strategy in this context, offering a safety net for employers and ensuring the sustainability of healthcare provisions.