Directors of Benefits and employee benefit brokers are under increasing pressure to deliver comprehensive, cost-effective strategies while maintaining exceptional outcomes for plan members. One of the most impactful ways to achieve this is by leveraging data from medical and pharmacy benefit claims. Data alignment is no longer optional—it’s essential for managing costs, optimizing plan performance, and meeting the needs of today’s self-insured employers. Directors of Benefits and employee benefit brokers must grasp how data is revolutionizing medical and pharmacy benefit decisions.

Why Data Alignment Is Crucial for Benefits Management

Medical and pharmacy claims data often exist in silos, creating blind spots in cost management and care strategies. For example, understanding the total impact of high-cost specialty drugs requires analyzing both medical (J-codes) and pharmacy benefits. Without alignment, it’s nearly impossible to identify patterns, optimize formulary decisions, or improve outcomes.

Aligned claims data allow benefits professionals to:

- Pinpoint Cost Drivers: See the complete picture of how certain drugs or conditions affect plan costs.

- Support Better Plan Design: Use integrated data to create benefits that balance cost control with member satisfaction.

- Deliver Strategic Insights: Provide employers with actionable recommendations based on real-world analytics.

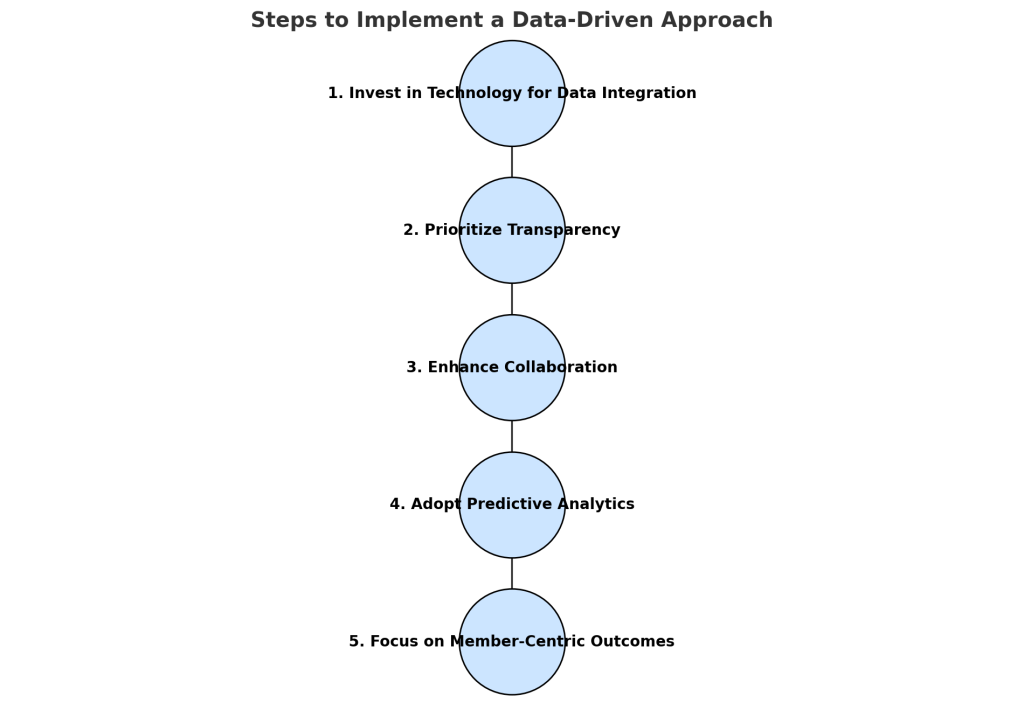

Implementing a data-driven approach to benefits management begins with investing in technology that integrates data from medical and pharmacy claims into a unified platform. This step is foundational, as it enables a comprehensive view of costs, utilization, and outcomes. Once the technology is in place, the focus shifts to prioritizing transparency, ensuring that all stakeholders—whether payers, brokers, or plan sponsors—can access and understand the data driving decisions. Transparency builds trust and allows for more informed discussions about cost-saving strategies and plan performance.

Next, fostering collaboration between medical and pharmacy benefit teams is essential. By breaking down silos, these teams can work together to identify patterns, improve member outcomes, and align strategies. The process continues with the adoption of predictive analytics to anticipate trends and costs, enabling benefits professionals to recommend proactive interventions. For example, predicting the impact of high-cost specialty drugs allows brokers to guide employers toward cost-effective solutions before expenses spiral out of control.

Finally, all efforts must converge on a member-centric approach that focuses on improving employee health and satisfaction. By aligning benefits with the needs of plan members—such as medication adherence programs or personalized interventions—employers can achieve better outcomes while controlling costs. As a result, this integrated, step-by-step approach not only enhances decision-making but also positions brokers and benefits directors as indispensable partners in delivering value to self-insured employers.

What Results Can Directors of Benefits and Brokers Expect?

By aligning medical and pharmacy claims data, benefits teams can achieve:

- Cost Savings: Unified data uncovers inefficiencies and opportunities for savings, such as moving high-cost J-code drugs from medical to pharmacy benefits, where discounts and management are more robust.

- Better Employer Retention: Employers want results. Offering aligned, data-driven strategies positions brokers as indispensable partners in their success.

- Improved Outcomes: Benefit strategies rooted in data lead to healthier, more productive employees and fewer costly interventions.

- Stronger Reporting: Unified data simplifies the process of meeting reporting requirements while providing powerful insights to employers.

Why It Matters for Brokers and Benefits Directors

As the healthcare landscape evolves, self-insured employers expect more from their benefits professionals. By driving discussions around data alignment and sustainable strategies, you can position yourself as a forward-thinking leader who delivers measurable results. Data isn’t just a tool—it’s your competitive advantage. Use it to design benefits that control costs, improve outcomes, and meet the demands of the modern workforce.