Navigating the world of pharmacy benefits can be complex, but it’s essential for those managing employee health plans. A key piece of this puzzle is understanding how formulary positions are decided. Formulary position refers to the placement of drugs on a list that determines how easily they can be accessed and how much they will cost. This placement can have significant cost implications for employers and employees alike. Here are three main points from the paper “The Market Design for Formulary Position” that are particularly relevant for employee benefit brokers and self-funded employers.

Formulary Position as a Market: How It Works

- Imagine the formulary position like a market where drug manufacturers (Pharma) bid for prime spots on the list. These spots are often managed by Pharmacy Benefit Managers (PBMs), who act as gatekeepers. The more favorable the position, the more likely a drug will be used, which means big business for Pharma companies.

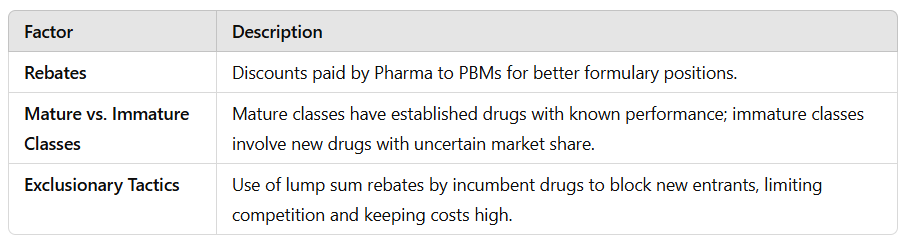

- This process is similar to an auction. Like Google’s ad placement system, where higher bids secure better ad positions, Pharma companies pay rebates (a type of discount given after a drug is sold) to PBMs for these prime formulary positions. The PBMs then decide which drugs to favor based on these rebates, expected demand, and other factors like drug effectiveness.

Impact on Costs: Mature vs. Immature Therapeutic Classes

- The paper explains that the way drugs are positioned can depend on whether the therapeutic class (the category of treatment) is “mature” or “immature.” Mature classes have a lot of competition with multiple drugs offering similar benefits, like different brands of painkillers. In these cases, PBMs have a history of how well these drugs work, which helps them make cost-effective decisions.

- For immature classes, where new drugs are just entering the market, things get trickier. There’s uncertainty about how well these new entrants will perform. This uncertainty gives established drugs (incumbents) more power because PBMs are hesitant to favor new drugs that might not meet demand, even if they are cheaper. This dynamic can keep prices high and limit the cost-saving potential of new competition.

Rebates and Exclusionary Tactics: A Double-Edged Sword

- Rebates can help lower the cost of drugs by incentivizing PBMs to choose certain drugs over others. However, the paper highlights that these rebates can also be used in ways that exclude new market entrants. Incumbent drugs might offer lump sum rebates, a large upfront payment to PBMs, to maintain their dominance and keep new competitors out.

- This practice can drive up the overall cost for employers and employees because it limits competition. Without competition, there’s less pressure on incumbents to lower prices. This can result in higher costs for health plans and, ultimately, higher premiums for employees.

Key Takeaway for Employers and Brokers:

Understanding the market dynamics of formulary positions can help you advocate for more cost-effective pharmacy benefits. By recognizing the strategies PBMs and Pharma companies use, you can push for formulary designs that prioritize not just rebates but also value and access, ensuring that your employees get the medications they need at a fair price.