Managing drug spend efficiently is no easy task. It requires quite a bit of time, effort, and skill to do it right. Anyone with business training can look at a P&L statement and determine whether a company made a profit. However, understanding the story behind the numbers requires a certain set of skills only a certified public accountant can provide, for example. The same can be said for medical and pharmacy benefit drug costs.

Pick anyone from HR, finance or procurement and they will tell you succinctly that prescription drugs are expensive. Ask these same professionals how to reduce costs without increasing employee cost share, restricting access, or trimming benefits and you’ll get crickets. You’re thinking, that’s why we hire brokers and consultants. I’ll let the note Michael Critelli, former CEO at Pitney Bowes, sent to me address that point.

“I am pleased that you wrote the particular essay I downloaded. Many corporate benefits departments do not understand that they are overmatched in negotiating with pharmacy benefit managers, as are the “independent consultants” who routinely advise them. The first step in being wise and insightful is admitting what we do not know, and you have humbled anyone who touches this field.”

For those interested in improving their company’s medical and pharmacy benefit drug cost performance and unafraid of unconventional concepts, here are 4 Little Known Ways to Optimize Drug Spend.

1) Dr. Sree Chaguturu, the chief medical officer for CVS Caremark, recently made this bold

recommendation, “

Combine coverage for all specialty medications—including those currently covered in the medical benefit—under the pharmacy benefit.” Regardless of the motivation behind the recommendation, Dr. Chaguturu is correct. There are some distinct advantages beyond the obvious potential for realizing lowest net cost. PBMs use utilization management (UM) programs to encourage the use of generics or preferred products, for example. UM is the unsung hero of an efficiently run pharmacy benefits management program. These programs are extremely limited in medical benefits which leads to

Fraud, Waste, and Abuse.

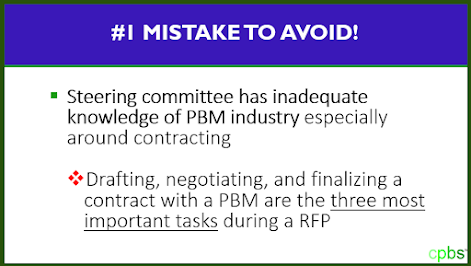

2) Put the contract front and center during your next RFP (request for proposal).

3) Move beyond simple spreadsheet analysis. When conducting a side-by-side claims analysis it is a disservice to plan sponsors when “best price” is calculated from a claim repricing report. Instead, the data must be viewed holistically. Ask yourself,

“if the plan were being managed efficiently, what would the final plan cost for this group have been?” A claims analysis or re-pricing looks primarily at retrospective pricing which is a good starting point but does not come close to telling the whole story. For example, it doesn’t usually consider poor product mix or bad utilization from which non-fiduciary PBMs intentionally profit. It’s not unusual for a legacy PBM’s management fee to be higher than your drug costs at the end of a plan year. This management fee is profit which is hidden in the final plan cost. Any cost analysis which doesn’t take into consideration the PBM’s management fee falls well short of telling the entire story.

4) Get PBM educated. “The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn,” wrote Alvin Toffler. Education is the most logical and effective foundation for achieving extraordinary results in pharmacy benefit management services. To improve on the job execution and career growth, benefits consultants, finance managers, procurement and HR professionals must expand their PBM knowledge beyond a functional role and understand exactly how each domain works together within the pharmacy distribution and reimbursement system. Don’t operate an inefficient employer-sponsored pharmacy benefit program.

Learn the intricacies of managing pharmacy benefits like a pro.