According to a study published by the National Bureau of Economic Research, drug copay coupons offer patients savings on prescriptions, but they significantly increase amounts paid by insurers and employers. Three economists analyzed data on net-of-rebate prices and quantities from a large pharmacy benefits manager. They found drug copay coupons increased quantities sold by 21-23 percent for the commercial segment relative to Medicare Advantage in the year after they were introduced, but they do not affect net-of-rebate prices.

The research team estimated coupons raise negotiated prices by 8 percent and result in about $1 billion in increased U.S. healthcare spending annually — just for multiple sclerosis drugs. Combined, the results suggest copayment coupons increase spending on couponed drugs without bioequivalent generics by up to 30 percent. A disturbing trend is patients aren’t required to present copayment coupons at the point of sale. In fact, many patients believe the plan is providing a discount.

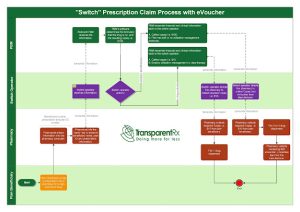

Brand drugmakers circumvent pharmacy benefit plan designs by offering eVouchers or electronic vouchers for expensive drugs at the “Switch.” The switch is what routes the third-party prescription claims to the PBM, or health plan associated with the prescription. Within seconds, the script leaves the pharmacy, goes to the switch, and then is received at the relevant PBM.

When the benefit design has soft UM or no utilization management protocols, such as mandatory generic enforcement, it allows drugmakers to bypass a tier 1 drug for a tier 2-4 drug or even worse a non-formulary drug, with eVouchers (see process flow diagram below). The two largest switch companies are RelayHealth and Change Healthcare.

There are two ways to prevent the scenario above from happening:

(1) PBM puts language into its contract with the Switch company, preventing the action.

(2) Benefit design maximizes the drug utilization management toolkit including prior authorization, step therapy and mandatory generic enforcement programs.

The first bullet point, PBM puts language into its contract, is unlikely to happen. Some PBMs want in on the action. Number two is sticky as many plan sponsors are hellbent on employees getting the drug they want without any scrutiny (i.e. step therapy). I don’t agree but it’s not my checkbook.

eVouchers, especially when supported with direct-to-consumer TV ads for high-cost brand drugs and soft utilization management protocols, are an expensive proposition for health plan sponsors yet lucrative one for brand drugmakers.