In pharmacy benefit management (PBM) competitive bidding processes, a broker or consultant identifies 3 – 10 pharmacy benefit managers and invites each to submit a proposal. The entire bidding process, from development of the request for proposal (RFP) packet to selection of the winning bidder, can take as little as a month to two years. The latter is reserved for larger clients such as unions, state, or federal plans. The conventional PBM RFP process is flawed read on to learn how to fix it.

The packet a PBM receives from a consultant as part of the RFP process can include claims data, census data such as date of birth, sex, name, dependent status, or address, and incumbent PBM contracts.  Once all bids are collected the consultant then plugs them into their in-house Excel spreadsheet or a third-party bid analyzer software platform. This is where the problems begin more on that in a bit.

Once all bids are collected the consultant then plugs them into their in-house Excel spreadsheet or a third-party bid analyzer software platform. This is where the problems begin more on that in a bit.

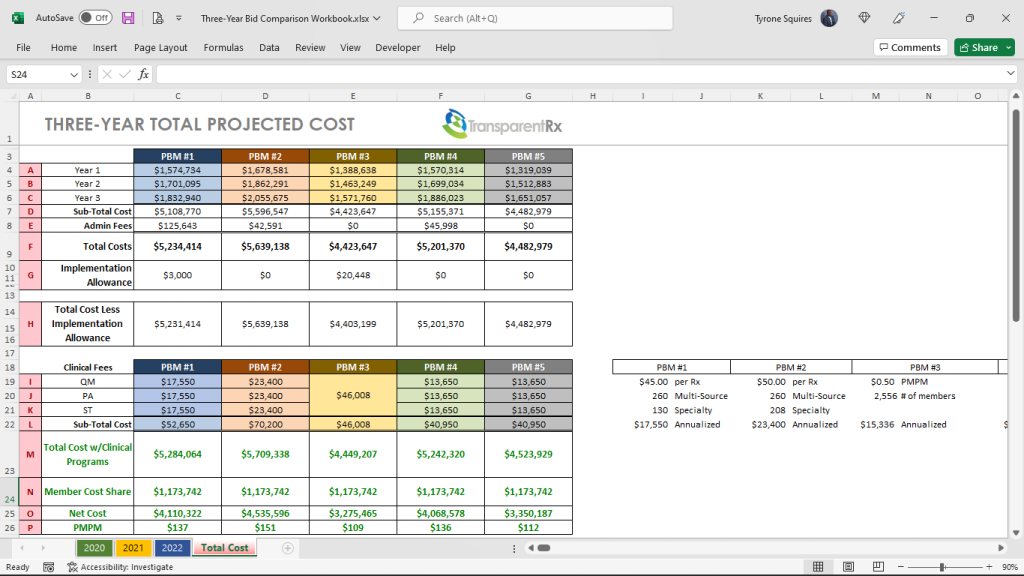

Figure 1 provides a glimpse into the pricing a consultant, CFO, or CHRO might look at when evaluating PBM bids. Financials are just one criterion others include but are not limited to:

- Accreditation support to pharmacy UM and Credentialing (5%)

- Clinical support services (15%)

- Explaining Differentiators (5%)

- Health support services, including data integration (10%)

- Implementation plan (10%)

- Member service capabilities (5%)

- Pricing and Transparency (50%)

Each criterion is usually scored, with a weighted average, based upon client needs. Since pricing is most important to the client in the example above, pricing weighs the heaviest (50%) in the final score. Because most evaluators in a PBM competitive bidding process are not experts, they tend to rely on what they know which is two is less than three. I wish it were that simple. Michael Critelli, former CEO at Pitney Bowes, sent me a message a few years back tackling this very point.

I’ve been teaching pharmacy benefits management for six years and just recently came to realize the forethought of his message. Michael wrote, “I am pleased that you authored the essay I downloaded. Many corporate benefits departments do not understand that they are overmatched in negotiating with pharmacy benefit managers, as are the “independent consultants” who routinely advise them. The first step in being wise and insightful is admitting what we do not know, and you have humbled anyone who touches this field.” There is a tidal wave of increased drug [specialty] spending on the horizon. One change will level set corporate benefits departments against pharmacy benefit managers at the negotiating table.

The one change corporate benefits departments or steering committees must make is to put the PBM contract at the front of the competitive bidding process and keep it there. It is unthinkable that many corporate benefits departments select a winning PBM bid before even looking at or finalizing the contract. The PBM services agreement sets the foundation for all the financials.

Staff, including legal, have inadequate knowledge of the PBM industry especially around contracting and driving meaningful transparency. Achieving optimal outcomes, cost and clinical, will be more effectively done by a trained eye with personal knowledge of the purchaser’s benefit and disclosure goals. Drafting, negotiating, and finalizing a contract with a PBM are the three most important tasks during an RFP. Here are some additional steps to take:

- Require consulting firms to have skilled staff working on the deal with extensive PBM knowledge. Twenty years of consulting experience, CEBS, SHRM-SCP, JD or PharmD alone doesn’t come close to fulfilling this requirement. Pharmacy benefits are more complicated than medical benefits. Verifying PBM knowledge will require third-party attestations such as CPBSTM.

- Require consulting firms to draft, negotiate, and finalize the PBM contract before a winner is announced.

- Conduct extensive legal negotiations memorializing increasingly better terms and prices; every PBM will have made some changes.

- Require consulting firms to sign disclosure forms identifying all PBM $$$ and relationships.

- Draft an entirely different contract that eliminates all loopholes including blanks for pricing terms & guarantees PBMs will fill in with their offers. In lieu, sign an agreement with a PBM who offers the full extent of ERISA fiduciary language.

The Conventional PBM RFP Process Is Flawed – Here’s the #1 Way to Fix It (Conclusion)

In figure 1 which financial bid is better? It is impossible to know, with any degree of certainty, without first conducting an expert review of the contract starting with the definitions. PBM financial proposals are easily diluted with opaque contract language. The winning PBM can easily explain your YOY costs increasing by blaming new high-cost claimants, for instance. Furthermore, large PBMs have staff analysts whose primary responsibility is to pull levers left available to them, via opaque contract language, taking margins from 10% to 30% of your final plan cost. If a plan spends $10,000,000 on pharmacy benefits, $3,000,000 of that spend should never be attributable to the PBM’s management fee or take home. A lack of meaningful transparency should be a dealbreaker. The #1 way to fix the conventional PBM RFP process is to make the PBM contract the most important part of the competitive bidding process. PBM services, while especially important, have been commoditized, don’t treat them like the Hope diamond.