Idioms like “hang your hat on” come in handy when you write or talk a lot. One of my other favorites is talk is cheap. Having the right information, however, is invaluable when you know how to interpret it and then create a plan. Where pharmacy benefits are concerned, look no further than these 6 PBM performance metrics for your competitive advantage.

In her book, Competitive Intelligence Advantage, Seena Sharp wrote, “Companies often downplay intelligence, believing their competitors to have access to the same information. Well, everyone also has access to a wide array of fruits and vegetables, yet many don’t eat them or eat very few. Access does not translate into action. Your competitive advantage includes executing good analysis of the right information and then figuring out what all of this means for your company…Those who seize the opportunity and develop an effective plan that can be accomplished have a significant competitive advantage.”

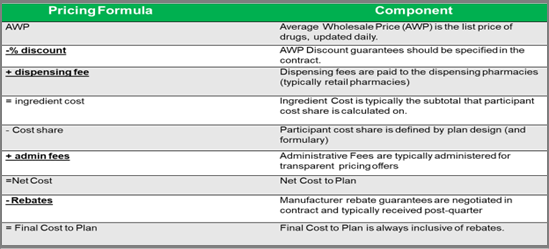

- BER (Brand Effective Rate) means the average percent discount off the AWP for all brand drugs (as determined by a price reporting service such as Medispan) for each reporting period i.e. monthly, quarterly etc. Break out by channel i.e. retail 30, specialty etc. and don’t permit any cost offsets. Cost offsets permit performance overages in one channel to be added to underperformance in a different channel. Goal > 18%.

- GER (Generic Effective Rate) is the average percent discount off the AWP for all generic drugs whether reimbursed at MAC, usual and customary pricing, or AWP discount. Because nine out of ten dispensed drugs are generic, the GDR performance metric is especially important. It can be difficult to catch where you are losing money until it is too late. You want to catch overpayments early enough to make the proper adjustment(s). Continuously monitor your GER so any overpayments to PBMs don’t pile up. Analyze performance by channel i.e. retail 30, retail 90 etc. Goal > 88%.

- GDR (Generic Dispense Rate) or generic dispensing ratio is the number of generic fills divided by the total number of prescriptions. GDR is a standard performance metric on which our formulary managers are regularly evaluated. For every 1% increase in GDR a plan can expect to realize a 2.5% reduction in gross drug spend. Both GDR and GSR are indicators of how well clinical programs are performing. For example, loose utilization management will produce a low GDR. Goal > 90%.

- GSR (Generic Substitution Rate) is the rate at which generic drugs are dispensed in place of their brand equivalents. To calculate GSR, divide the number of generic drug prescriptions by the total of all multisource prescriptions (both generic and multisource brand). Goal > 97.5%.

- MER (MAC Effective Rate) is the average percent discount off the AWP for drugs processed by the MAC list to be applied to your organization. MAC lists are proprietary to each PBM, so MAC’d drugs and their corresponding prices are set by PBMs. MAC or maximum allowable cost is used to establish an upper limit the PBM will reimburse a pharmacy and subsequently bill its clients for branded drugs and their multi-source and authorized generics. Non-fiduciary PBMs can have multiple MAC lists. For brokers and consultants, MER is an excellent way to compare how MAC lists perform for multiple pharmacy benefit managers. Goal > 90%.

- PMPM (Per Member Per Month) is the most fundamental cost indicator for financial benchmarking in pharmacy benefits. As such, every proposal should include a projected PMPM. Additionally, incumbent PBM cost performance should be measured by change in PMPM YOY for both whole dollars and percentage. It is calculated by dividing the total annual cost or revenue by the number of member months. Goal < $100 PMPM.

Conclusion – 6 PBM performance metrics

Each goal provided above assumes clean claims. In other words, all claims are included and there are no reclassifications of any drugs. When running a comparative PBM analysis, make sure you are comparing apples to apples. PBMs are notorious for reclassifying drugs, reducing claim counts and other tricks to make their numbers look better than how they performed. The Pharmacy Benefit Manager Transparency Act of 2022 could very well be the first stage of failure for bad actors. It targets the profits of non-fiduciary pharmacy benefit managers. Is this game over?