Your PBM Isn’t Just Overbilling. It May Be Billing Your Plan for Illegal Drugs.

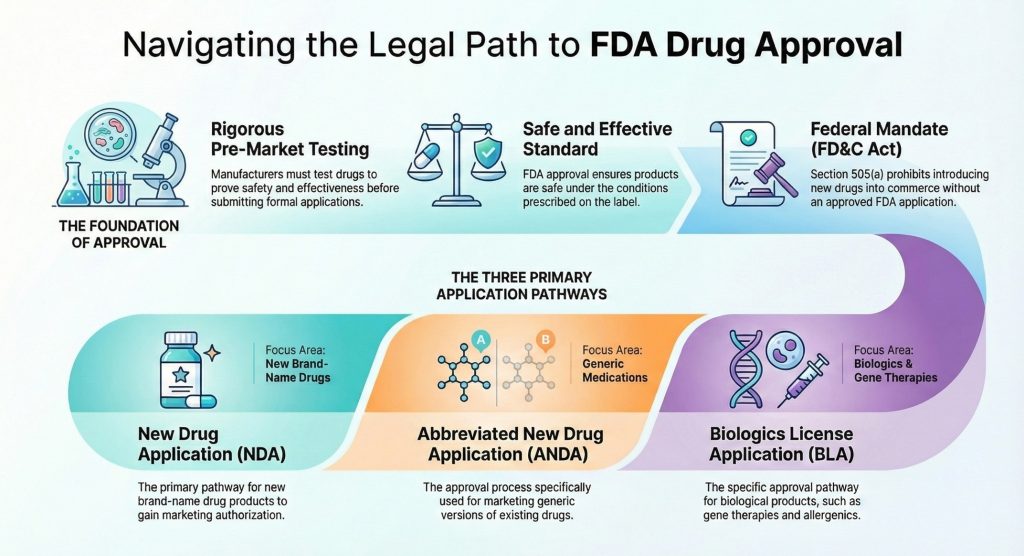

Most people involved in benefit governance assume a basic safeguard exists in pharmacy benefits: if a drug adjudicates through the PBM system and carries a National Drug Code, it must be FDA approved. That assumption feels reasonable, but it is incorrect. Federal law requires that prescription drugs marketed and sold in the United States be approved by the FDA for safety and effectiveness under the Food, Drug, and Cosmetic Act (1). Drugs that bypass that process are considered illegally marketed, even if they appear in commercial drug databases or process cleanly through PBM claim systems. The FDA has been explicit that assignment of an NDC does not indicate FDA approval (2).

Despite this, unapproved drugs continue to be paid for by both public and private health plans. This is not a theoretical concern or a fringe compliance issue. It is a documented pattern that persists largely because it remains invisible within traditional PBM reporting, eligibility rules, and audit frameworks.

A federal oversight review by the U.S. Department of Health and Human Services Office of Inspector General found that Medicaid reimbursed for hundreds of drugs that were not FDA approved in a single year, totaling tens of millions of dollars (3). The same review identified additional drugs where approval status could not be confirmed due to gaps or inconsistencies in FDA listings, creating further exposure. Medicaid operates with statutory definitions, rebate oversight, and federal review requirements. Commercial and self-funded plans operate with far fewer guardrails.

This is where the issue becomes relevant for brokers, consultants, benefit directors, and steering committees. PBMs rely on third-party drug compendia and manufacturer-submitted data to determine claim eligibility. Inclusion in those systems does not equal FDA approval. The FDA has repeatedly warned that many unapproved drugs carry NDCs and continue to be marketed, prescribed, and dispensed without having undergone FDA review for safety, effectiveness, manufacturing quality, or labeling accuracy (4).

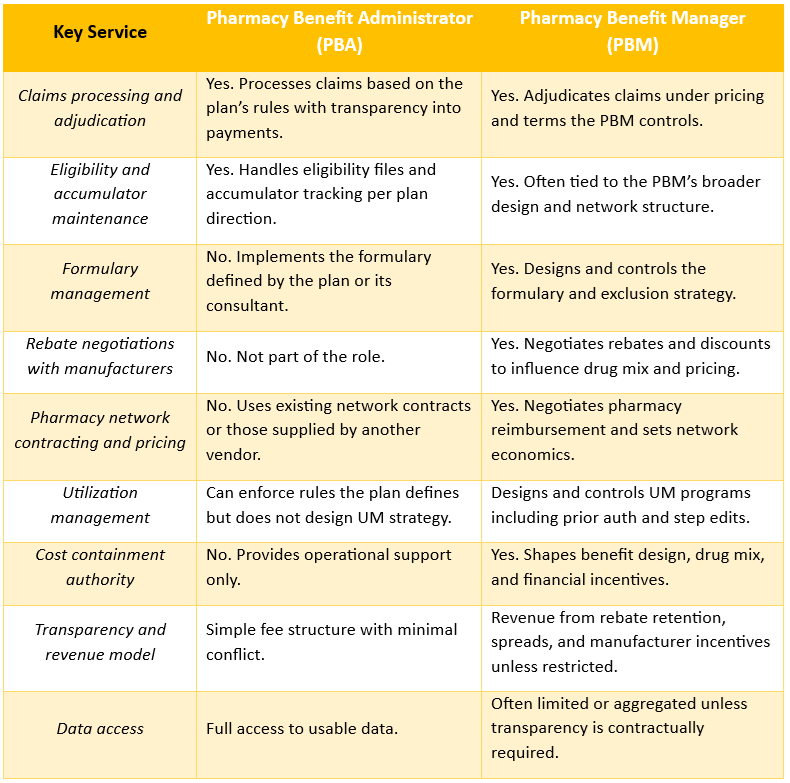

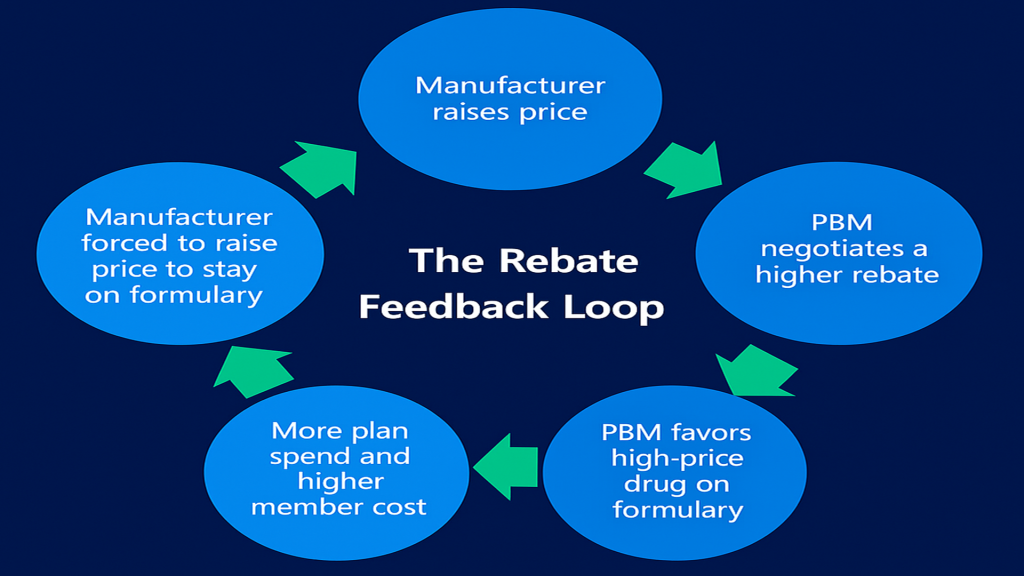

The persistence of this issue is not hard to explain. In the traditional PBM model, no party is contractually required to verify FDA approval status at the claim level. Most PBM agreements are silent on it. Most audits never test for it. Most plan fiduciaries are never told it exists as a risk. Claims adjudicate as expected, reports reconcile, and the assumption of compliance goes unchallenged.

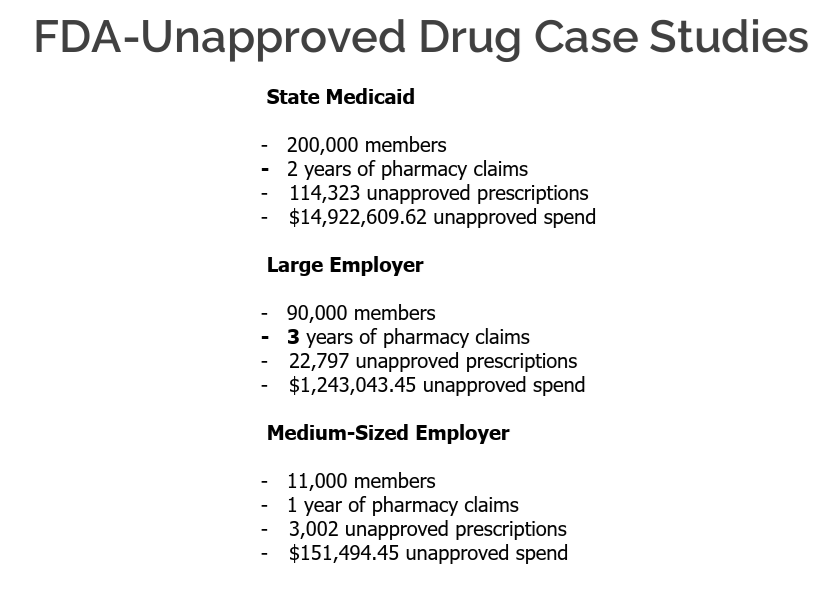

When plans do look, the findings are consistent. Independent audits and compliance reviews across employer plans, unions, and public entities routinely identify a small but meaningful percentage of claims tied to non-FDA-approved drugs. This is often confused with the separate reality that high-cost specialty medications drive a disproportionate share of pharmacy spend. Those are not the same issue. Specialty drugs account for the familiar statistic that one to two percent of prescriptions can drive thirty to forty percent of total drug spend. Non-FDA-approved drugs usually represent a smaller dollar amount, but they introduce a different and more fundamental risk.

From a patient safety perspective, these drugs have not been reviewed by the FDA for clinical effectiveness, manufacturing standards, or accurate labeling. The agency has documented cases of patient harm tied to unapproved drugs and has stated clearly that their continued marketing poses public health risks (4). From a compliance standpoint, federal law prohibits introducing unapproved drugs into interstate commerce, and public programs define covered outpatient drugs as those approved by the FDA, with narrow statutory exceptions (1, 5).

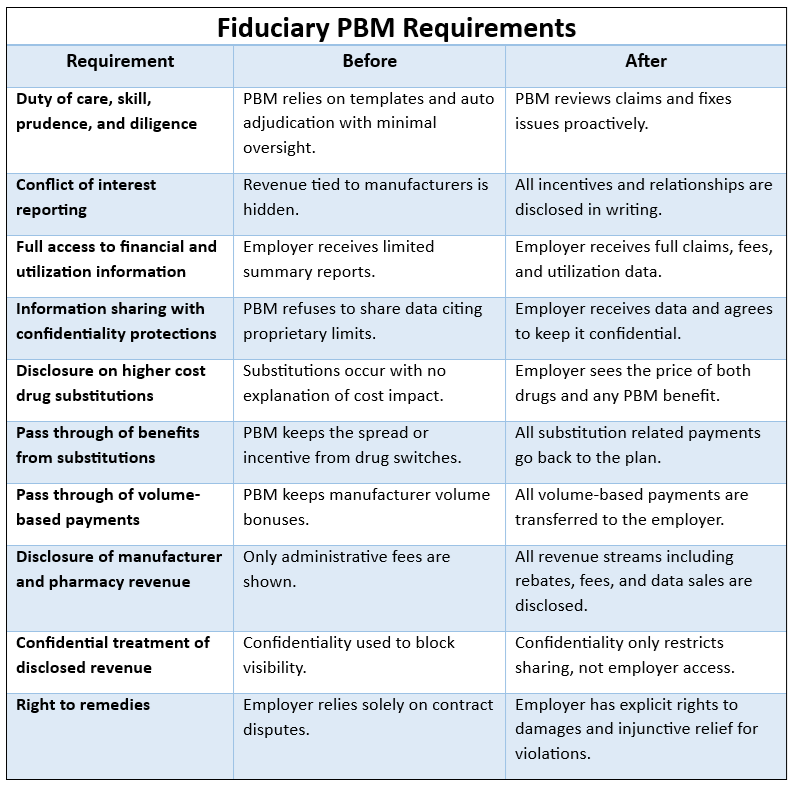

There is also a fiduciary dimension that benefit committees should not dismiss. Once a plan sponsor becomes aware that its pharmacy benefit may include drugs that should not legally be marketed or reimbursed, continued reliance on a PBM process that does not address that risk becomes harder to defend under a prudent oversight standard. This is not about intent. It is about governance and reasonable controls once the issue is known.

This is not an indictment of PBMs. It is an acknowledgment of a longstanding blind spot in pharmacy benefit oversight. PBMs adjudicate claims based on the rules and eligibility criteria they are given. If FDA approval status is not part of those rules, it is not checked. That gap persists unless plan sponsors and their advisors insist on closing it.

For benefit professionals advising fiduciary committees, the takeaway is straightforward. FDA approval should not be assumed. It should be verified. If a PBM cannot clearly explain how it identifies and excludes non-FDA-approved drugs, that is not a technical oversight. It is a governance gap with legal, financial, and patient safety implications. Ignoring the issue does not make the exposure disappear. It only ensures that when the question is eventually raised, the answer will be uncomfortable.

References

(1) Food, Drug, and Cosmetic Act, 21 U.S.C. § 355(a)

How We Can Work Together

Whether you’re a plan sponsor trying to get control of pharmacy spend, or a broker guiding clients through PBM decisions, education is the fastest way to improve outcomes. If you want a focused, high-value session your team can actually use, here are several ways we can work together.

Option 1: Get Certified

American College of Benefit Specialists (ACoBS) equips benefits professionals with practical knowledge across pharmacy, medical, retirement, and voluntary benefits. Organizations working with ACoBS-certified consultants gain better plan oversight, stronger vendor accountability, and more disciplined cost control. The certification signals a clear commitment to fiduciary guidance and protecting plan assets.

Option 2: Book a Webinar

A clean, educational session for employers, brokers, or TPAs. We’ll cover the most common PBM profit tactics, how to spot contract red flags, and what a fiduciary standard of care looks like in pharmacy benefits. Great for client education and thought leadership.

Option 3: Join the Virtual Roundtable

Bring your internal team (HR, Finance, and Benefits) or your broker group. I’ll lead a live discussion focused on PBM oversight, cost drivers, and what to ask your PBM right now. You’ll leave with a short action list you can use immediately.

Option 4: Get a Quote

When a PBM change is on the table, the RFP process should surface more than just headline pricing. We participate in RFPs to provide full transparency into costs, guarantees, and alignment so plan sponsors can make informed, defensible decisions.

Choose your session type and reserve your date to get clear, fiduciary guidance your team can rely on for pharmacy benefits decisions this week.