The Four Essential Ingredients of Pharmacy Benefit Plan Design

Designing a pharmacy benefit plan is a lot like making a great pizza. Without the cheese, sauce, or pepperoni, the whole experience falls apart. Each ingredient plays a distinct role, and together they make something both satisfying and complete. The four essential ingredients of pharmacy benefit plan design form the base of every effective plan: access, cost-containment, outcomes and safety, and cost-shifting. Leave one out and your plan risks being costly, inefficient, or unsafe for members.

Access: Defining the Foundation

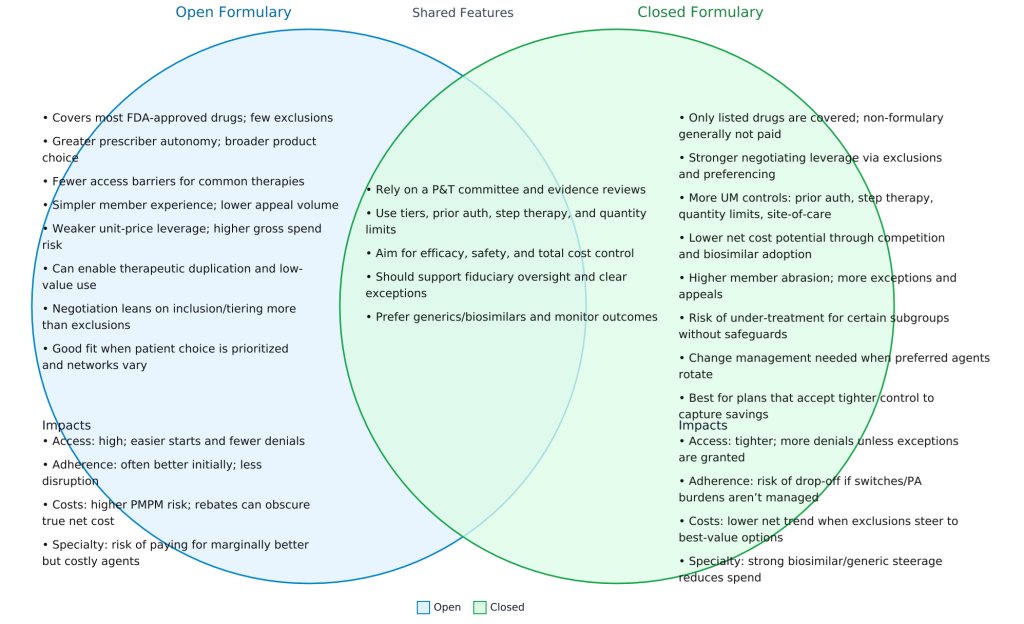

Just like the dough is the base of every pizza, access is the foundation of every pharmacy benefit. It defines what is and is not covered, how members access their prescriptions, and under what conditions. Access decisions determine:

- Which drugs are on the formulary and which are excluded

- Requirements for prior authorization

- Cost-sharing rules, including copays, deductibles, and benefit maximums

- Mail-order availability including international

- Quantity and frequency limits

Without clear access rules, members and providers face confusion and costs can quickly spiral. Properly managed access ensures fairness, consistency, and predictability in coverage.

Cost-Containment: Encouraging Smarter Choices

If access is the dough, cost-containment is the cheese. It binds the plan together and keeps expenses from spilling over. Cost-containment strategies guide members toward safe, effective, and lower-cost alternatives. This includes:

- Mandatory use of generics when available

- Incentivizing preferred products

- Encouraging over-the-counter substitutions where appropriate

A value-based formulary and generic-first approach help align prescriber behavior with the plan’s financial goals. Employers who neglect this ingredient often pay more for the same therapeutic outcomes.

Outcomes and Safety: Ensuring Quality

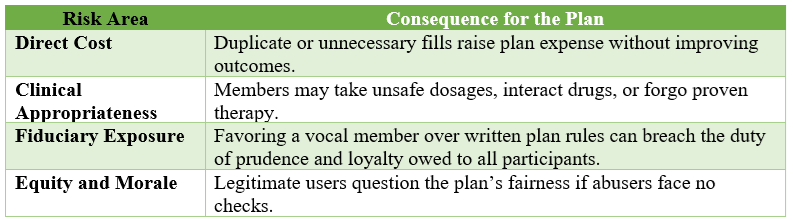

The sauce makes a pizza flavorful, but it also needs balance. In the same way, outcomes and safety ensure the plan is not just affordable but also effective and protective. This component excludes products that do not contribute to member health or pose risks of abuse, such as opioids, benzodiazepines, cosmetic drugs, or appetite suppressants in certain contexts.

Safety measures also include formulary design that avoids coverage of unnecessary or harmful therapies while prioritizing those that deliver proven health outcomes. This ingredient protects both the financial integrity of the plan and the health of the members.

Cost-Shifting: Sharing Responsibility

Pepperoni gives the pizza its punch, and cost-shifting gives plan sponsors the ability to align incentives. Members who choose higher-cost drugs when lower-cost alternatives exist bear more of the financial responsibility. For example:

- Higher copayments for branded drugs when generics are available

- Increased cost-sharing for non-preferred products

This is not about penalizing members. It is about fairness. When members opt for costlier care without added clinical value, they should share in the cost. Properly structured, cost-shifting encourages members to make value-conscious decisions.

Bringing It All Together

Access, cost-containment, outcomes and safety, and cost-shifting are the four essential ingredients of pharmacy benefit plan design. They must be present and balanced to protect both the financial health of the plan and the physical health of members.

Is your current plan missing one of these ingredients? If so, it may be costing your organization far more than you realize. Now is the time to evaluate your pharmacy benefit plan and ensure all four are baked into the design.

Elevate your expertise in pharmacy benefits management with the Certified Pharmacy Benefits Specialist® (CPBS) program, sponsored by the UNC-Chapel Hill Eshelman School of Pharmacy. Whether you’re an HR leader, finance executive, consultant, or pharmacist, this certification provides the in-depth knowledge and strategic insight needed to manage pharmacy benefits with confidence and cost efficiency. Gain up to twenty continuing education credits, enhance your career prospects, and help your organization take control of pharmacy spend. Register today to join a growing network of professionals shaping the future of pharmacy benefits management. Learn more at the Pharmacy Benefit Institute of America.