|

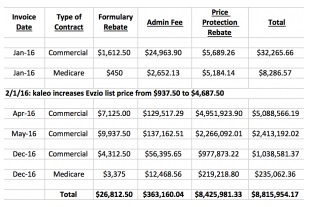

| Table 1: Revenue Going from Drugmaker, kaleo, to Express Scripts for a Single Drug |

But over time they became just another special interest. In the 1990s, some of the biggest PBMs were acquired by drug companies, creating conflicts of interest that led to federal orders for divestment. The next phase was a wave of mergers and acquisitions within the field, followed by acquisitions by insurers and pharmacy companies — CVS acquired Caremark, then the biggest PBM, in 2007 and UnitedHealth merged CatamaranRx, then the fourth-largest PBM, into OptumRx in 2015.

The position of the three major PBMs at the center of the drug distribution system appears to be unassailable for now. Last year CalPERS, California’s public employee benefits system, awarded OptumRx a five-year, $4.9-billion contract to manage prescriptions for nearly 500,000 members and their families enrolled in non-HMO health plans. The only other finalists in the bidding were CVS Caremark and Express Scripts.

Express Scripts reported profit of $3.4 billion last year, up 34% from 2015, on $100.2 billion in revenue, down slightly from $101.8 billion in revenue the year before. OptumRx reported operating profit of $2.7 billion last year, up from $1.7 billion the year before. CVS doesn’t break out its PBM financials.

Today the firms extract billions of dollars in price concessions from drug companies eager to remain in their good graces (see table 1). The drugmakers’ goal is to secure spots on the PBMs’ formularies, the rosters of approved drugs the PBMs maintain for their health plan clients. To do so, the drugmakers offer PBMs rebates for each prescription filled and agree to a dizzying list of other fees. The PBMs say that since most of those rebates and fees are passed on to health plans and subsequently to patients, they fulfill their promise to reduce drug costs all along the line.

But no one can be sure that’s really happening, because the size of the rebates and the degree to which they’re passed along is guarded by the PBMs as trade secrets. Each PBM contract for each health plan, moreover, is concealed from other health plans.

“The PBMs are sitting at the center of a big black box,” says Linda Cahn, a drug pricing consultant to health insurers. “They’re the only ones who have knowledge of all the moving pieces.” Among the murky areas are how much in rebates and other fees the PBMs collect from drug companies, and what share gets passed on to health plans.

Whatever the pass-through, critics say the rebate process forces up prices. “It’s not a secret anymore

that the drug companies are just raising prices to pay for the rebates,” says Derek Loeser, a Seattle lawyer who filed the Los Angeles lawsuit and others around the country making similar allegations.

[Source]