The Real Problem with PBM Spread Pricing

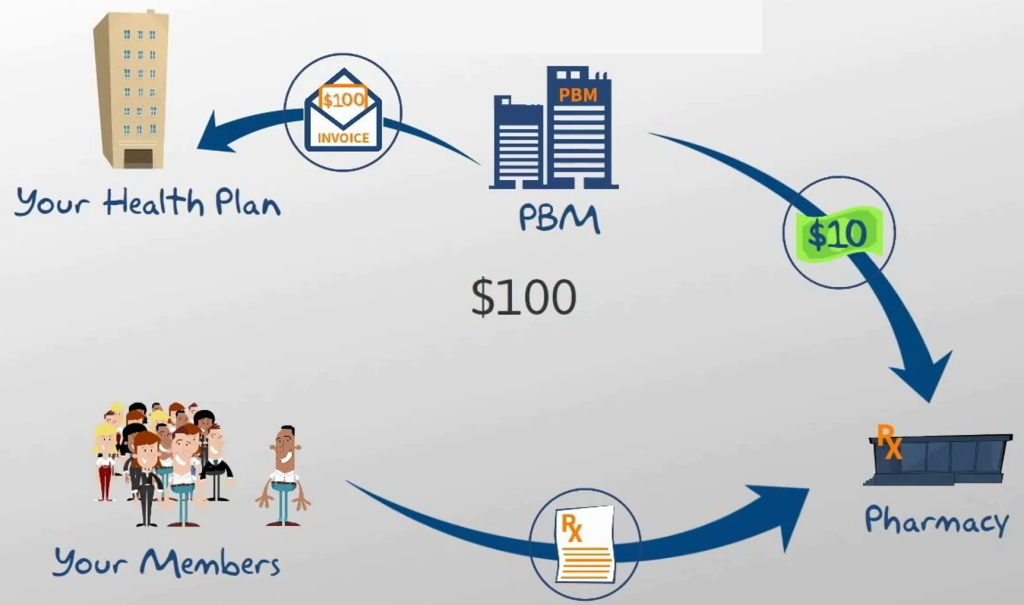

Many plan sponsors discover too late that one of the biggest drivers of their pharmacy spending isn’t the price of the drugs themselves. It’s the hidden margin between what the PBM bills to the plan and what it pays the pharmacy, known as spread pricing. The trouble starts in the RFP process, where cost comparisons often appear clean and straightforward on paper. In reality, three challenges make it difficult to pinpoint true costs thus the real problem with PBM spread pricing.

- Opaque Language

A Director of Benefits once confided that her initial pricing proposal seemed too good to be true. The PBM’s bid boasted impressive discount guarantees, but the contract’s language was vague on how those savings would be passed through. Later, she learned that pharmacy claims were paid at a lower rate than what the plan was billed, with the PBM pocketing the difference.

- Focus on Discounts or Price Benchmarks Over Net Cost

A CFO reviewing multiple PBM bids noticed they focused on discount guarantees: “AWP minus X%” for brands and “MAC price” for generics. The spreadsheets looked competitive, but he never found a clear statement of net costs. Months into the contract, the weekly invoices revealed that true costs for high-volume generics kept creeping up. The CFO realized that the “savings” factored into the spreadsheets didn’t show how spreads were adding to the final bill.

- Contract Complexity

One employee benefits consultant described a convoluted 40-page PBM agreement where terms like “House Generics” and “Brand Base Guarantee” were buried. This made it tough to reconcile how much the PBM paid pharmacies with what the plan owed. By the time they uncovered discrepancies, it was clear the spread fees were much higher than expected.

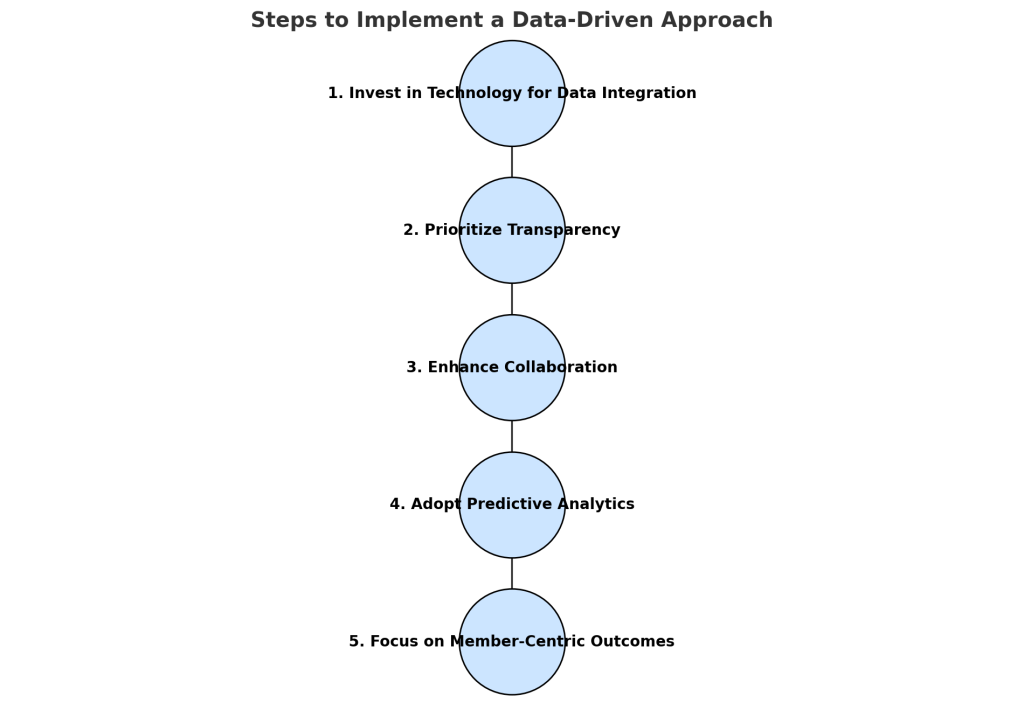

How to Address PBM Spread Pricing Challenges

- Insist on Pass-Through Pricing

Require that all negotiated rates, including post-adjudication, flow directly to your plan. If a PBM pays a pharmacy $10 for a claim, your plan pays the same $10, not $100. Ask that every RFP explicitly confirms whether the PBM guarantees this standard.

- Continuously Monitor Claims and Terms

Check whether the PBM’s invoiced claim file aligns with what the pharmacy actually received. Audits don’t have to be a headache when conducted regularly or paired with automation. If something doesn’t match the agreement, bring it up immediately.

- Work with a Fiduciary PBM

A fiduciary PBM won’t profit from spread or undisclosed fees. The PBM’s commitment ensures that you see the true cost of each prescription. The fiduciary model also builds trust and transparency, so you can accurately plan and manage costs without worrying about hidden margins.

It’s possible to stop paying for spreads you didn’t sign up for. Clarity in contracts, regular checks on performance, and partnering with a PBM that truly aligns with your goals can remove the guesswork and give you more control over your pharmacy benefits.