Take Back Control: Navigating PBM Profit Tactics with Confidence

For years, Pharmacy Benefit Managers (PBMs) have controlled the narrative around prescription drug costs, operating behind a veil of secrecy. But self-insured employers, brokers, and consultants have the power to rewrite that story. Watch “Navigating PBM Profit Tactics” to uncover strategies for managing costs and driving transparency in pharmacy benefits.

During a recent webinar, Tyrone Squires, a visionary in pharmacy benefit management, shed light on the practices that drive up costs and provided actionable strategies to help organizations take control. If you’ve ever felt frustrated by rising pharmacy expenses or wondered where your dollars are truly going, this session is your road map to clarity and empowerment.

Unmasking PBM Profit Strategies

PBMs are masters of complexity, employing tactics that often go unnoticed until it’s too late. Here are a few common practices they use:

- Spread Pricing: PBMs charge employers more for drugs than they reimburse pharmacies, pocketing the difference.

- Rebate Retention: Instead of passing savings to employers, PBMs keep significant portions of manufacturer rebates.

- Hidden Fees: Contracts with vague language allow for fees that inflate overall costs.

But these tactics are not inevitable. By understanding how they work, you can uncover hidden revenue streams and redirect them toward meaningful healthcare investments.

Why Fiduciary PBMs Are Game-Changers

Imagine a PBM that works for you, not the other way around. That’s the promise of the fiduciary model—an approach built on transparency and aligned incentives. Fiduciary PBMs commit to acting in their clients’ best interests, offering:

- 100% rebate pass-through.

- Clear, simple contract terms.

- Fee structures that prioritize value over volume.

With a fiduciary PBM, you’re no longer at the mercy of opaque practices. You’re in control, making decisions that align with your organization’s goals and values.

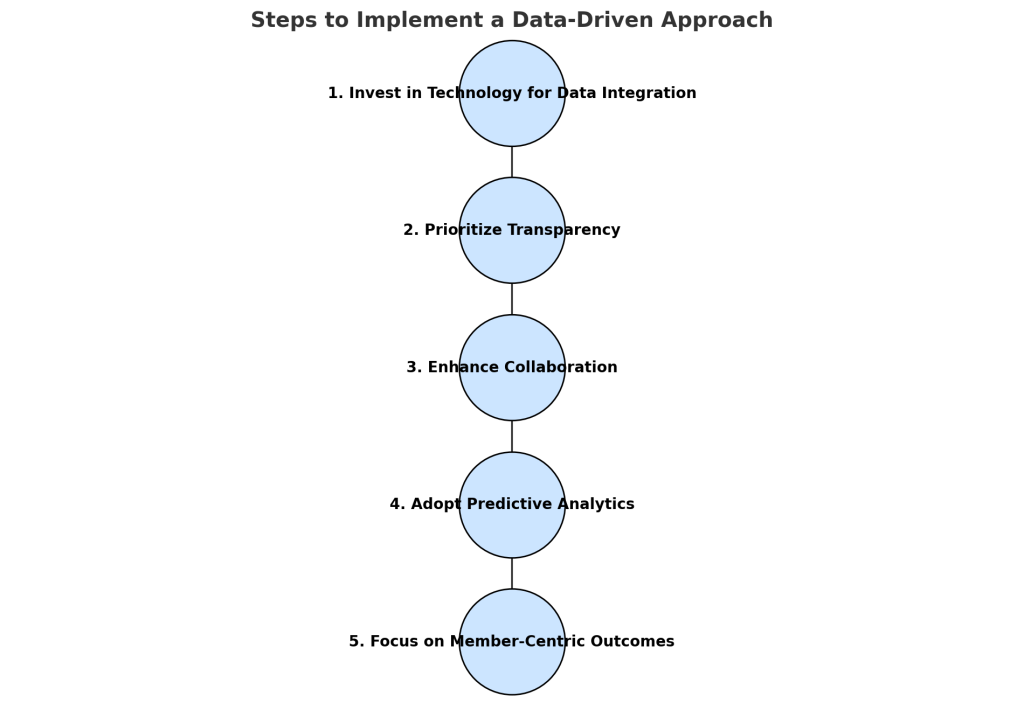

Practical Steps to Reduce Pharmacy Costs

Empowerment starts with knowledge—and action. Tyrone Squires outlined specific strategies to take charge of pharmacy benefits:

- Audit Your PBM Contracts: Shine a light on hidden fees and ambiguous terms.

- Carve Out High-Cost Drugs: Shift specialty medications to more affordable alternatives.

- Leverage Formulary Management: Create a drug list that balances cost savings with patient needs.

These steps aren’t just about cutting costs; they’re about reclaiming your organization’s right to transparency and fairness.

Oversight Is Key: How to Hold PBMs Accountable

Accountability isn’t a luxury—it’s a necessity. With the right oversight tools, you can ensure your PBM is delivering the value you deserve.

- Conduct Regular Audits: Verify claims, fees, and rebate arrangements.

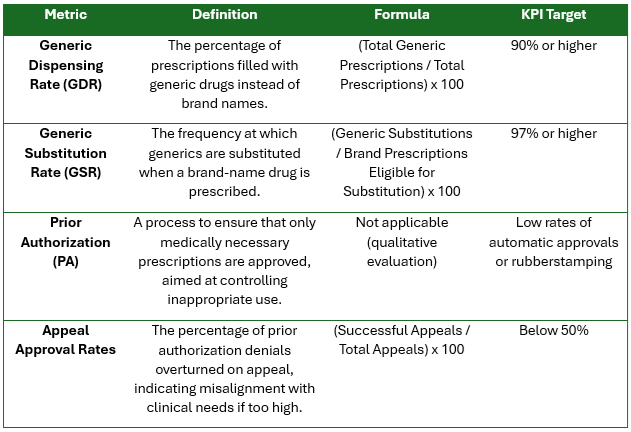

- Set Clear Performance Metrics: Use KPIs to measure savings and member outcomes.

- Adopt Advanced Analytics: Leverage data to uncover inefficiencies and optimize programs.

Every audit, metric, and analysis brings you closer to a benefits program that works for your organization—not against it.

Believe in the Power of Transparency

Transparency is more than just a buzzword—it’s a movement. When you demand openness, you unlock a benefits plan that serves your team’s health and your organization’s bottom line.

This isn’t just about reducing costs; it’s about creating a system that prioritizes fairness and outcomes. By taking action, you set an example for others, inspiring a ripple effect of positive change in the industry.

Your Journey Starts Here

The path to better pharmacy benefits begins with a single step. Whether you’re a CFO, CHRO, or benefits consultant, now is the time to demand clarity, embrace accountability, and deliver meaningful results for your organization.

Are you ready to lead the change? Watch “Navigating PBM Profit Tactics” and discover actionable insights to manage costs and enhance transparency in pharmacy benefits. Connect with Tyrone Squires today to explore how a fiduciary PBM model can transform your approach to pharmacy benefits.