Designing a Pharmacy Benefit Management Program to Reduce FWA and Improve Patient Outcomes

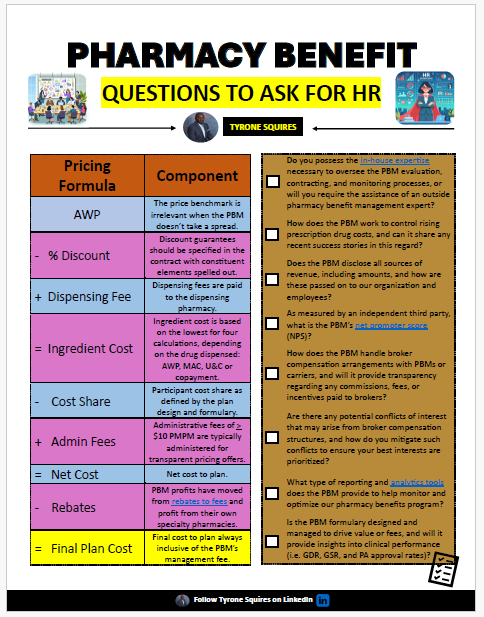

In the complex landscape of healthcare, designing a robust Pharmacy Benefit Management (PBM) program is essential not only for controlling costs but also for reducing fraud, waste, and abuse (FWA) while ensuring optimal patient outcomes. Designing a pharmacy benefit management program to reduce FWA and improve patient outcomes demands careful planning and strategic implementation. The following tips will guide you in crafting a PBM program that aligns with these goals.

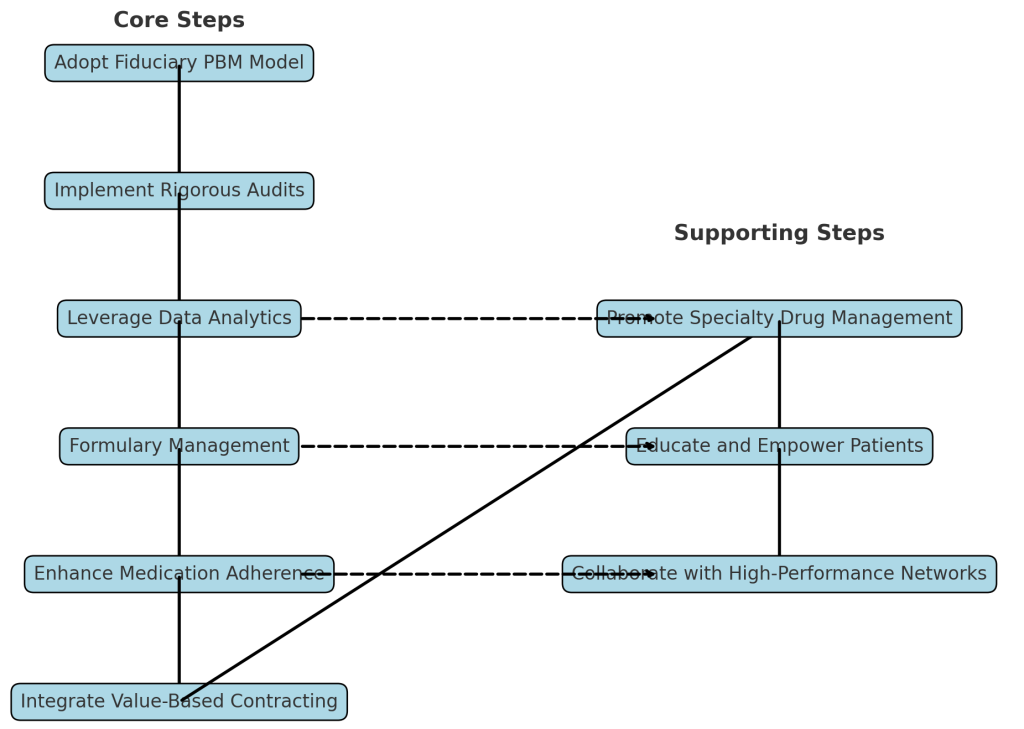

1. Adopt a Fiduciary PBM Model

Choosing a PBM partner that operates under a fiduciary model is the first step toward reducing FWA. Fiduciary PBMs, like TransparentRx, are legally obligated to act in the best interests of their clients. This model eliminates hidden fees and conflicts of interest, ensuring transparency in pricing and decision-making. By aligning the PBM’s incentives with your organization’s goals, you can reduce unnecessary costs and focus on improving patient care.

2. Implement Rigorous Audit Processes

Regular audits are a cornerstone of any effective PBM program. By implementing comprehensive, systematic audit processes, you can identify and address potential instances of FWA early. This includes reviewing pharmacy claims for unusual patterns, verifying the accuracy of rebates, and ensuring compliance with formulary guidelines. These audits should be conducted regularly and be detailed enough to catch even subtle discrepancies.

3. Leverage Data Analytics

Harnessing the power of data analytics can significantly enhance your ability to monitor and prevent FWA. Advanced analytics can identify unusual prescription patterns, detect fraud, and optimize drug utilization. By analyzing data from multiple sources—claims, patient outcomes, and pharmacy behavior—you can gain a holistic view of your PBM program’s performance and make data-driven decisions to improve efficiency and patient outcomes.

4. Establish Strict Formulary Management

Formulary management is crucial in reducing FWA and ensuring that patients receive the most effective treatments. By creating a well-structured formulary that prioritizes clinically proven, cost-effective medications, you can limit the use of unnecessary or overpriced drugs. Regularly review and update your formulary to reflect the latest clinical guidelines and market changes. This approach not only reduces costs but also improves patient outcomes by ensuring access to the most appropriate therapies.

5. Enhance Medication Adherence Programs

Medication adherence is directly linked to patient outcomes. Implementing programs that encourage patients to follow their prescribed treatment plans can reduce hospitalizations, prevent complications, and lower overall healthcare costs. Consider strategies such as personalized patient education, automatic prescription refills, and reminders to take medication. Additionally, working with pharmacies that offer adherence support services can further enhance patient engagement and outcomes.

6. Integrate Value-Based Contracting

Value-based contracting is an innovative approach that ties payment to patient outcomes rather than the volume of prescriptions. By integrating value-based contracts with manufacturers and providers, you can incentivize the use of treatments that deliver the best outcomes for patients. This model encourages the selection of therapies based on their clinical effectiveness and cost-efficiency, ultimately reducing FWA and improving patient care.

7. Promote Specialty Drug Management

Specialty drugs represent a significant portion of pharmacy spending and are often targets for FWA. Effective specialty drug management requires a focus on prior authorization, step therapy, and the use of specialty pharmacies that offer clinical support. By implementing these strategies, you can ensure that patients receive the right specialty medications at the right time while controlling costs and preventing misuse.

8. Educate and Empower Patients

Patient education is a powerful tool in reducing FWA and improving outcomes. Educate patients about the importance of medication adherence, the potential risks of using non-formulary drugs, and the benefits of generic alternatives. Empower them to ask questions and make informed decisions about their treatments. An informed patient is less likely to fall victim to fraud and more likely to experience positive health outcomes.

9. Collaborate with High-Performance Networks

Partnering with a network of high-performance pharmacies and providers can enhance your PBM program’s effectiveness. These networks are typically more vigilant about adhering to best practices, which can reduce FWA. They also tend to offer higher-quality care, leading to better patient outcomes. Ensure your PBM program includes provisions for collaborating with these networks to maximize the value of your pharmacy benefits.

Conclusion

Designing a PBM program that effectively reduces fraud, waste, and abuse while improving patient outcomes requires a comprehensive approach. By adopting a fiduciary model, implementing rigorous audits, leveraging data analytics, and focusing on value-based care, you can create a program that not only controls costs but also delivers high-quality care to your patients. Remember, the ultimate goal of any PBM program should be to support the health and well-being of your members, and these strategies will help you achieve that.