Employers falling short on managing healthcare costs

A study of more than 400 senior HR and finance executives issued by insurance brokerage Hub International found that while 70% believe their strategies for “reining in costs” are successful, only 16% are using narrow networks, 18% are self-funding, and 31% are using pharmacy benefit carve-out strategies.

Potential health cost reductions from adopting those tactics range from 9% from self-funding, to 20% using a pharmacy carve-out, according to Linda Keller, national operating officer of employee benefits for the global insurance brokerage and risk mitigation service provider.

Not all-or-nothing

Whereas self-funding health benefits was once uneconomical for smaller employers, today “100% of companies can self-fund” and incur savings, Keller says. What’s holding many smaller employers back, she believes, is a misperception that self-funding is an all-or-nothing proposition in terms of risk assumption. Smaller companies may be more vulnerable to financial consequences of an erratic health claims pattern.

However, Keller points out, financing options are available to self-insured employers that level out funding requirements, plus stop-loss coverage can be tailored to accommodate the employer’s risk tolerance. However, there is no free lunch, she acknowledges. The more self-insuring looks and feels like a fully insured arrangement, the lower the savings that are available.

At a minimum, however, self-insuring eliminates the 2-3% premium tax that insurance carriers pay and build into their premium structure. Also, employers with a healthy workforce might do better by self-insuring than they would with a carrier due to the risk-pooling (including with higher-risk employers) inherent in insured arrangements, Keller says.

“If you think you have a lower risk profile, you can ease in to self-insuring to test your assumptions,” she says.

|

| Source: lookfordiagnosis.com |

Pharmacy carve-outs

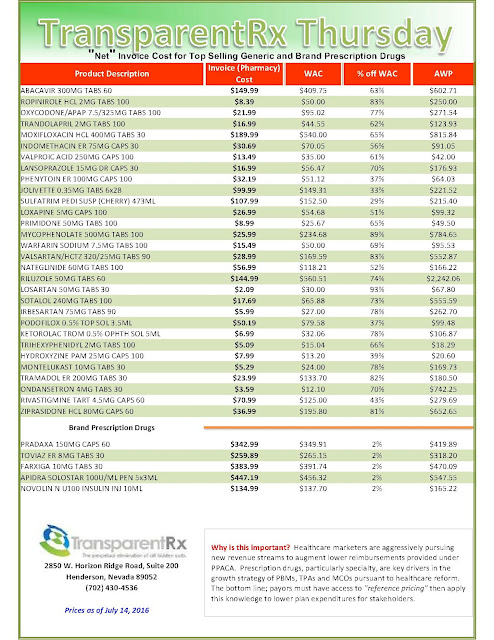

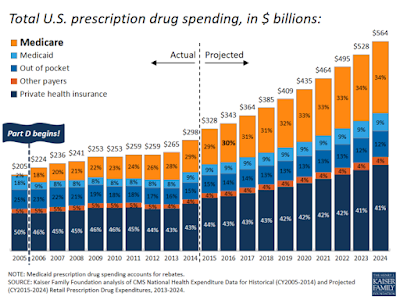

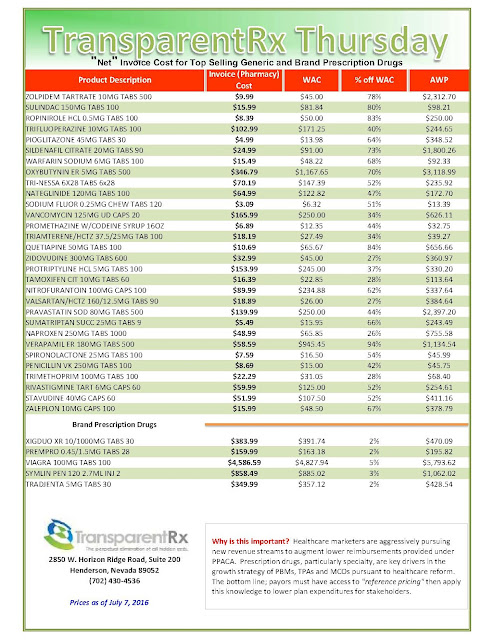

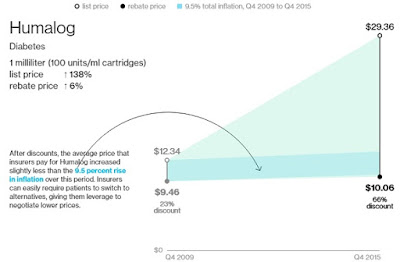

The most dramatic potential savings, Keller asserts, are available from carving pharmacy benefits out of the medical plan. With the cost of drug benefits now typically totaling 20-25% of health costs and rising rapidly due to the proliferation of expensive targeted “designer” medications, it’s an area that larger employers have been focusing on for years.

The 20% average savings on drug benefit costs Keller says are enjoyed by Hub clients through carve-out arrangements is due not so much to lower negotiated drug prices or the elimination of rebates to insurance carriers from drug companies, but to more aggressive case management and utilization review.

Finally, smaller employers’ apparent reluctance to embrace “narrow networks,” as noted, may be costing them an average of 16% in foregone savings potential. Narrow networks limit approved providers to those deemed to offer high quality but the most cost-effective care.

Narrow networks

Employers reluctant to impose tight restrictions on provider access through such plans need not think of narrow networks as an either/or choice. Narrow network plans can (and generally do) sit side-by side-with traditional PPO plans, leaving the “consumers to think about how they want to spend their money,” Keller says.

She notes that as employers become more strategic in their use of voluntary benefits, they can expect higher rates of employees’ opting for narrow-network plans, and the savings they can provide. For example, if the voluntary benefits menu features life insurance, “an employee might decide, I’d rather use the savings from the narrow network plan to buy some life insurance,” Keller says.

“It all comes down to employee communication and education.”