FTC reaffirms commitment to unfair business practices

In a statement released last week, the FTC reaffirms commitment to unfair business practices. Beyond what is covered by the other antitrust provisions, Congress granted the Federal Trade Commission (FTC) the exclusive power to detect and enforce this conduct. However, the agency hasn’t always consistently fulfilled this duty in recent years. By limiting its oversight to a more limited range of situations, the FTC’s previous policy made it more difficult for the agency to address the whole spectrum of anticompetitive behavior in the market.

With the recent announcement, this restriction is lifted, and the agency states its intention to use all its statutory power to take legal action against businesses that take unfair advantage of their competitors rather than engaging in fair competition. Congress created the Federal Trade Commission Act in 1914 as a result of dissatisfaction with the Sherman Act’s enforcement, the first antitrust law. The FTC Act’s Section 5 prohibits “unfair methods of competition” and directs the Commission to uphold this rule.

According to the policy statement, unfair methods of competition are strategies that aim to acquire an advantage without engaging in a merit-based competition and that are likely to lessen market competition. The Commission’s strategy for policing them is outlined in the Policy Statement. It is the outcome of several months’ worth of collaboration between agency departments. Staff members combed through hundreds of Commission decisions, consent orders, and court rulings—including more than a dozen Supreme Court opinions—to examine the legislative background of Section 5 and its interpretation. The agency will follow the rich case history as it applies Section 5 to its operations. The Commission will warn firms about how to compete fairly and legally through enforcement and rulemaking.

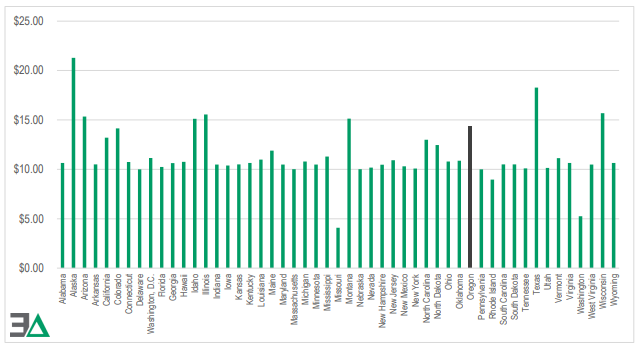

This is without a doubt a prelude to the FTC’s inquiry into pharmacy benefit manager (PBM) practices. Those stakeholders seeking change, for the better, in pharmacy benefit manager practices are eagerly awaiting the commission’s final report. PBMs are a crafty bunch. They’ve already made moves to protect margins from any FTC decision that might curtail PBM revenue streams that are bad for customers.