How Coupons Keep Drugs Costly [Weekly Roundup]

How coupons keep drugs costly and other notes from around the interweb:

- How Coupons Keep Drugs Costly. An economist who holds a joint appointment at the Harvard Kennedy School, began studying this topic more than a decade ago, prompted by the growing number of pharmaceutical ads that included coupons. Such coupons offer consumers a discount on the co-pay for the advertised drug and have grown increasingly popular; the share of brand-name prescription drug spending that included a coupon rose from 26 percent in 2007 to 90 percent in 2017, Leemore S. Dafny reports. And the number of drugs with available coupons rose from about 200 in 2008 to more than 800 in 2018. Not everyone is eligible for coupons; Medicare enrollees are prohibited by law from using them. “The coupons are considered kickbacks or financial inducements to consume a product that is reimbursed by the federal government,” Dafny explains, and are therefore banned in that context. But pharmaceutical companies are permitted to donate to independent charities that subsidize co-pay assistance for patients, even those on Medicare, and to earmark those donations for conditions treated by drugs they make.

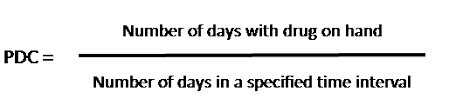

- Accumulators And Maximizers: A New Front in the Battle Over Drug Costs. At the time the patient presents to the retail pharmacy and uses the copayment coupon, the retail pharmacy (which contracts with the PBM) enters the amount of the coupon in the adjudication system. The PBM notes this part of the transaction and deducts the value of the coupon so that it does not “accumulate” against the deductible. (The pharmaceutical assistance program also notes the value of the coupon, as the programs do put limits on the amount of assistance available.) The beneficiary still avoids the copayment cost at least until she hits the limits on the copayment program, when the coupon ceases to become available and the patient must begin to pay, reinstating the original incentives. From the payer’s point of view—either the self-insured employer or the insurer—the effect is financially salutary. Some pharmaceutical firm funds help pay for the initial costs of the medication. But eventually, the deductible and copayments come back into play and promote consumerism. Yet, as the coupon limits come into play, the beneficiary faces challenges from out-of-pocket spending, and adherence can drop.

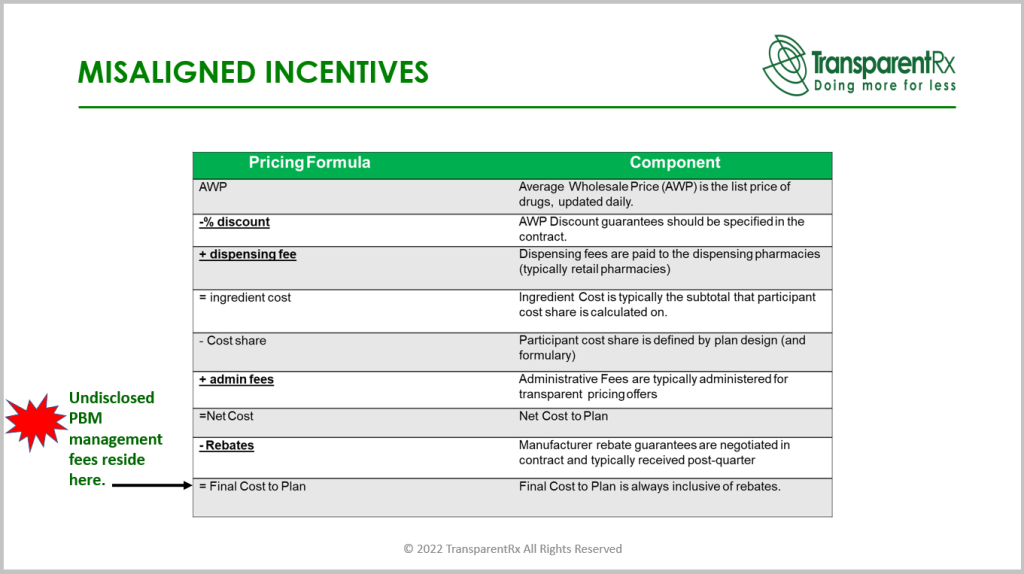

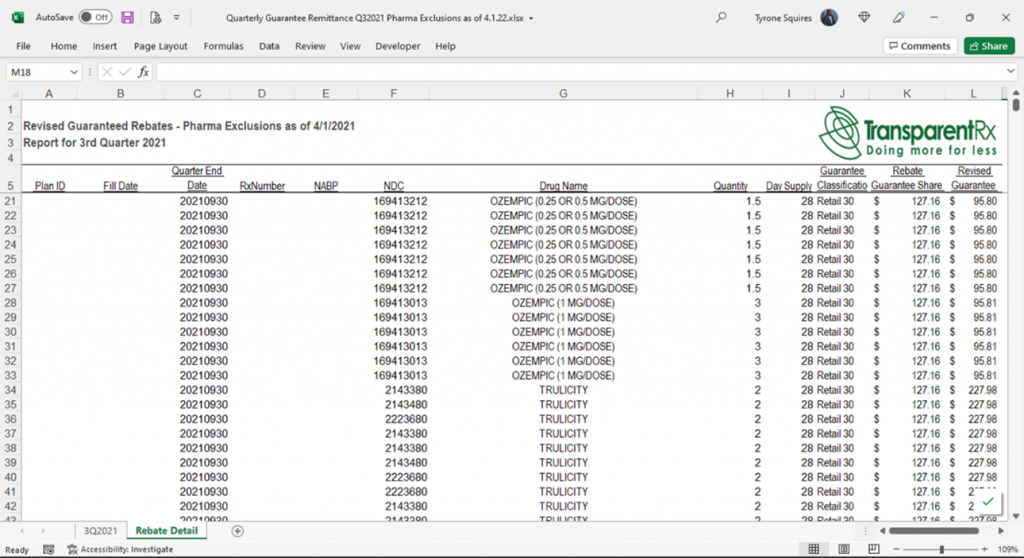

- Getting off the PBM Merry-go-Round: How Late-stage Offer Tricks Take Employers for a Ride. Monies offered by PBMs come in many forms – a general allowance credit that the client can use to pay for claims and expenses during open enrollment and implementation, an administrative credit that the client can use to pay back to the PBM for administrative fees, a clinical credit that the client can use to pay for voluntary clinical programs administered by the PBM or, at times, slightly improved pricing. If it seems odd that two of these credits go towards paying back the PBM for additional services, that’s because it is. Employers should think of these credits like getting tokens at a carnival – the tokens are valuable, but only if the employer uses them at the proverbial PBM carnival (i.e., invests them back into the PBM). If PBMs would manage their costs appropriately to begin with, employers wouldn’t be taken for this ride.

- Self-funded plans sue health care company alleging overcharging and other ERISA violations. The plaintiffs, self-funded health plan fiduciaries, claim the defendants breached their fiduciary duty under ERISA by denying the plaintiffs access to their plan claims data, failing to manage the claims “prudently, loyally, and in compliance with documents governing the plans,” and partaking in “prohibited transactions relating to the management and disposition of plan assets,” the complaint said. ERISA is a federal law that requires health plans to “provide participants with plan information, including important information about plan features and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; and gives participants the right to sue for benefits and breaches of fiduciary duty,” according to the U.S. Department of Labor.