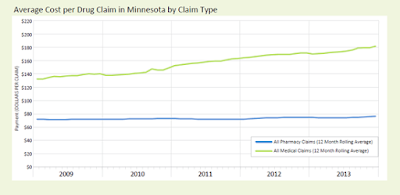

Minnesota Department of Health finds drugs given in medical settings are big drivers of costs

|

| Courtesy of MDH |

The study analyzed claims data from 2009 to 2013 and found that the spending growth for drugs given in medical settings was nearly three times more than the spending growth for drugs from pharmacies (35.5 percent vs. 13.5 percent).

This finding sheds new light on the sources of growth in health care costs. This is the first time the state has compared the spending on drugs given in medical settings to those provided through pharmacies. Drugs given in medical settings are common for treating conditions such as cancer, multiple sclerosis, rheumatoid arthritis and autoimmune disease.

“Minnesota is one of the first states in the nation to show how drugs delivered in medical settings are increasingly important – and not well-understood – drivers of health care costs,” said Minnesota Commissioner of Health Dr. Ed Ehlinger. “We are hopeful that this first analysis from a planned series of publications will help insurers and policy makers find solutions for managing unsustainable trends.”

Minnesotans have an average of 15 prescription claims a year averaging about $90 each, according to the MDH analysis of claims data from 2009 to 2013. A claim could represent a single occasion when a patient received a drug in the doctor’s office or hospital, or a monthly refill of an ongoing prescription from a retail pharmacy.

Retail or other types of pharmacies filled about 80 percent of drug claims. These were paid for by a patient’s pharmacy insurance benefit. The remaining approximately 20 percent were given in medical settings, such as hospitals and clinics. They gave these drugs generally as a single dose, which were paid by a patient’s medical insurance benefit.

Total drug spending for Minnesota residents with health insurance, both at pharmacies and in medical settings, was $7.4 billion in 2013. Between 2009 and 2013, it grew 20.6 percent, or at twice the rate of inflation.

“Employers are very concerned about the pressure that both the unjustifiable cost and rate of increase in price and use of ‘specialty drugs’ have on their ability to provide affordable benefits to their employees and family members,” said Carolyn Pare, president and CEO of Minnesota Health Action Group. “We need to know that patients are getting the right drug, at the right time, in the right place.” Pare noted the MDH research helps her organization by offering benchmarks, and describing the patterns and costs of drug use.

Drugs given in medical settings accounted for more than half of this growth, even though these medical claim drugs only accounted for about 20 percent of all drug claims in 2013.

Tyrone’s comment: Is this the best argument yet for shifting specialty drugs from medical to the pharmacy benefit?