Drug prices soar as Big Pharma targets discount program

Meanwhile, the pharmaceutical industry is trying to derail a vital federal drug discount program called 340B that helps hospitals and community health centers supply lower-cost medicines and enhanced services to underserved patients.

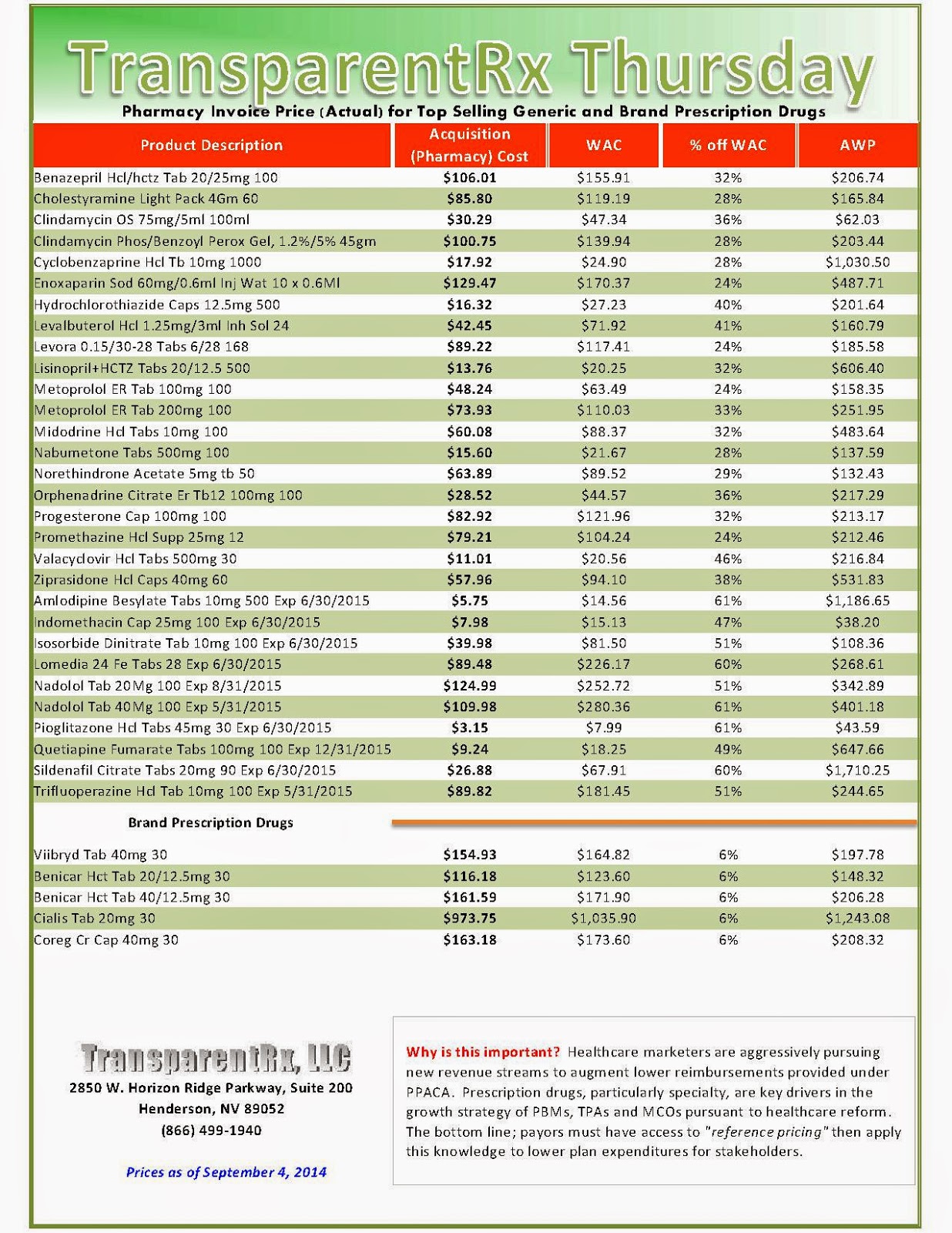

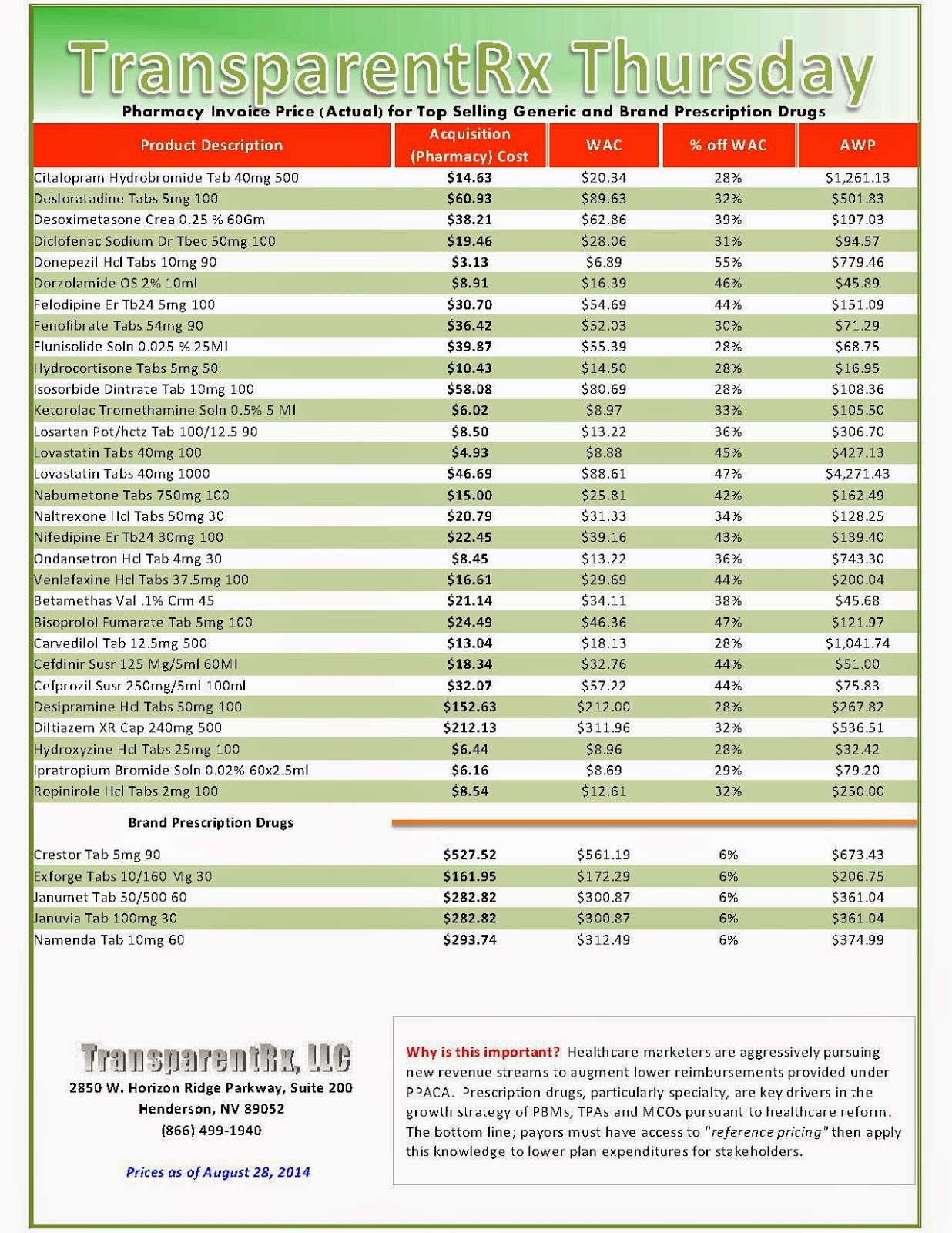

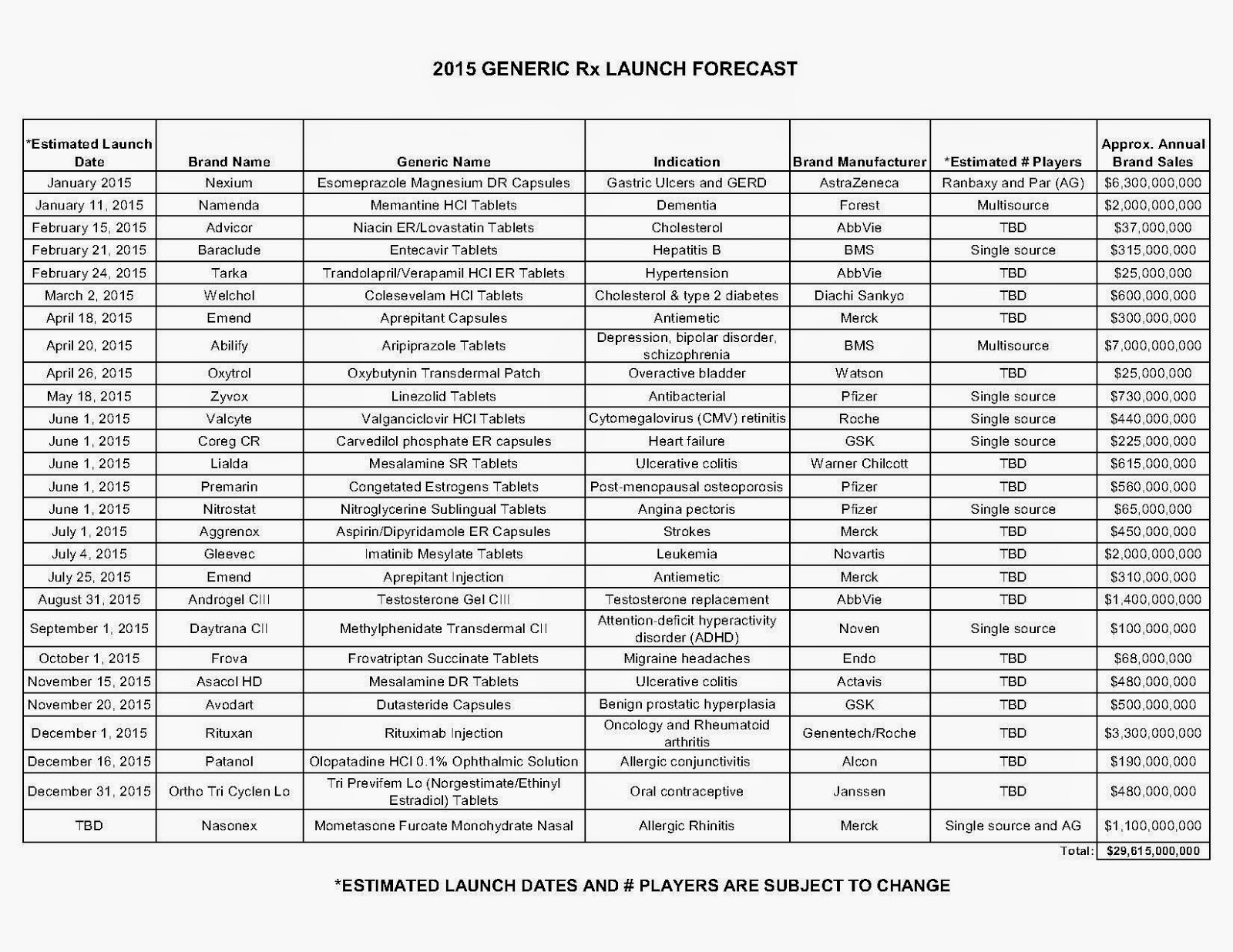

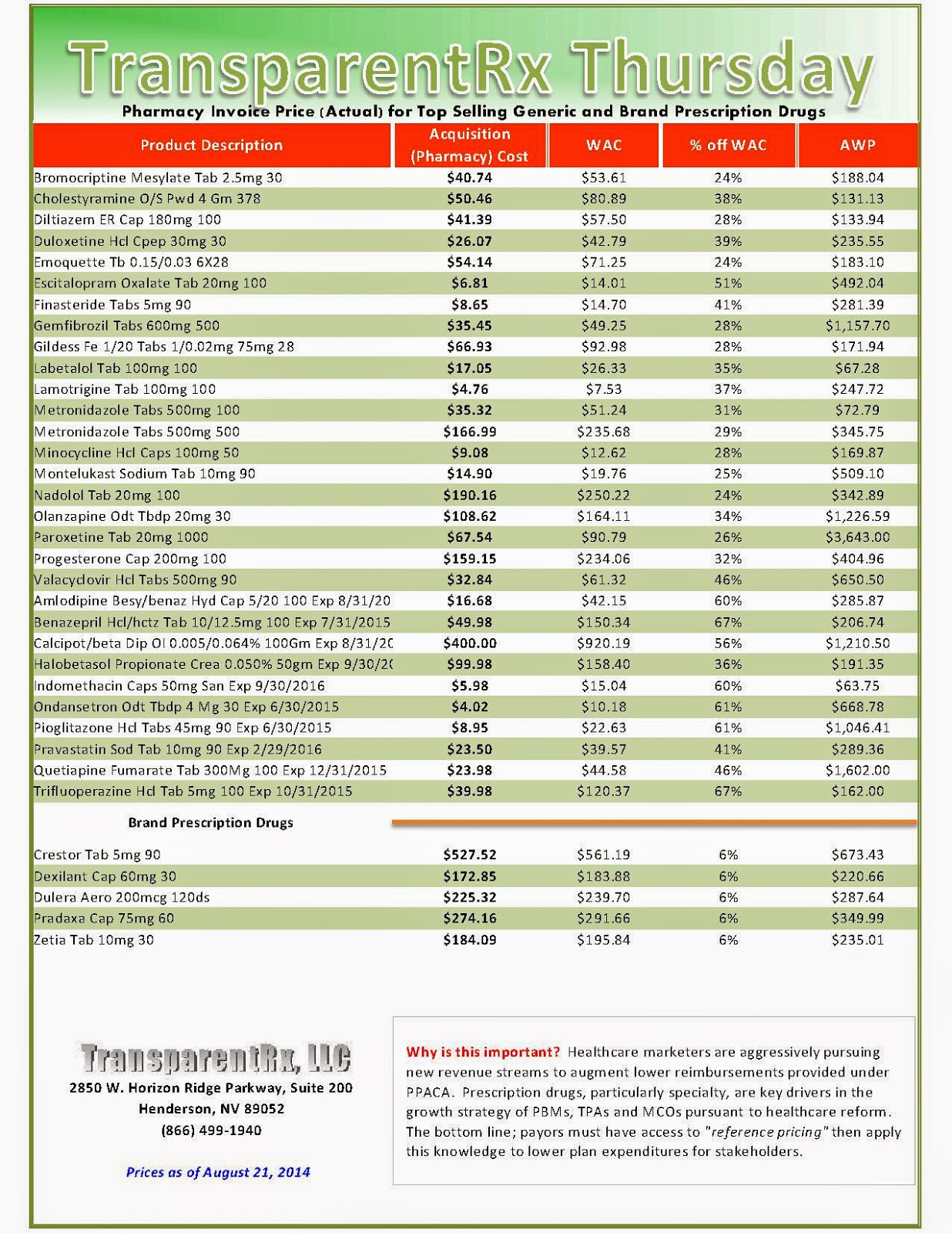

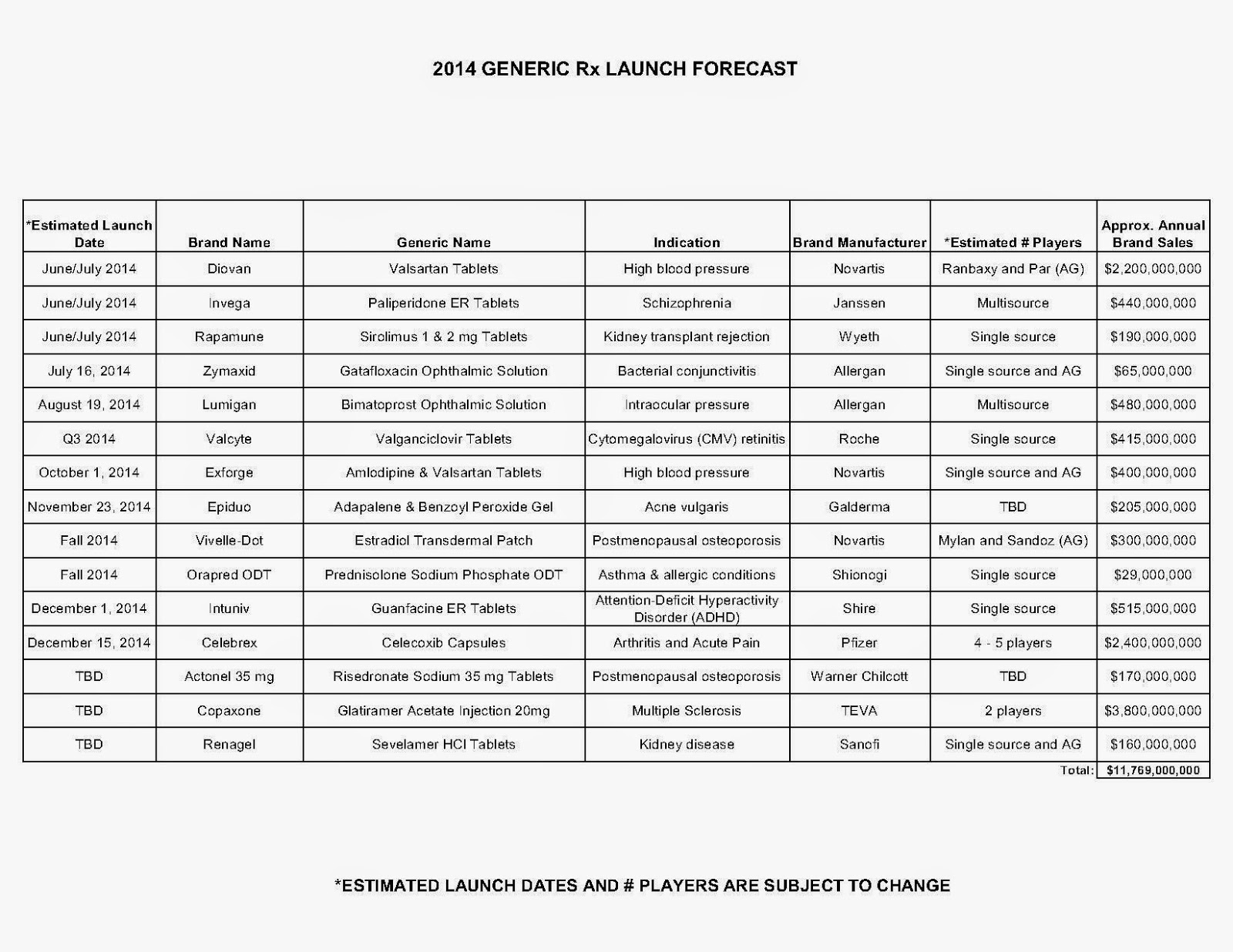

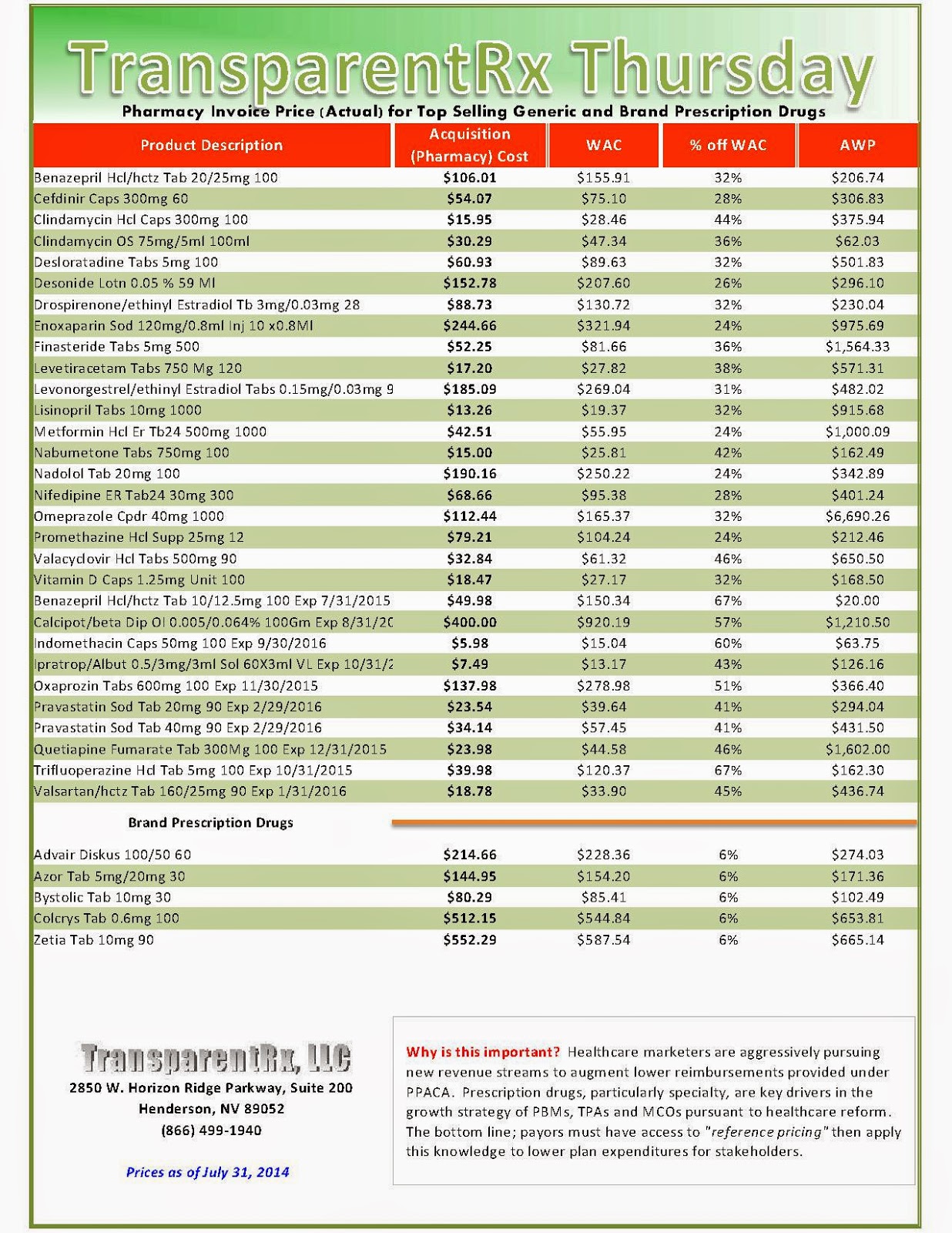

The industry’s profiteering has gotten the attention of Congress, insurance companies and patients. Per-unit costs on specialty drugs rose 12 percent last year, according to Express Scripts. A database compiled by Bloomberg News shows the steady price increases of leading medications during the past seven years. An Epipen for allergic reactions rose 222 percent. A single dose of the drug Benicar for high blood pressure is up 164 percent. The high-cholesterol medicine Crestor jumped 103 percent per pill.

Against this backdrop, the drug industry has marshalled an army of lobbyists to go to war against poor, underserved Americans and the hospitals that treat them. Congress created the 340B drug discount program in 1992 with bipartisan support to allow health providers that serve large numbers of low-income patients to receive discounted medication from drug companies. In turn, these safety-net hospitals and clinics supply low-cost or no-cost medicines to the community. The program also helps fund diabetes, HIV/AIDS, cancer, dental and primary-care clinics.

Affordable medications are the key to improving health outcomes. When drug costs get too high, patients skip doses — or pass up buying prescriptions altogether. According to a survey from the Commonwealth Fund, the United States leads the world in this respect, with one quarter of adults choosing to go without their medications. Their health often declines and many end up back in the emergency room, largely on the taxpayer’s dime.

Everyone agrees, even John Castellani, CEO of the industry trade association PhRMA. In a recent interview with Kaiser Health News, he said patients’ “out-of-pocket expenses are potentially so high that we have to be concerned about whether or not people will be able to afford to continue to get their medicines.”

In fairness, Castellani was complaining about high prescription deductibles in some plans offered under the Affordable Care Act. But what about the devastating impact of his own industry’s overpriced medications? Here, Big Pharma ducks responsibility and conveniently chooses profits over people.

Click here to register: “How To Slash the Cost of Your PBM Service, up to 50%, Without Changing Providers or Employee Benefit Levels.” [Free Webinar]

- by: GIL GUTKNECHT

_1.jpg)

_1.jpg)

_2.jpg)

_1.jpg)

_1.jpg)

_1.jpg)

_1.jpg)