One of the most powerful middleman industries in the global economy is emerging from more than a half-decade of difficult transition. Drug distributors purchase drugs, often entire lines of drugs, from manufacturers. They warehouse and sell them to retail chains and mail-order, online and specialty pharmacies, as well as to physician offices and clinics.

Three companies dominate this key piece of the pharmaceutical supply chain. The largest, San Francisco-based McKesson (MCK ), reported almost $138 billion in fiscal 2014 revenue. The companies earn slim margins from their massive revenue, however. And those thin profits have come under harsh pressure in recent years due to shifting trends in health care.

AmerisourceBergen (ABC), McKesson and Cardinal Health (CAH ) have been able to withstand this squeeze largely because they’ve combined their purchasing power with major pharmacy chains Walgreen Boots Alliance (WBA ), Rite-Aid (RAD ) and CVS Health (CVS).

|

| Source: www.fda.gov |

The three dominant drug distributors control more than 85% of the market. Their stocks have trended higher the past five years, with AmerisourceBergen up 29%, McKesson up 27% and Cardinal Health ahead 20% the past 12 months.

Challenges And Benefits

The drug wholesaler-drugstore partnerships unite the two middlemen in the pharmaceutical supply chain. Their common bond is in wanting to defend the spread between the wholesale price the manufacturer charges and the retail price that the insurer lets pharmacies bill patients.

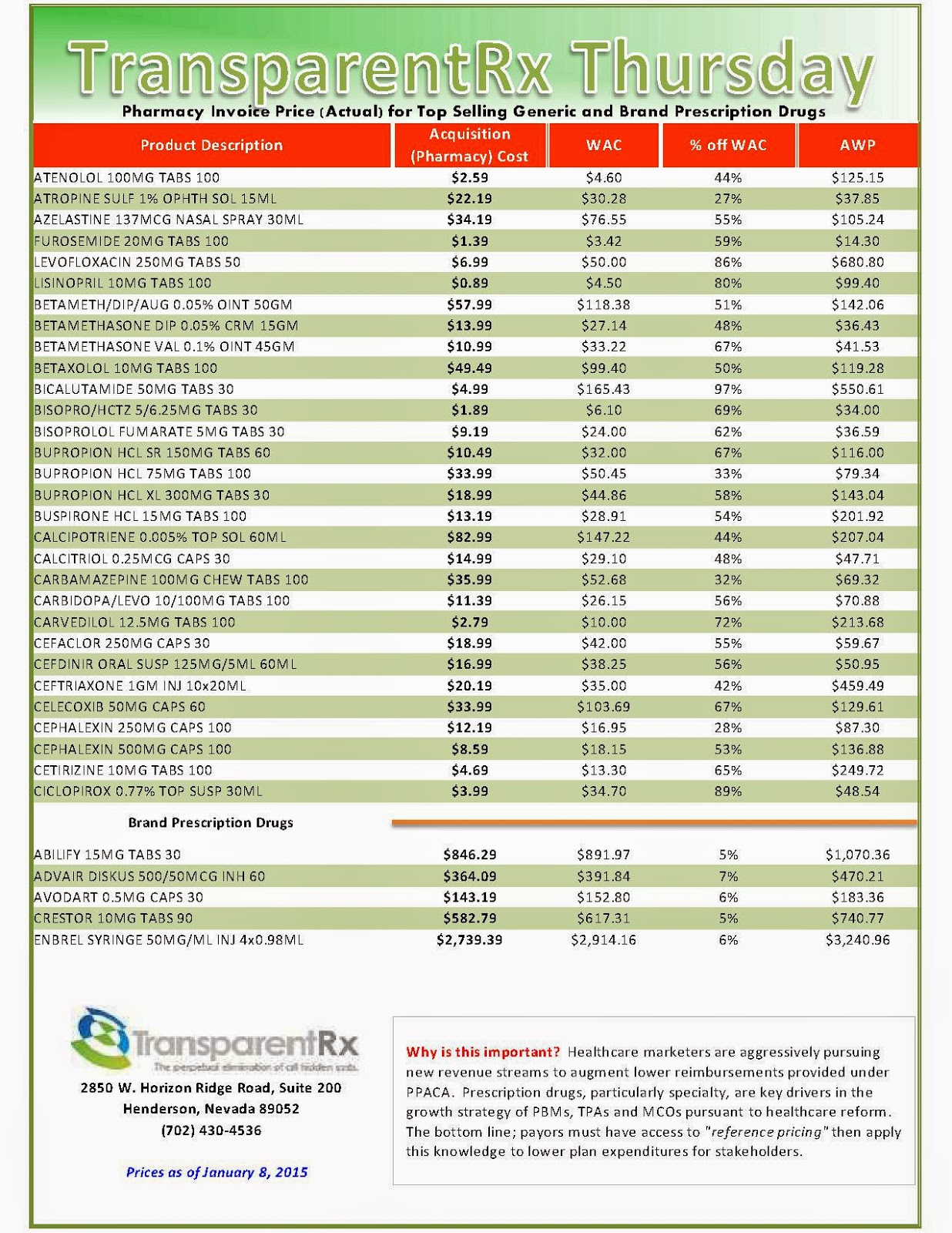

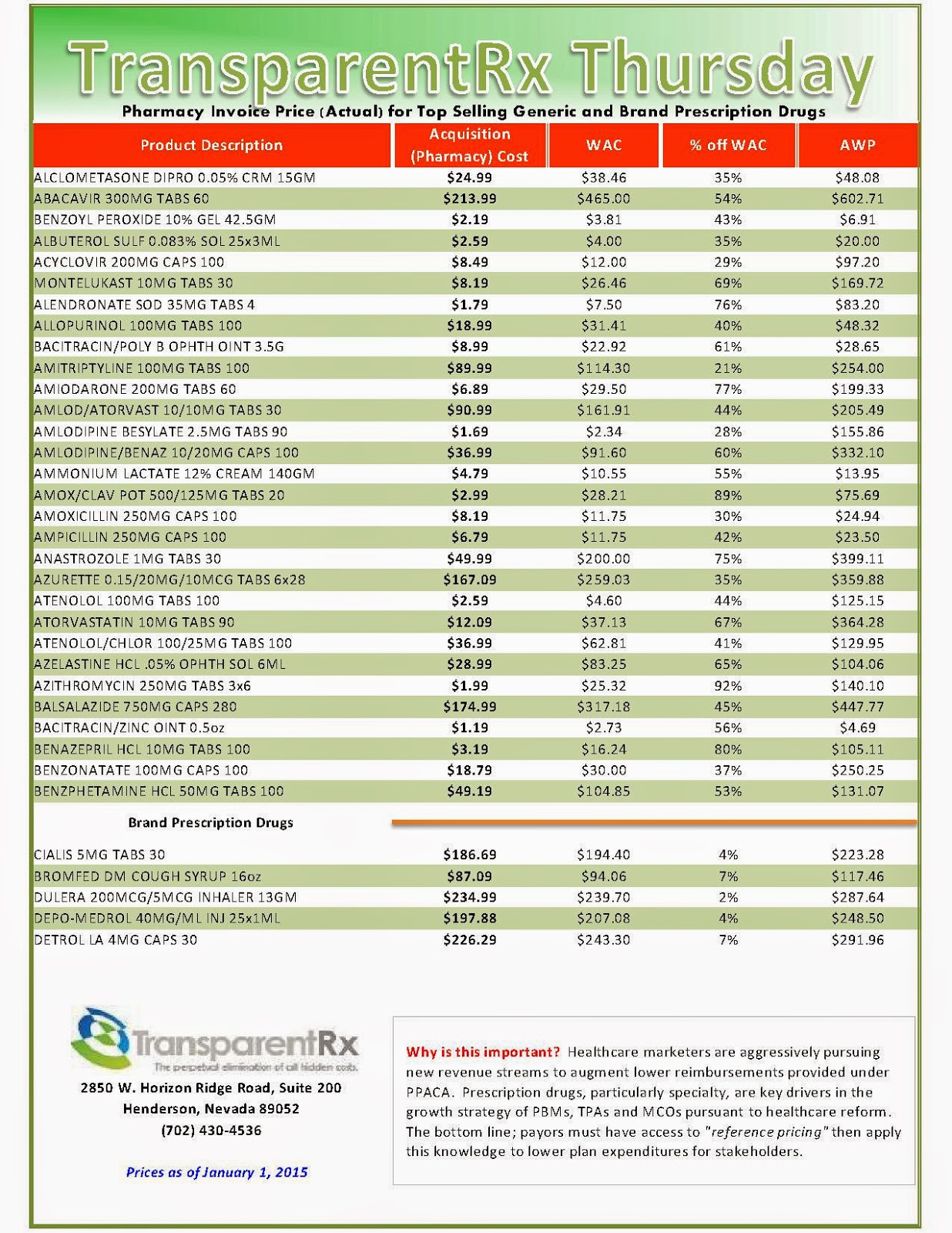

That spread can be paper-thin for branded drugs, and often substantially wider for generics. The catalyst for the distributor/pharmacy chain deals: “The payers in the U.S. have been looking at every single option to lower prices,” said Vishnu Lekraj, health care service analyst at Morningstar.

This price pressure, applied by the pharmacy benefit manager side, leverages the PBMs’ market power to control prices on behalf of insurers, Lekraj said.

The AmerisourceBergen-Walgreen, Cardinal Health-CVS and McKesson-Rite Aid ventures have each elevated their generics purchasing to $10 billion to $12 billion a year, estimates FBR Capital Markets data.

By joining together, drug wholesalers and drugstores can better withstand the profit squeeze and pass most of the pricing pressure onto generic drug manufacturers, Lekraj says. That advantage until recently has remained largely theoretical, although the partnerships have begun to bear fruit.

Rite-Aid’s latest quarterly results demonstrate the value provided by its deal struck last February to have McKesson purchase its generic drugs and deliver them directly to stores, notes Fein. The pharmacy chain’s total inventories were $255 million below year-ago levels in the third quarter, a boon to working capital and profit margins.

“If Rite Aid keeps posting such positive results, expect other large pharmacy buyers to give in … and begin sourcing generics through the large wholesalers,” he wrote on his Drug Channels blog.

One wrinkle to McKesson’s partnership with Rite Aid: the distributor’s plans to use its own NorthStar generic manufacturing arm for some generic production, providing more pressure on generic-drug makers to make concessions on price. McKesson suppliesWal-Mart (WMT) with branded drugs, but the retailing giant currently buys its own generics.

The Wholesale Story

Branded drugmakers have long used the wholesalers, rather than sell directly to big drugstore chains. Those branded drugs provide the Big Three with lots of revenue, but at margins of only around 1%.

Generics, though much lower priced, offer much higher margin opportunities. The recent wave of branded drugs coming off patent was bad news for manufacturers but a net positive for distributors and pharmacies, even though it dampens revenue growth. That trend is set to continue for the next few years.

Some of the big potential generic launches being eyed within the next couple of years include Nexium (acid reflux), Copaxone (multiple sclerosis), Abilify (anti-depressant), Enbrel ( rheumatoid arthritis) and Advair (asthma).

Aggressive Partnering

AmerisourceBergen has been the pace-setter in the industry. It kicked off the drugstore-chain partnering trend, striking a deal with Walgreen in March 2013. Last week it pushed into animal health territory, saying it would buyMWI Veterinary Supply (MWIV) for $2.5 billion.

The game changer was its deal with Walgreen. That relationship, including brand and generic drug distribution, fueled a 29.1% jump in AmerisourceBergen’s revenue from the prior year to $31.6 billion in the September quarter and a 30.1% rise in operating earnings to $423.8 million, or 1.34% of revenue.

The deal with Walgreen also provided scale in Europe for the drug wholesaler via Walgreen’s combination with Alliance Boots, the biggest U.K.-based pharmacy. Walgreen has since tapped its option to acquire an equity stake in AmerisourceBergen.

As of last August, Walgreen had bought 11.5 million shares of AmerisourceBergen on the open market, giving it a stake of less than 5%, though it has an option to acquire 23%. McKesson followed suit, strengthening its generic-buying clout when it acquired a controlling stake in German drug distributor Celesio in January 2014 for $5.4 billion.

While analysts have awaited a similar move into Europe by Cardinal Health, the company has instead directed its international push into China. That piece of the business has grown from $1 billion a year to $2.6 billion since 2011. Sales in China are growing more than 30% a year, and account for over 10% of Cardinal Health’s total revenue.

Specialty Segment: On The Rise

Amerisource has been the leader in distributing specialty drugs, which is the fastest-growing segment of the industry. The company’s oral oncology, opthalmology and plasma revenue grew 11% to nearly $20 billion last year. Cardinal Health’s specialty segment has grown from $1 billion to $5 billion the past four years.

Because these high-priced drugs often require special handling and delivery mechanisms, and can be geared to smaller patient pools, they aren’t normally distributed through the standard drugstore channels. Specialty pharmacies sometimes source directly from the manufacturer, bypassing the distributors.

Read more: http://www.nasdaq.com/article/drug-distributors-build-strength-in-an-era-of-change-cm433710#ixzz3P5ku5S1c

_1.jpg)

_1.jpg)

_1.jpg)

_1.jpg)

_1.jpg)