PBM Formulary Management Tips: Three That Are Meaningful [Rerun]

Claims repricings are an integral part of what a growing fiduciary-model PBM does daily. I happen to believe that plan sponsors and their advisors rely too heavily on them. In fact, I wrote recently, “each time a non-fiduciary PBM gets caught with its hand in the cookie jar you can’t go beyond the first sentence of the obfuscation without the word CONTRACT being thrown around. Yet, when you ask self-funded employers or their advisors what’s most important to them when evaluating PBM proposals you get CLAIMS REPRICING. PBM contract nomenclature sets the foundation for all the financials. A 400 question RFP might make you feel better, but it doesn’t deliver results or in this case radical transparency. PBM literacy, on the other hand, delivers results. PBM transparency is best determined by a trained eye. When the PBM operates with radical transparency, you CANNOT overpay. The same cannot be said for even the most aggressive claims repricing or rebate guarantees unaccompanied by a fiduciary standard of care and/or radical transparency.” It was written in response to the Louisiana Attorney General’s recent lawsuit against a large PBM. Keep reading for the three meaningful PBM formulary management tips to take advantage of so not to be taken advantage of.

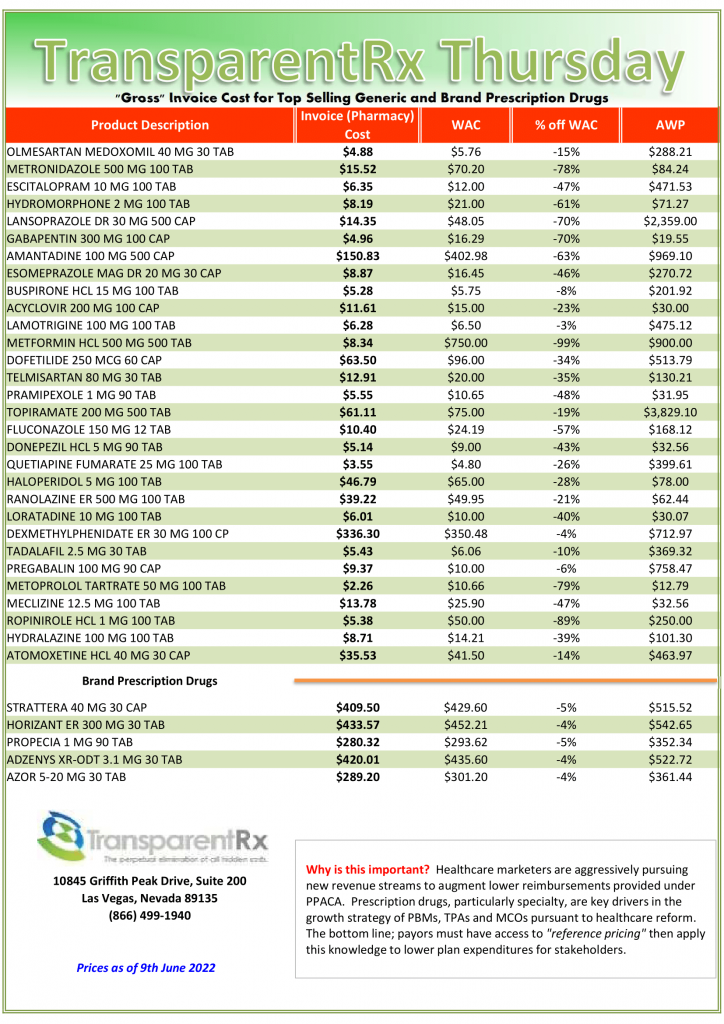

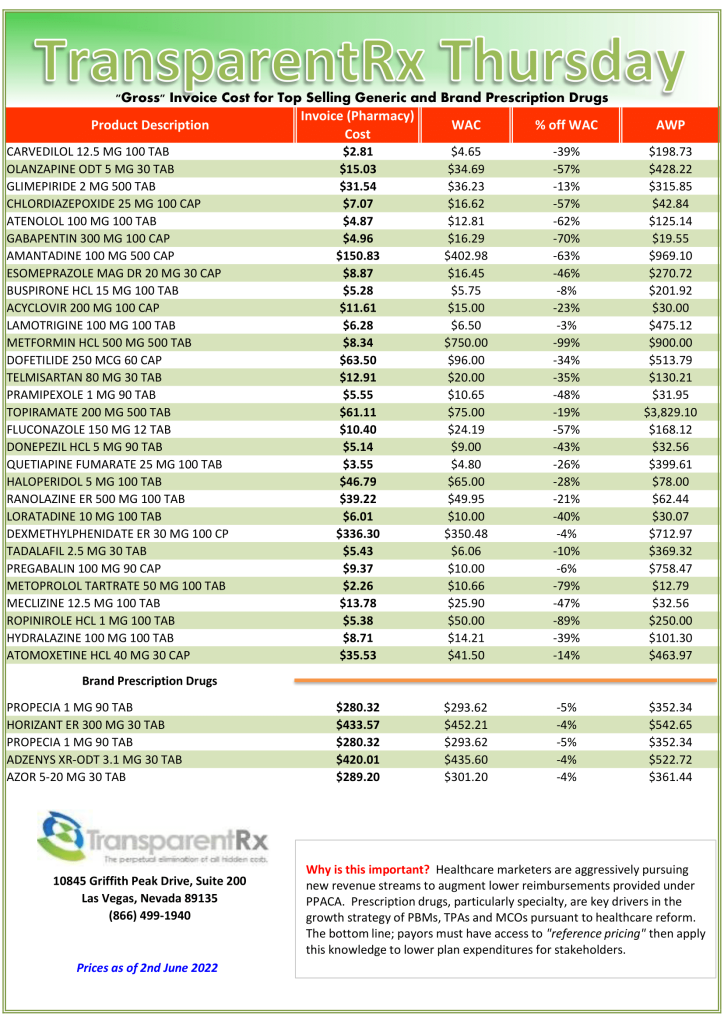

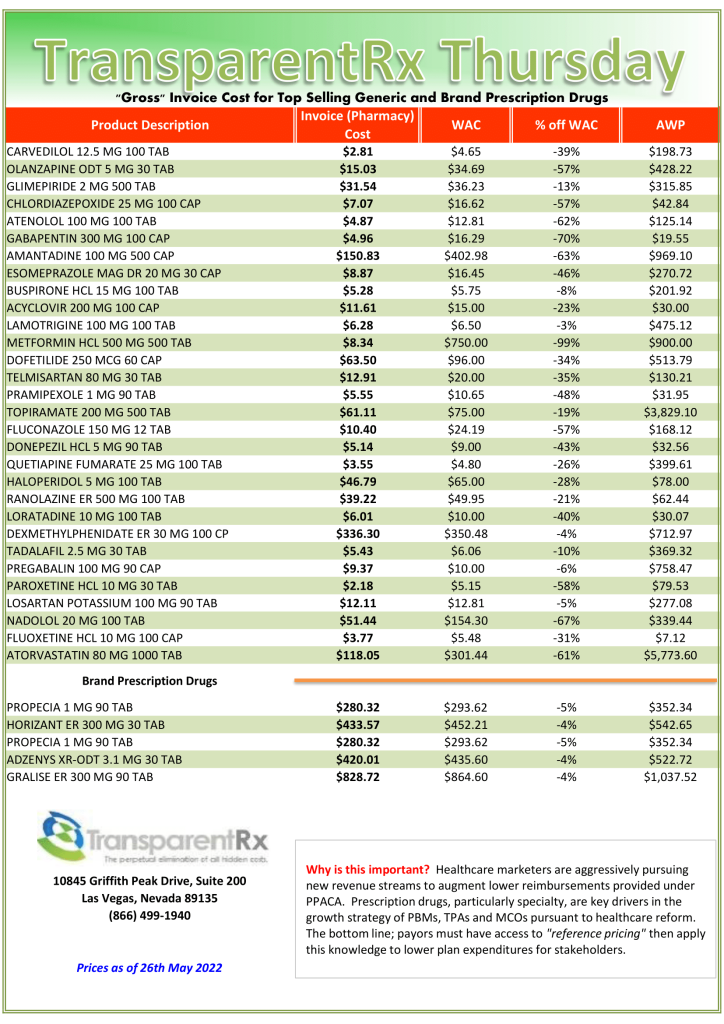

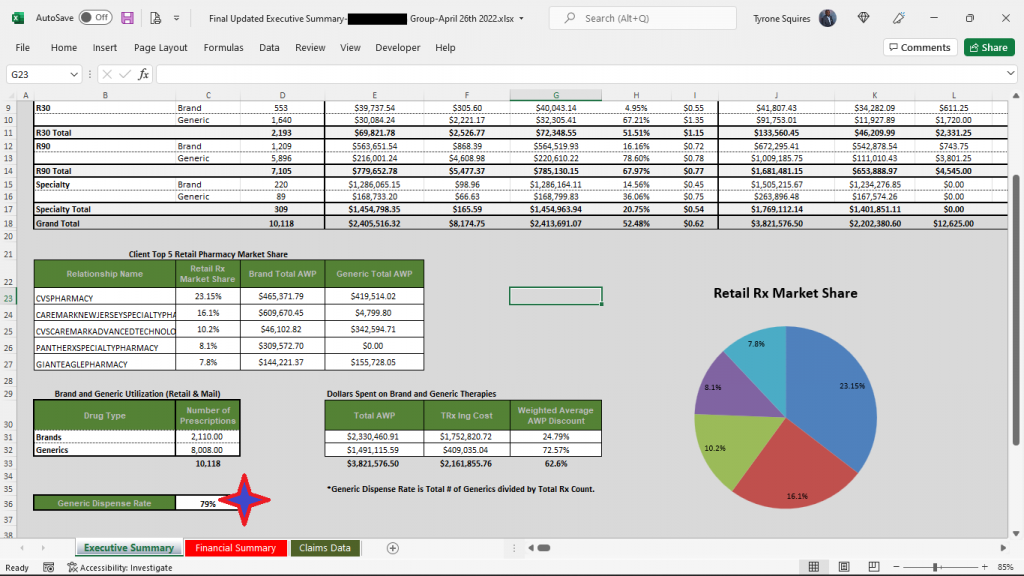

Even though I’m not a huge fan of claims repricings, I am intrigued by the process and results. For example, in the results below (figure 1) you will see that TransparentRx’s price difference alone isn’t enough to warrant a PBM vendor change. This always concerns me as most plan sponsors don’t look beyond the claims repricing results. It isn’t until you look at the incumbent PBM’s clinical performance (product mix and utilization) that there is a problem big enough to consider that something must change. Formulary management is a clinical service. The Generic Dispense Rate or GDR is only 79%. Fortunately for us our book performance is in line with the national GDR average of 90%! Furthermore, for every 1% increase in GDR a self-insured employer can expect to reduce drug costs by 2.5%. This employer was leaving $650,000 annually on the table all because of poor clinical oversight. More specifically, drug utilization management processes were rubberstamped, and the formulary managed inefficiently. Here are three PBM formulary management tips to take advantage of so not to be taken advantage of.

- Don’t give up cost control to make participants happy. At the beginning of the pandemic employers, at the behest of PBMs, decided to open the flood gates for prescription drugs. They removed safety nets such as refill too soon, quantity limits and step therapy. The only entities to benefit were the PBMs themselves as volume increased significantly. Worse yet, some of these plans have not yet reverted to pre-pandemic drug utilization management protocols. Proper pharmacy benefits management practices call for safety and efficiency first no matter the circumstances. Critics, prescribers and patients, view cost control as impeding on what’s best for them. We “had” a client who insisted their employee be allowed to have a brand drug dispensed for $2000 although the generic drug would have cost less than $200. There was no clinical reason only that the employee didn’t want to take a generic. If it were going to cost you money or put employees in danger, you wouldn’t change your manufacturing processes just to make an employee happy. So why do it in your employer-sponsored pharmacy benefits program?

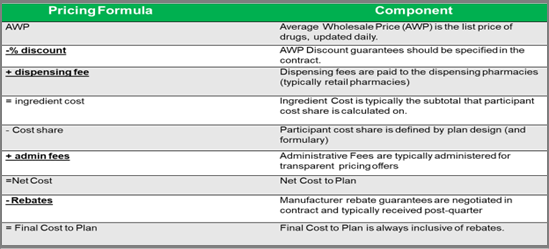

- Treat formularies as a cost-containment tool not a recruiting tool. Price is the most common driver of pharmacy costs. Drug pricing takes into consideration AWP discounts, inflation, and rebates, for example. Cost share is the second driver of pharmacy cost HR and finance are most familiar. Cost sharing consists of coinsurance, copays and more recently accumulator and maximization programs. However, there are two big drivers of pharmacy cost that often get overlooked and they are utilization and product mix. Since I’ve already addressed product mix let’s look at utilization. Formularies are often used in conjunction with drug utilization management tools such as refill too soon, step therapy, quantity limits, dose optimization, prior authorization, or pill splitting, for example. An efficient combination of benefit design, utilization and product mix offers the best of both worlds; maximization of participant choice while simultaneously helping to reduce final plan drug costs. If you want to learn more about plan design, formulary, or utilization management techniques, join our next Certified Pharmacy Benefits Specialist class.

- Opt for a closed formulary. As an employer myself, it just never made sense to me that my peers say, “here is my checkbook have at it.” The fundamentals which allowed the business to grow are somehow lost after the business becomes successful. As a side, Carl Icahn’s documentary “The Restless Billionaire” is fascinating. Check it out if you haven’t already. He talks a lot about wasteful spending. In pharmacy benefit plans, thousands of dollars are paid for drugs when a $100 generic drug would provide similar clinical benefits. Worse yet, millions of dollars are spent on drugs with no clinical benefit. An open formulary is a list of medications which has no limitation to access to a medication by a practitioner. A closed formulary on the other hand, is a list of medications (formulary) which limits access of a practitioner to some medications. The truth is efficiency (cost control and clinical outcomes), and participant satisfaction are exceedingly difficult if not impossible to separate. The path to clinical success in pharmacy benefits management gets clearer with a closed formulary.

PBM Formulary Management Tips: Three That Are Meaningful, Conclusion

Unless it has contractually agreed to contain your costs, do not leave the responsibility of formulary management solely in the hands of the PBM. When rebates are involved, the formulary could become a tool for favoring drugs from preferred manufacturers instead of a tool to maximize clinical benefit.