5 Questions to Ask PBM Finalists Before Announcing the Winner of a Competitive Bidding Process

A competitive bidding process is a frequent procurement practice that involves sending invitations to PBM vendors to submit proposals for their services. Competitive bidding, an RFP for example, is designed to allow equality of opportunity, the ability to demonstrate that the outcomes represent the best value, and transparency.

However, in a PBM competitive bidding process contract nomenclature often obscures the actual cost. What’s more a PBM could tell you it is pass-through or transparent and even include those terms in the contract yet behave very differently after the group goes live, for instance. Here are 5 questions to ask PBM finalists before announcing the winner of a competitive bidding process.

- Information Failure. Is there any language in your contract which restricts access to our claims data in any way?

- Network Spreads. Does the contract language bind you from keeping any differences in the amounts billed to us and the amounts reimbursed to pharmacies for identical claims?

- Rebate Spreads. Does the contract language prevent you from paying us an amount less than the amount refunded to you by drug manufacturers or rebate aggregators for identical claims?

- Utilization Management. Does the contract language prevent you from substituting a lower priced generic and therapeutically equivalent drug for a higher priced prescribed drug?

- Formulary Management. Does the contract language prevent you from including on the formulary a higher priced brand drug when a lower priced generic and therapeutically equivalent drug is available?

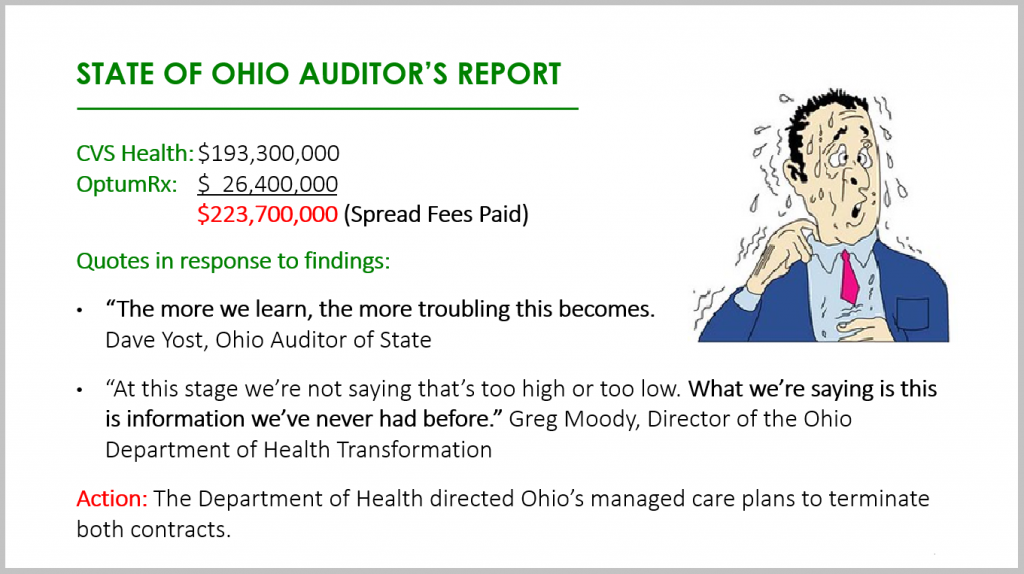

The State of Ohio had not asked all these questions before it paid out almost $250 million in network spreads alone! Its staff had inadequate knowledge of the PBM industry, especially around contracting. Drafting, negotiating, and finalizing a contract with a PBM are the three most important tasks during a competitive bidding process. Select finalists based on radically transparent contract terms with constituent elements spelled out. Do not select a winner based on non-binding pricing guarantees, unverifiable information, or optics.

5 Questions to Ask PBM Finalists Conclusion

PBMs provide transparency and disclosure to a level demanded by current and prospective clients for disclosure in negotiating their contracts. The best proponent of transparency and lowest net cost is educated purchasers of PBM services. The purchaser needs to understand not only what they want to achieve in their relationship with their PBM but also the competitive market and their ability to drive disclosure of details on outcomes important to them. The Certified Pharmacy Benefits Specialist (CPBS) certification is the only training program which puts brokers, consultants, and self-funded employers on a level playing field with PBMs. Click here to read a handful of CPBS course testimonials.