New Exposé Reveals Pharmacy Benefit Manager Tactics That Hurt Patients, Providers, Employers, and Taxpayers [Weekly Roundup]

News and notes from around the interweb:

- PBMs ranked by market share: CVS Caremark is No. 1. Three companies dominate the pharmacy benefit manager market, accounting for 79 percent of all prescription claims in 2020, according to data from Health Industries Research Companies, an independent, non-partisan market research firm. To assess market share, HIRC used self-reported data from twenty-nine pharmacy benefit manager leaders collected in December 2020 and January 2021.

- Documenting Patient Interventions Is Essential. The most common MRPs or medication-related problems included Beers criteria medications (mostly antidepressants, protein pump inhibitors, gabapentin, and opioids), medication omission, drug-condition interaction, duplicate therapy, medication nonadherence, drug-drug interactions, untreated conditions, dose that were too low, and doses that were too high. MRPs were also equally prevalent among face-to-face versus phone interventions. However, the presence of documentation in the “assessment” section of the comprehensive medication review (CMR) was higher when MTM was conducted via phone (42%) compared to face-to-face (28%).

-

Join the Movement! A shared opportunity: The future of cell and gene therapy. Despite the many challenges of the last two years, the global cell and gene therapy (CGT) market continues to rapidly expand. The investment landscape for regenerative medicine has grown 16% in 3 years, hitting an all-time high in 2021 of $23.1 billion raised. With more funding pouring in each year and over 2,261 ongoing global clinical trials in regenerative medicine, the market is expected to reach $34.31 billion in 2030. With this immense growth potential, the industry is reaching a tipping point heading towards commercialization.

- Over 800 Prescription Medications Got More Expensive in January 2022. The list prices for 810 prescription drugs increased by an average of 5.1 percent between Dec. 29 and Jan. 31, according to a GoodRx report released Feb. 4. Of the 810 medications that saw price increases in January, 791 were brand drugs, 19 were generics, 199 were specialty drugs and 84 were healthcare practitioner-administered drugs. The 791 brand drugs’ prices increased by an average of 4.9 percent, and the 19 generic drugs’ prices increased by an average of 12.6 percent. Price hikes in January 2022 were on par with January 2021, which saw 832 price hikes. In January 2022, drug prices rose by an average of 5.1 percent, half a percentage greater than in January 2021. The price hikes came from 155 drugmakers.

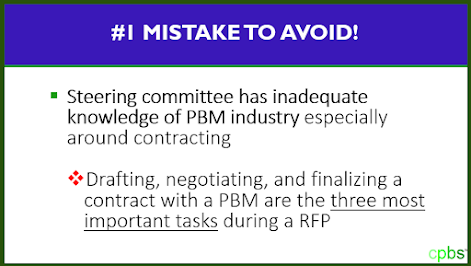

- New Exposé Reveals Pharmacy Benefit Manager Tactics That Hurt Patients, Providers, Employers, and Taxpayers. The report, “Pharmacy Benefit Manager Exposé: How PBMs Adversely Impact Cancer Care While Profiting at the Expense of Patients, Providers, Employers, and Taxpayers,” was commissioned by the Community Oncology Alliance (COA) and written by industry experts at the law firm of Frier Levitt, LLC. It provides a comprehensive exposé and legal analysis of the most pervasive and abusive PBM tactics, highlighting the adverse impact they have on patients, providers, and health care payers (including Medicare, Medicaid, employers, and taxpayers). The goal is for the report to serve as an authoritative reference for policymakers, regulators, employers, and others seeking greater understanding of PBM behavior while also suggesting solutions to reshape the health care industry for the better.