Private Equity Firms Gobbling Up Health Care Facilities at a Skyrocketing Pace [News Roundup]

Private Equity Firms Gobbling Up Health Care Facilities at a Skyrocketing Pace and other news from around the interweb:

- Private Equity Firms Gobbling Up Health Care Facilities at a Skyrocketing Pace. In 2024 Steward Health Care filed for bankruptcy, depriving socioeconomically disadvantaged communities of essential health services, straining nearby state hospitals, and leaving more than 4,430 health providers, staff, and administrators out of a job. Steward, formerly the Caritas Christi Health Care System, was once the second-largest health care system in New England, employing over 12,000 people and serving more than one million patients each year—from poor and working-class communities. A nonprofit system of six Catholic hospitals in cities like Brockton, Dorchester and Fall River, Caritas was acquired in 2010 by the private equity firm Cerberus Capital Management. Cerberus, which takes its name from the mythical three-headed dog that guards the gates of the underworld, converted Caritas into a for-profit system and rebranded it as Steward Health Care.

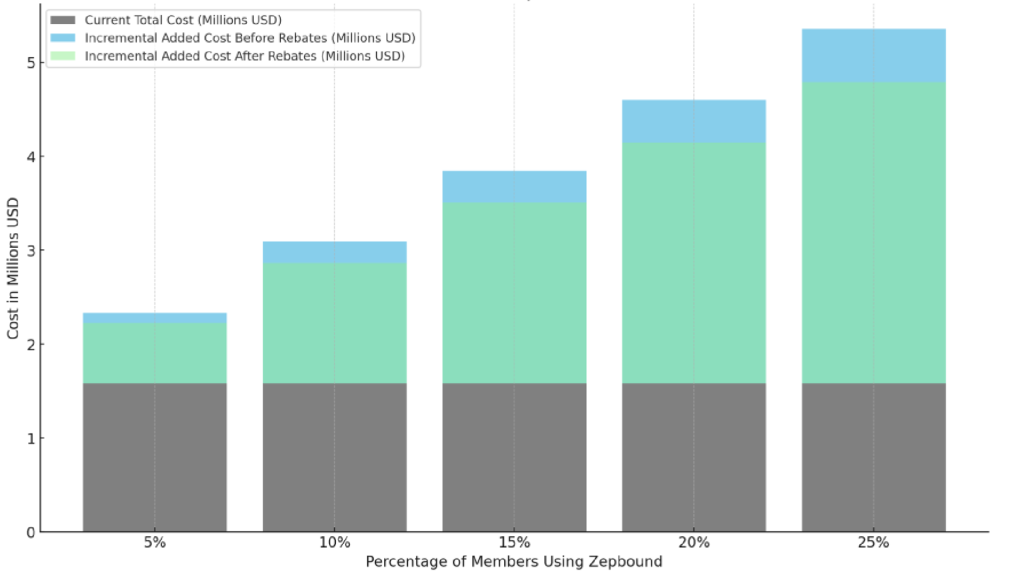

- Patients Taking Newer Weight Loss Drugs Likely to Return to Their Original Weight Within 2 Years, Study Says. A new analysis discovered that patients who stop using weight loss drugs like Wegovy and Mounjaro are likely to regain the total weight they had lost in less than two years. The review, conducted by the University of Oxford’s Biomedical Research Centre, sought to measure weight gain after stopping the use of weight loss medication, or GLP-1 receptor agonists. Researchers determined that ceasing older weight loss medications resulted in a return to original weight within one year — and less than two years for newer weight loss medications.

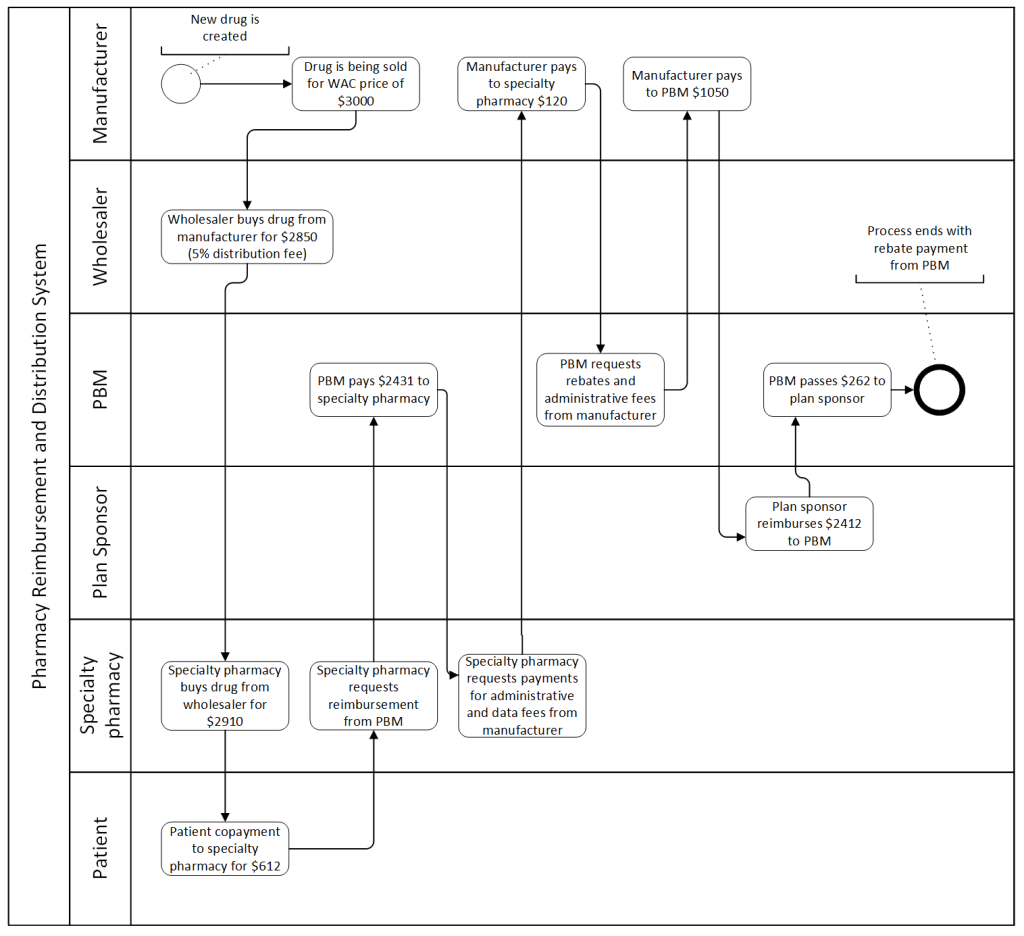

- Stuck in the Middle: Self-Funded Health Plans and Recent Challenges to State PBM Laws. In recent years, prescription drug prices have been top-of-mind for state legislators, who have responded by passing laws that seek to control that pricing in a variety of ways, including by regulating pharmacy benefit managers (PBMs). While states are permitted to regulate fully insured products offered in their state, including mandating the benefits that insurers must offer, the Employee Retirement Income Security Act of 1974, as amended (ERISA) preempts state laws that impermissibly relate to self-funded employer-sponsored health plans that are subject to ERISA.

- New law raises prescription drug costs for most Hoosiers. Because most Hoosiers rely on their employers for health care coverage and the manufacturing industry employs 1 in 5 Hoosiers, the Indiana Manufacturers Association (IMA) has long championed efforts to control spiraling health care costs. This issue is critical to individuals and employers alike, and the IMA is encouraged that Indiana has seen a lot of improvement on this topic in recent legislative sessions. Senate Enrolled Act 140, however, takes a step in the wrong direction. By mandating pharmacy dispensing fees, SEA 140 will ultimately burden employers and individuals with higher prescription drug expenses across the board. At the heart of our concern is the provision within SEA 140 that mandates insurers, pharmacy benefit managers, or other administrators of pharmacy benefits to reimburse pharmacies at a rate that includes “a fair and reasonable dispensing fee.” This mandated fee will raise prescription drug costs on consumers.

Why TransparentRx Is Your Trusted Partner for Smarter Pharmacy Benefits

At TransparentRx, we specialize in delivering fiduciary pharmacy benefit management services that prioritize transparency, cost containment, and optimal patient outcomes. Our unique approach helps self-funded employers, benefits consultants, and health plan sponsors navigate the complexities of pharmacy benefits while reducing costs and enhancing care.

If you’re ready to take control of your pharmacy benefit strategy and eliminate hidden fees, contact TransparentRx today for a consultation. Let us help you achieve smarter, more effective benefits management.