Why the Smartest Employers Are Switching to Closed Formularies

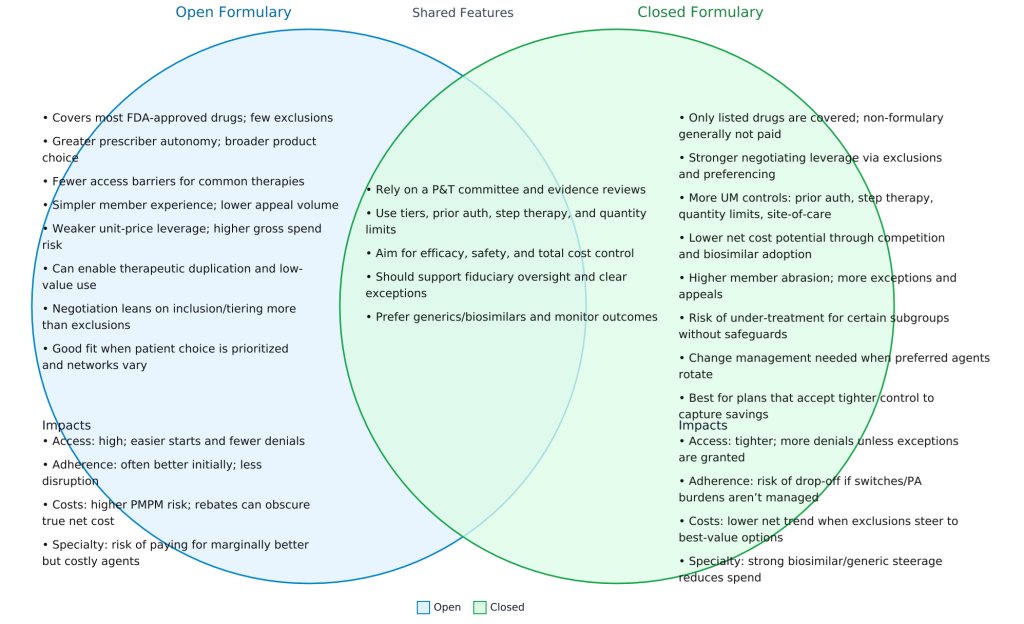

Employers and plan sponsors aiming to take control of drug costs and protect patient health should explore the proven advantages of closed formularies. By carefully curating which drugs are covered, closed formularies strengthen cost management, increase transparency, and support better health outcomes, making them a smart, forward-thinking choice for any benefits plan.

How the Best PBMs Manage Their Programs

The most effective pharmacy benefit managers operate with a clear set of priorities:

- Safety – Every covered drug must first meet the highest safety standards, protecting participants from unnecessary risks or harmful side effects.

- Outcomes – Drugs are chosen based on their ability to deliver meaningful health improvements, supported by credible clinical evidence.

- Cost-Effectiveness – Even when a drug is safe and effective, it must provide value for the money, ensuring resources are used wisely.

- Participant Satisfaction – A sustainable program also considers the patient experience, aiming for access to appropriate medications, reasonable costs, and minimal disruption to therapy.

Closed formularies align perfectly with this priority sequence. They ensure that only medications meeting these criteria are covered, fostering trust between employers, PBMs, and participants.

Stronger Cost Management

Closed formularies cover only clinically vetted, cost-effective drugs. This approach forces manufacturers to compete for placement, which increases rebates and lowers net costs. It also ensures that high-cost brand-name drugs are only used when no equally effective, lower-cost alternatives exist. Specialty drugs, the fastest-growing cost driver, are monitored and managed more effectively.

The results speak for themselves:

- Lower per-member-per-month (PMPM) drug spend

- Greater negotiating leverage with manufacturers and wholesalers

- Stronger control over specialty drug use

Greater Transparency

With a closed formulary, employers can easily see which drugs are covered, where exceptions are granted, and how those decisions impact spending. This clarity helps identify trends, spot potential waste, and maintain accountability across the supply chain.

Better Patient Outcomes

Closed formularies promote the use of first-line therapies that are safe, effective, and affordable. Patients benefit from standardized treatment protocols, which help ensure they receive the most appropriate care. Lower costs also reduce out-of-pocket expenses, which can improve adherence and overall health.

The Takeaway

A closed formulary is not about limiting care; it is about ensuring the right care at the right cost. By aligning clinical best practices with financial stewardship, closed formularies protect both budgets and patient well-being. For any plan committed to sustainable, high-quality care, the choice is clear.

Elevate your expertise in pharmacy benefits management with the Certified Pharmacy Benefits Specialist® (CPBS) program, sponsored by the UNC-Chapel Hill Eshelman School of Pharmacy. Whether you’re an HR leader, finance executive, consultant, or pharmacist, this certification provides the in-depth knowledge and strategic insight needed to manage pharmacy benefits with confidence and cost efficiency. Gain up to twenty continuing education credits, enhance your career prospects, and help your organization take control of pharmacy spend. Register today to join a growing network of professionals shaping the future of pharmacy benefits management. Learn more at the Pharmacy Benefit Institute of America.