Florida Takes Additional Actions to Lower Prescription Drug Prices [Weekly Roundup]

Florida Takes Additional Actions to Lower Prescription Drug Prices and other notes from around the interweb:

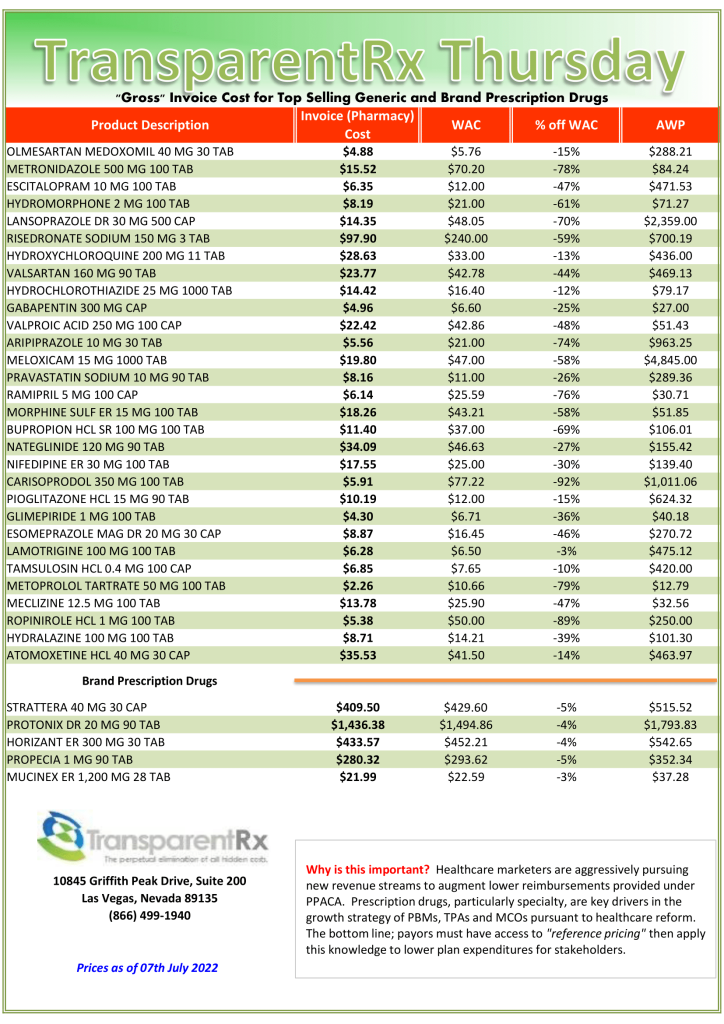

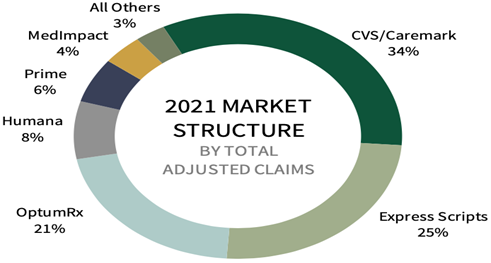

- Florida Takes Additional Actions to Lower Prescription Drug Prices for Floridians. The Executive Order directs all executive agencies to include provisions in all future contracts and solicitations with these PBMs, services that include the following: prohibit spread pricing for all PBMs; prohibit reimbursement clawbacks for all PBMs; directs agencies to include data transparency and reporting requirements, including a review of all rebates, payments, and relationships between pharmacies, insurers, and manufacturers; and directs all impacted agencies to amend all contracts to the extent feasible with these same provisions. A copy of Executive Order 22-164 can be found HERE.

- 300 drugs now in generic ‘cartel’ probe. What started as an antitrust lawsuit brought by states over just two drugs in 2016 have exploded into an investigation of alleged price-fixing involving at least sixteen companies and three hundred drugs, Joseph Nielsen, an assistant attorney general and antitrust investigator in Connecticut who has been a leading force in the probe, said. His comments represent the first public disclosure of the dramatically expanded scale of the investigation. The unfolding case is rattling an industry that is portrayed in Washington as the white knight of American health care. “This is most likely the largest cartel in the history of the United States,” Nielsen said. He cited the volume of drugs in the schemes, that they took place on American soil and the “total number of companies involved, and individuals.” The lawsuit and related cases picked up steam last month when a federal judge ruled that more than one million emails, cellphone texts and other documents cited as evidence could be shared among all plaintiffs.

- The drug rebate curtain. Lawyers for PBMs carefully define what a “rebate” means. For example, according to one template, “inflation payments” are not considered rebates. PBMs receive inflation payments from drug companies to cover year-over-year hikes to a drug’s list price. If employers don’t ask about inflation payments, PBMs keep them by default. The state of Delaware, however, modified its contract in 2015 to ensure those inflation payments are routed back to Delaware’s state employees, according to a copy of the contract that is publicly available.

- Formulary Steering Prevents Members from Accessing Generics. A suit, first obtained by Stat, was filed by Alexandra Miller, who worked at CVS for nearly two decades before leaving the company three years ago. Miller says that when she reported the behavior to a superior, she was told that the company had decided the benefits of the alleged scheme outweighed the likelihood of being caught. Miller claims that CVS’ SilverScripts Part D subsidiary as well as its Caremark pharmacy benefit manager and retail pharmacies worked together to prevent access to generics, which allowed it to pocket higher rebates because members were pushed to buy branded medications rather than lower-cost options.