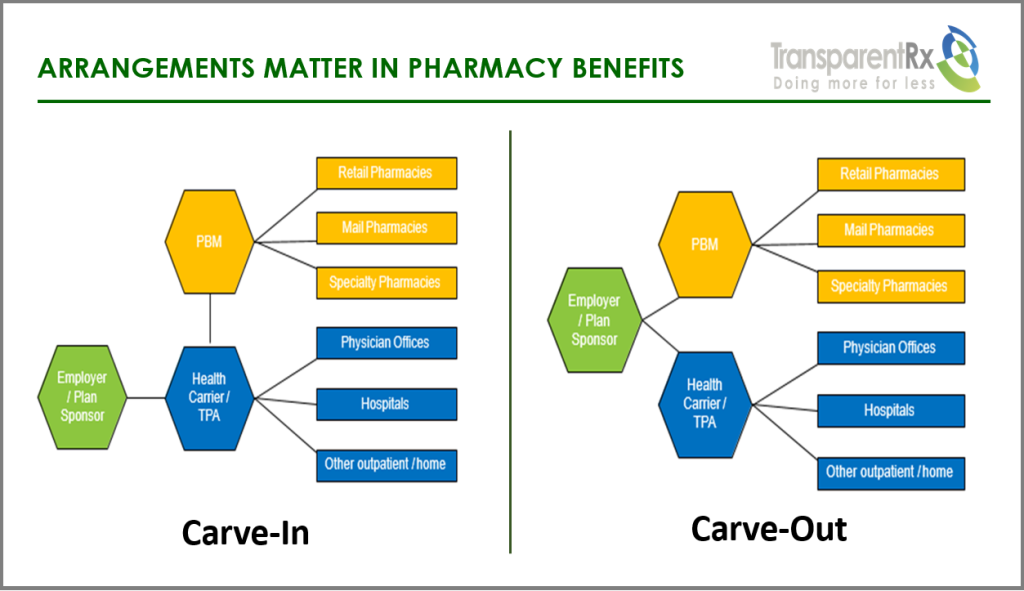

PBM programs typically function in two ways. They are either “carved in”, provided by the health insurance company or “carved out”, provided independent of insurance. Whether the pharmacy benefit plan is self-funded or fully insured, any employer with more than one hundred active employees should consider and investigate a carve-out strategy for their pharmacy benefits. Simply put, a PBM carve-out gives employers more control and flexibility which leads to efficiency in managing pharmacy benefits.

A carved-out program provides better cost control, transparency, information, and reporting. In a carve-in arrangement, health insurers may bundle the two programs and subsidize some of the pricing from one service with that of another. If service levels are equal or better yet costs are lower with more transparency, why choose a carve-in arrangement?

For companies with a carved-in program, there may be concerns about changing to a carved-out program due to a perception that additional time and resources will be needed, but I have seen that on a day-to-day basis, there is slight difference in having a separate PBM program. The functions are similar along with the type and quantity of calls into HR.

Over the course of a year, there are separate review meetings for companies with carved out programs, but overall, the time spent should be roughly the same as meetings taking place with carved in providers. From the employees point of view there is virtually no change besides possibly another card in their wallet. They will have continued access to the full range of services offered by a pharmacy benefit manager (PBM). In fact, many carved in programs use third party PBM companies to provide pharmacy services.

What are the Benefits of a Pharmacy Carve-out?

1. Better Contract Terms – Carved-in plans are based on a single, pre-determined contract that does not allow a plan sponsor or its advisor to negotiate non-pricing terms critical to managing cost trends. For example, carved-in Rx plans seldom have audit rights and, if they do, they are frequently toothless. Detailed clinical programs are also usually missing. Conversely, a carved-out PBM contract, if correctly negotiated by the plan sponsor or an advisor specializing in pharmacy benefit contracting, will clearly outline important non-pricing terms.

2. Carved-out Specialty Rx – A carved-out PBM also permits the plan sponsor to install a carved-out specialty pharmacy benefit. Because specialty pharmacy is the fastest growing and most expensive portion of any pharmacy benefit plan, carving-out specialty drugs provides all the advantages listed above including lower cost and more transparency.

3. Customized Clinical Programs – Better data management and detailed analytics enable clinical licensed pharmacists, whether at the PBM or within a specialized advisory firm, to recommend, implement, and manage customized clinical programs based on the plan sponsors unique population. Examples of this include opioid management, diabetes management, and oncology programs.

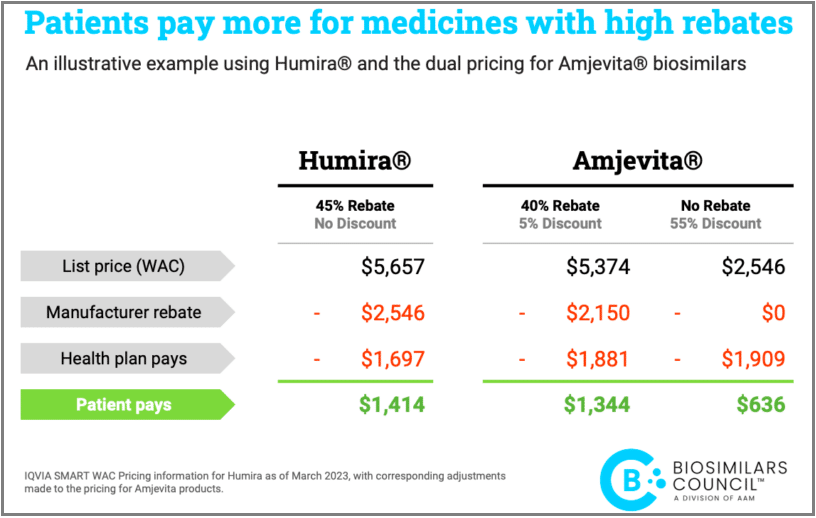

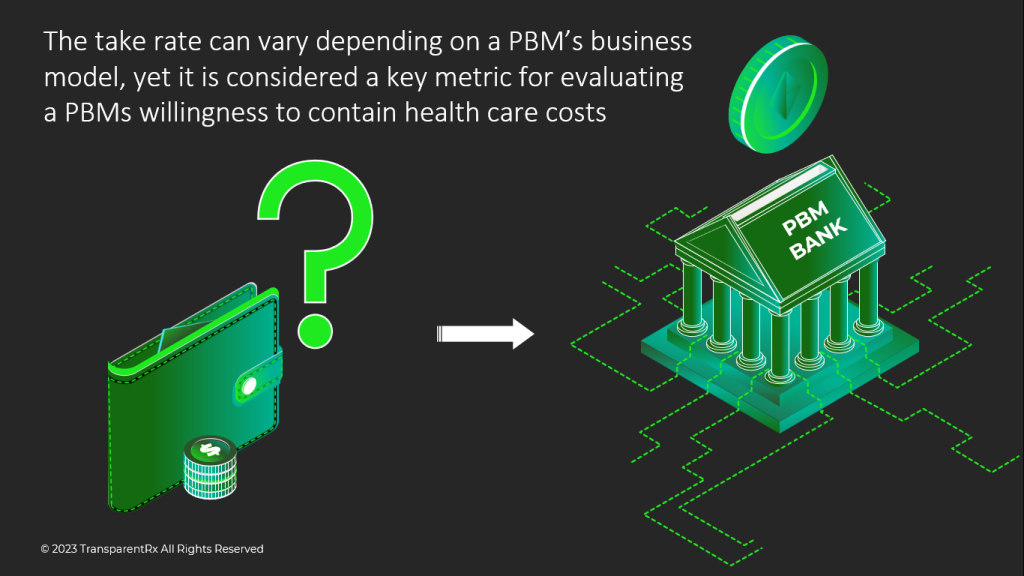

4. Lower Pharmacy Costs – A carved-out PBM contract allows for aggressive price negotiations and more competitive Request for Proposals (RFPs). Separating the medical and prescription drug benefits enables a plan sponsor to compare pricing for both benefits on an apples-to-apples basis. A direct PBM contract will also include the critical terms that govern pricing, including discounts, rebates, and soft dollar programs. In addition, administrative costs are not hidden within the healthcare benefits fee. Carved-in plans have increased fees and costs that reflect the health plan receiving compensation from their PBM arrangement.

5. Improved Data Management – Stand-alone PBMs with carved-out plans and direct contracts with plan sponsors capture and report all claims elements, allowing for accurate modeling, forecasting, and strategic planning. Data feeds and FTP interfaces between the PBM and the medical claims administrator allow automated delivery of pharmacy benefit claims and integration with medical claims. Plan sponsors and advisors can use the combined analytics to track trends and make informed benefit decisions.

6. More Detailed Analytics – The enhanced data management described above means more detailed reporting capabilities, more sophisticated analytical tools, and more accurate forecasting and modeling. All of these contribute to lower annual drug spending and better long-term planning. Best of all employers aren’t required to pay for their own data and aren’t told its proprietary information by their PBM or broker.

7. Transparency – A carved-in plan has little or no transparency for the cost of the prescription drugs, the size of the mark-up, the rebates earned by the health plan, the contract volume pricing concessions negotiated by the health plan, or other financial incentives, all of which drive up cost to the plan sponsor. The health plan administrator provides none of the details critical to lowering costs, managing risk, and creating better clinical outcomes.

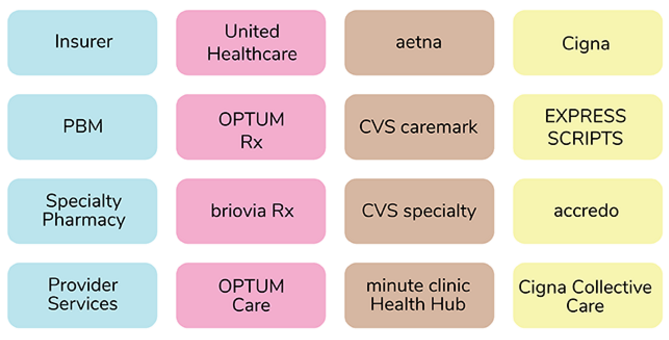

Medical and prescription benefits are completely different. The core strength of health plans and medical carriers is managing discounts with hospital chains and building provider networks. These skills are not transferable to managing prescription drug benefits, which are vastly different and, in many ways, more complex and more dynamic.

Employers with more than one hundred employees that are fully insured are losing out. Without adding to the HR department’s effort, carve-out service levels may be on par with or better with the right TPA and PBM partners. Oh, I nearly forgot to mention that the total cost of care may be cut by up to 40%!