Therapeutic Interchange: How It Could Affect Patients and Plan Sponsors

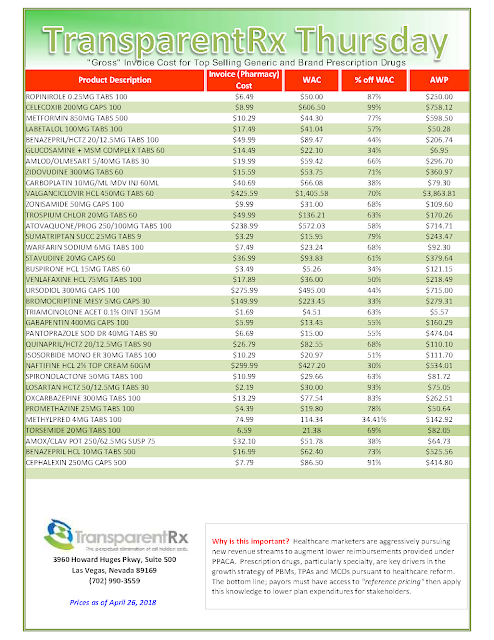

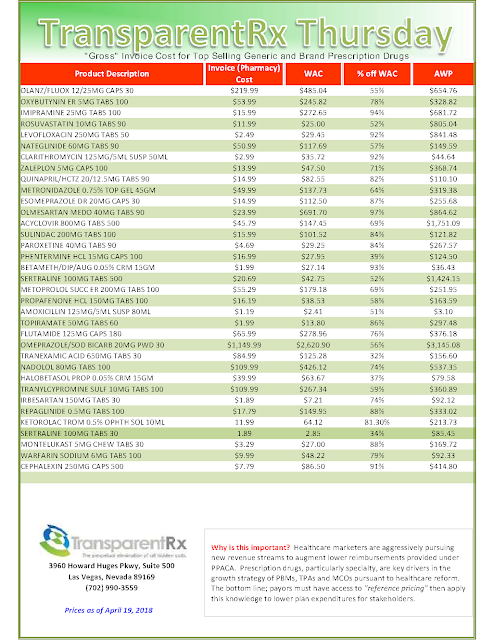

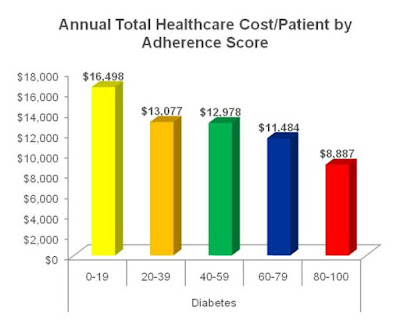

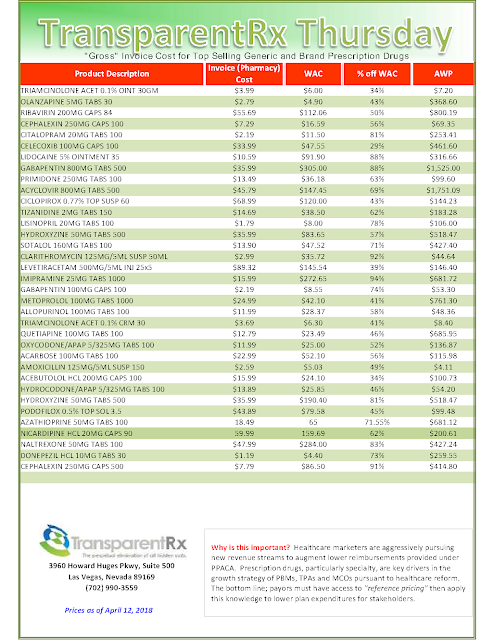

“The lower cost growth was due in part to utilizing low-cost generic drugs, which were dispensed to 86% of pharmacy benefit management (PBM) clients.” In other words, 17 out of 20 patients were moved to generics. The term “therapeutic alternatives” means that CVS will be (somehow) getting patients to use a less expensive medication within a therapeutic category.

|

| Source: http://www.amcp.org |

Tyrone’s Commentary:

The author seems to miss at least part of the point. It’s not just CVS Health who benefits from lower cost therapeutic alternatives; plan sponsors and patients may also benefit. He points out an extreme case and that’s exactly what it is – extreme! If you don’t care for CVS Health write that but don’t deter patients from medications with equal efficacy yet lower cost. The AMCP agrees so I think I’ll go with them. I do, however, agree plan sponsors have a responsibility to keep PBMs honest in any therapeutic substitution program.

To use an extreme example of how this could play out: let’s take blood thinners, within that class are “new oral anticoagulants” which includes Paradaxa, Xarelto, Eliquis. These medications each costs several hundred dollars per month. The “old” generic anti-coagulant is Warfarin which typically costs a patient as little as $4.00/month.