Large PBM is staking out million-dollar gene therapies

|

| Click to Enlarge |

Express Scripts Holding Co. built a multi-billion enterprise pressuring drug companies to lower their prices for U.S. patients. Now it is quietly building a side business: getting paid to help drug companies dispense a new generation of high-priced drugs.

Express Scripts is in talks with biotechnology companies Biomarin Pharmaceutical Inc., Spark Therapeutics Inc. and Bluebird Bio Inc. to have its specialty pharmaceutical business exclusively distribute their new hemophilia therapies when they are expected to become available in 2019 and 2020, Chief Medical Officer Steve Miller told Reuters in an interview.

Tyrone’s Commentary:

The shift is on! Non-fiduciary PBMs are giving more transparency, on the pharmacy benefit, only to shift [pharmacy] cost to the medical benefit. Vertically integrated carriers are preaching the benefits of their business models and in some cases rightfully so. But, if integrating the medical and pharmacy benefit requires that you relinquish flexibility and cost controls, the disadvantages of integration far outweigh the advantages. Disadvantages may include:

- Plan members may pay U&C (usual and customary) prices, which are higher than discounted prices

- Formulary and rebate arrangements may not be available or are significantly limited

- Plan sponsors lack authority and flexibility and are typically unable to adjudicate plan limitations, plan exclusions, enforce generic dispensing mandates or validate appropriate drug pricing

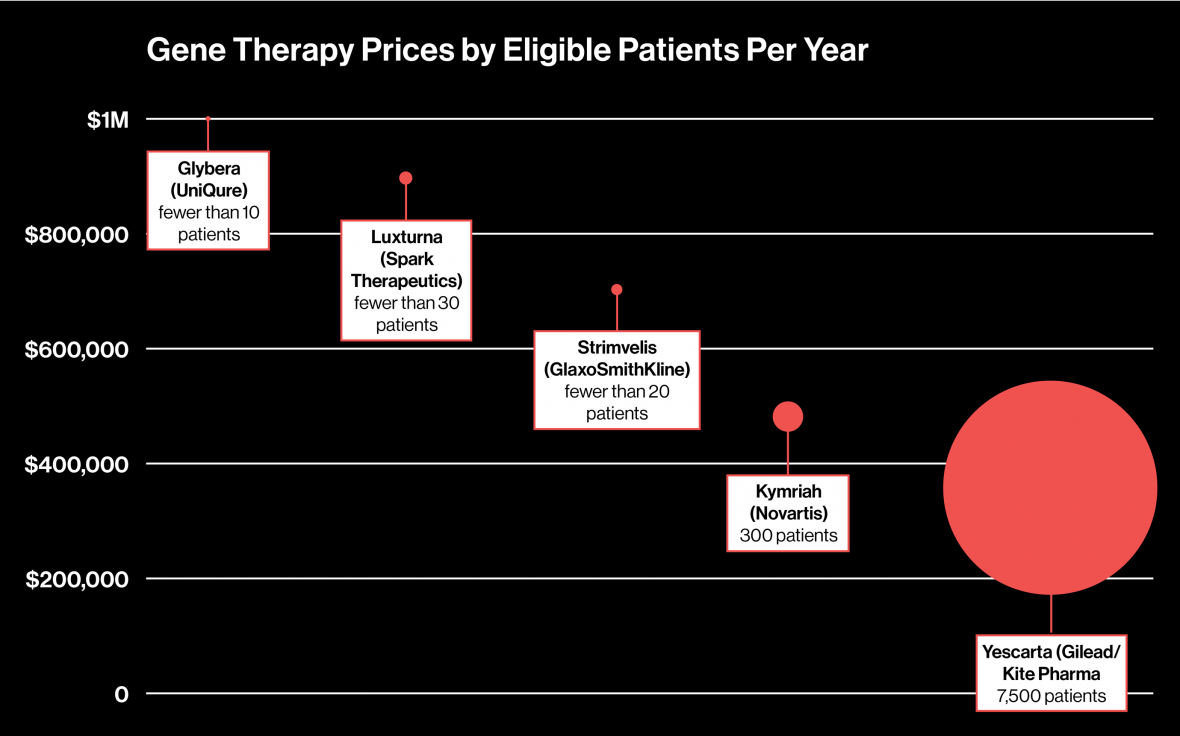

Biomarin, Spark and Bluebird confirmed to Reuters that they were speaking to payers, a group generally defined as pharmacy benefit managers, health plans and government agencies, about pricing models for future therapies. Analysts project those drugs could top $1 million to $1.5 million in price.

Rather than rail against the drugs’ expected high prices, Miller echoes the familiar drug company argument that the potentially curative therapies will likely be worth the high cost if they supplant the hundreds of thousands of dollars in annual medical costs to treat ailments such as hemophilia, which affects about 20,000 people in the United States alone.