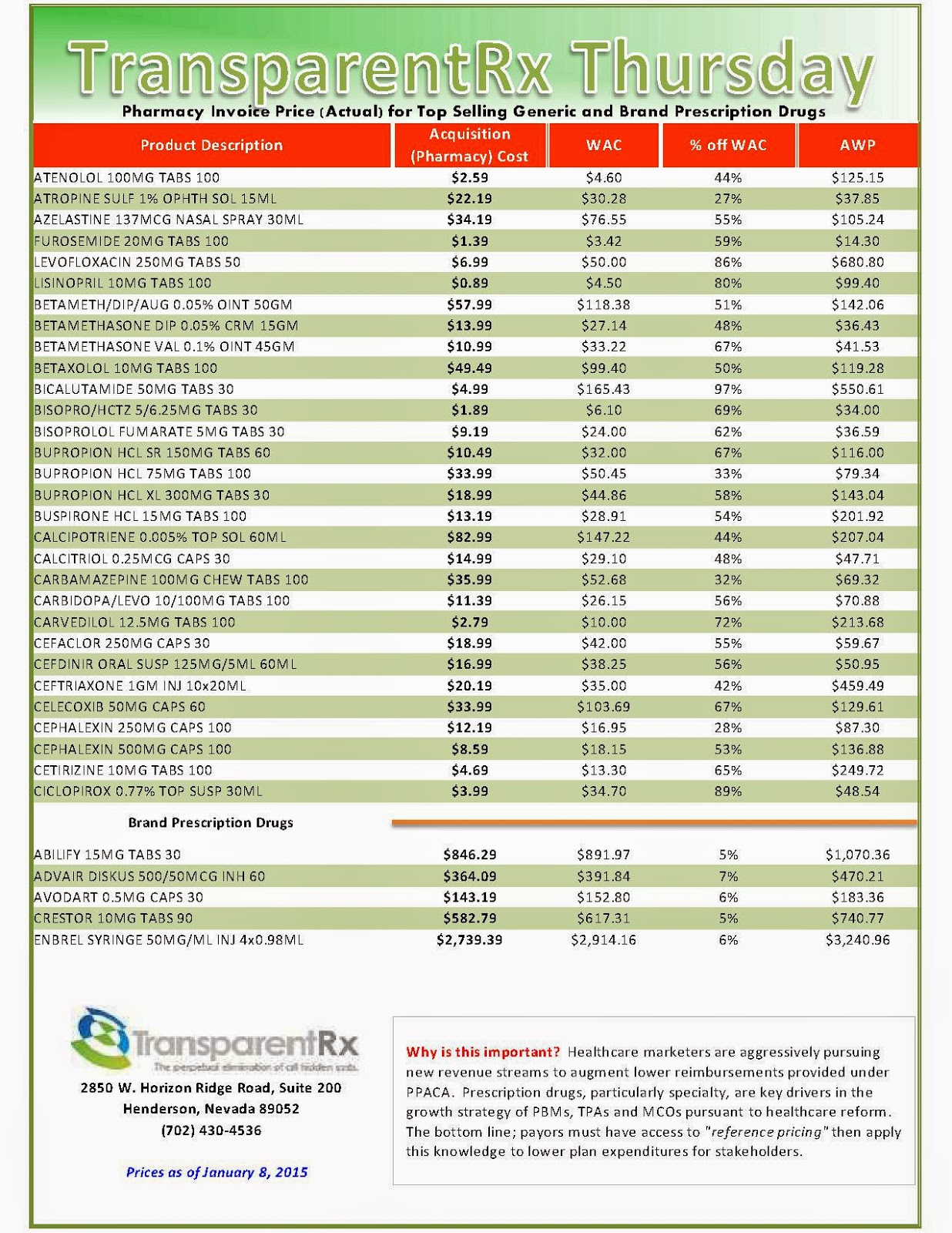

Reference Pricing: Pharmacy Invoice Cost (ACTUAL) for Top Selling Generic and Brand Prescription Drugs

The costs shared below are what our pharmacy actually pays; not AWP, MAC or WAC. The bottom line; payers must have access to “reference pricing.” Apply this knowledge to hold PBMs accountable and lower plan expenditures for stakeholders.

Note: This document is updated weekly to reflect changing prices and new products. Did you know that pharmacies (and PBMs) often negotiate discounts on prescription drugs which aren’t reflected in AWP, WAC or MAC prices? The only way to be sure you’re receiving these discounts is to gain access to invoices.

Step #1: Obtain a price list for generic prescription drugs from your broker, TPA, ASO or PBM every month.

Step #2: In addition, request an electronic copy of all your prescription transactions (claims) for the billing cycle which coincides with the date of your price list.

Step #3: Compare approximately 10 to 20 prescription claims against the price list to confirm contract agreement. It’s impractical to verify all claims, but 10 is a sample size large enough to extract some good assumptions.

Step #4: Now take it one step further. Check what your organization has paid, for prescription drugs, against our pharmacy cost then determine if a problem exists. When there is a 5% or more price differential (paid versus actual cost) we consider this a problem.

When better pricing is discovered the contract language should stipulate the client be indemnified. Do not allow the PBM to limit the market check language to a similar size client, benefit design and/or drug utilization. In this case, the market check language is effectually meaningless.

Click here to register: “How To Slash the Cost of Your PBM Service, up to 50%, Without Changing Providers or Employee Benefit Levels.” [Free Webinar]

Top 10 trends shaping the health industry in 2015

PricewaterhouseCoopers’ (PwC) Health Research Institute surveyed 1,000 U.S. adults, experts and clients to find out. They took a pulse on the top health industry issues for the coming year and presented their findings in a webinar last Thursday. Here are the top 10 issues of 2015.

1. Do-it-yourself healthcare. This year, the intersection of consumer desire and technological advancements will put “D.I.Y. healthcare” at the top of the agenda, PwC predicts. Increasingly, consumers are taking charge of more of their own care. Technology companies are ready to help this happen with the development of apps and mobile devices to track health metrics such as vital signs, medication adherence or even urinalysis. Nearly half of physician respondents said they would be comfortable using data from a mobile device to determine if a patient should be seen in person or prescribed medication, and 90 percent felt the apps and mobile devices would be important to their practice in the next five years, according to PwC’s HRI.

2. Making the leap from mobile app to medical device. The mhealth app space is getting more and more crowded. The FDA will likely review more mhealth apps this year than ever before. Regulatory approval could give some apps a competitive edge in a crowded sector. The rush of new apps also means consumers will need a way to sort through all the available tools.

3. Balancing privacy and convenience. Approximately five million patients had their personal records compromised from data breaches last summer alone, Mr. Isgur says. These EHRs, which offer personal, medical, financial and insurance information, can go for up to $1,300 on the black market. Yet as healthcare organizations strive to make data private, they must also consider their consumer, who could benefit from convenient data access. The healthcare industry can learn a lot from the financial and retail sectors on how to balance convenience and privacy with data. Collaborations with experts across industries may help healthcare organizations develop better security strategies.

4. High-cost patients spark cost-saving innovations. There is a very, very small percentage of people that cost our health system a lot of money. The sickest 1 percent of patients generates 20 percent of U.S. healthcare spending and dual eligibles are especially costly. We also know there’s a laser focus in most healthcare organizations to try to reduce costs. To do that, many organizations are trying to look at those populations and develop innovative care models. This year we will likely see health systems employ a variety of strategies, including delivering care in new settings, through telehealth and retail clinics, high-tech solutions like wearables and apps, and low-tech solutions like making sure diabetic patients have refrigerators to store their insulin.

5. Justifying the price of specialty medications. Increasing stress on the healthcare system is leading many insurers and healthcare systems to control drug costs by limiting access to high-priced, specialty medications. Though cost has been an issue for many years, expect insurers to raise the bar in 2015 for both patients and providers to access to these medications. From the patient perspective, we’ve seen an increase in financial responsibility that continues year over year, and frankly is not changing.

It’s getting more significant as insurers move to coinsurance and larger copayments, looking for the patient to have more of a contribution to the cost of their drugs, more of a conscious decision about the need for the drug. Patients will increasingly be a factor in decision making for drugs. Correspondingly, from the physician perspective, [insurers are] really looking for physicians to present a much more detailed, clinical profile of the patient to justify medical necessity, and in some cases, that’s extending all the way to the request for genomic data.

6. Open everything to everyone. There is a shift beyond making data transparent solely for the sake of remaining compliant. Instead, manufacturers, regulatory agencies and prescribers are transforming the way data is shared with a greater sense of collaboration. For instance, pharmaceutical and medical device manufacturers are contributing clinical trial data sets to Project Data Sphere, The Yale University Open Data Access Project and other programs. A great deal of clinical data is never published based on the outcomes of different trials, initiatives or registries. This movement to publish sort of the good and the bad and make things more transparent, I think, is clearly a top issue for this year.

7. Getting to know the newly insured. More than 10 million adults have gained health coverage through the Patient Protection and Affordable Care Act, according to PwC’s presentation. The insurance industry and provider community are trying to learn about this group in a short period of time. Additionally, primary care physicians, surgeons and other specialists have seen measurable increases in the proportion of Medicaid patients in expansion states, according to PwC. Hospitals and health systems in the states that have expanded Medicaid are seeing significantly different types of revenue figures, which are evidence of an increase in admissions and a reduction in uncompensated care debt. As far as implications, it makes sense for providers to contract broadly with insurers and help uninsured and underinsured enroll in coverage, she says.

8. Physician extenders see an expanded role in patient care. Extenders — such as nurses, physician assistants, pharmacists and others — will have an expanded role in patient care. Over the next five years, the supply of primary care nurse practitioners and physician assistants is expected to increase by 30 percent and 58 percent respectively. States will have to again visit and revisit their scope of practice laws. One implication of this trend is that extenders initially may not slow growth in the cost of care as much as people think due to the demand for extenders, resulting in an increase in the cost of wages. However, that is expected to level out.

9. Redefining health and well-being for millennials. As baby boomers retire, employers, insurers and health systems are looking for new ways to engage, attract and retain millennials. Employers will have to really pivot to better meet the expectations of this group of millennials. It will require them to reorient strategies from the concept of wellness to one of well-being. By 2030, millennials will make up 75 percent of the U.S. workforce, according to the PwC.

10. Partner to win. In this new hyper-competitive environment, people are thinking differently about how they collaborate and with whom they collaborate. According to the PwC, successful companies that want to thrive “will work together on innovative products and services.” An analysis of the Fortune 50 healthcare companies found that about 40 percent pursued new healthcare partnerships last year. It’s no longer enough to partner at a peripheral level…You really have to think critically about who you partner with.

Written by Kelly Gooch and Emily Rappleye

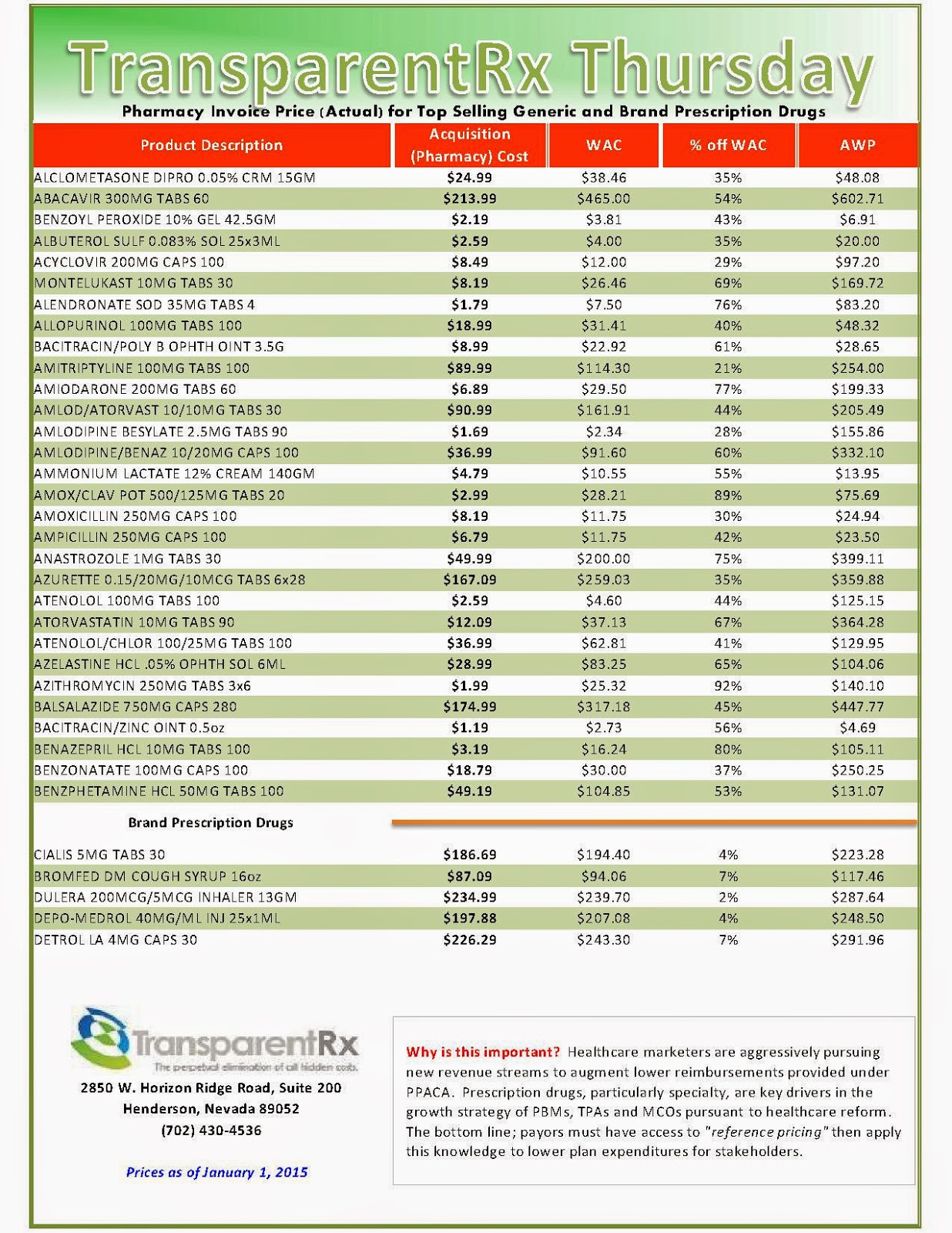

Reference Pricing: Pharmacy Invoice Cost (ACTUAL) for Top Selling Generic and Brand Prescription Drugs

The costs shared below are what our pharmacy actually pays; not AWP, MAC or WAC. The bottom line; payers must have access to “reference pricing.” Apply this knowledge to hold PBMs accountable and lower plan expenditures for stakeholders.

Note: This document is updated weekly to reflect changing prices and new products. Did you know that pharmacies (and PBMs) often negotiate discounts on prescription drugs which aren’t reflected in AWP, WAC or MAC prices? The only way to be sure you’re receiving these discounts is to gain access to invoices.

Step #1: Obtain a price list for generic prescription drugs from your broker, TPA, ASO or PBM every month.

Step #2: In addition, request an electronic copy of all your prescription transactions (claims) for the billing cycle which coincides with the date of your price list.

Step #3: Compare approximately 10 to 20 prescription claims against the price list to confirm contract agreement. It’s impractical to verify all claims, but 10 is a sample size large enough to extract some good assumptions.

Step #4: Now take it one step further. Check what your organization has paid, for prescription drugs, against our pharmacy cost then determine if a problem exists. When there is a 5% or more price differential (paid versus actual cost) we consider this a problem.

When better pricing is discovered the contract language should stipulate the client be indemnified. Do not allow the PBM to limit the market check language to a similar size client, benefit design and/or drug utilization. In this case, the market check language is effectually meaningless.

Click here to register: “How To Slash the Cost of Your PBM Service, up to 50%, Without Changing Providers or Employee Benefit Levels.” [Free Webinar]

Drug Distributors Build Strength In An Era Of Change

Three companies dominate this key piece of the pharmaceutical supply chain. The largest, San Francisco-based McKesson (MCK ), reported almost $138 billion in fiscal 2014 revenue. The companies earn slim margins from their massive revenue, however. And those thin profits have come under harsh pressure in recent years due to shifting trends in health care.

AmerisourceBergen (ABC), McKesson and Cardinal Health (CAH ) have been able to withstand this squeeze largely because they’ve combined their purchasing power with major pharmacy chains Walgreen Boots Alliance (WBA ), Rite-Aid (RAD ) and CVS Health (CVS).

|

| Source: www.fda.gov |

The three dominant drug distributors control more than 85% of the market. Their stocks have trended higher the past five years, with AmerisourceBergen up 29%, McKesson up 27% and Cardinal Health ahead 20% the past 12 months.

Challenges And Benefits

The drug wholesaler-drugstore partnerships unite the two middlemen in the pharmaceutical supply chain. Their common bond is in wanting to defend the spread between the wholesale price the manufacturer charges and the retail price that the insurer lets pharmacies bill patients.

That spread can be paper-thin for branded drugs, and often substantially wider for generics. The catalyst for the distributor/pharmacy chain deals: “The payers in the U.S. have been looking at every single option to lower prices,” said Vishnu Lekraj, health care service analyst at Morningstar.

This price pressure, applied by the pharmacy benefit manager side, leverages the PBMs’ market power to control prices on behalf of insurers, Lekraj said.

The AmerisourceBergen-Walgreen, Cardinal Health-CVS and McKesson-Rite Aid ventures have each elevated their generics purchasing to $10 billion to $12 billion a year, estimates FBR Capital Markets data.

By joining together, drug wholesalers and drugstores can better withstand the profit squeeze and pass most of the pricing pressure onto generic drug manufacturers, Lekraj says. That advantage until recently has remained largely theoretical, although the partnerships have begun to bear fruit.

Rite-Aid’s latest quarterly results demonstrate the value provided by its deal struck last February to have McKesson purchase its generic drugs and deliver them directly to stores, notes Fein. The pharmacy chain’s total inventories were $255 million below year-ago levels in the third quarter, a boon to working capital and profit margins.

“If Rite Aid keeps posting such positive results, expect other large pharmacy buyers to give in … and begin sourcing generics through the large wholesalers,” he wrote on his Drug Channels blog.

One wrinkle to McKesson’s partnership with Rite Aid: the distributor’s plans to use its own NorthStar generic manufacturing arm for some generic production, providing more pressure on generic-drug makers to make concessions on price. McKesson suppliesWal-Mart (WMT) with branded drugs, but the retailing giant currently buys its own generics.

The Wholesale Story

Branded drugmakers have long used the wholesalers, rather than sell directly to big drugstore chains. Those branded drugs provide the Big Three with lots of revenue, but at margins of only around 1%.

Generics, though much lower priced, offer much higher margin opportunities. The recent wave of branded drugs coming off patent was bad news for manufacturers but a net positive for distributors and pharmacies, even though it dampens revenue growth. That trend is set to continue for the next few years.

Some of the big potential generic launches being eyed within the next couple of years include Nexium (acid reflux), Copaxone (multiple sclerosis), Abilify (anti-depressant), Enbrel ( rheumatoid arthritis) and Advair (asthma).

Aggressive Partnering

AmerisourceBergen has been the pace-setter in the industry. It kicked off the drugstore-chain partnering trend, striking a deal with Walgreen in March 2013. Last week it pushed into animal health territory, saying it would buyMWI Veterinary Supply (MWIV) for $2.5 billion.

The game changer was its deal with Walgreen. That relationship, including brand and generic drug distribution, fueled a 29.1% jump in AmerisourceBergen’s revenue from the prior year to $31.6 billion in the September quarter and a 30.1% rise in operating earnings to $423.8 million, or 1.34% of revenue.

The deal with Walgreen also provided scale in Europe for the drug wholesaler via Walgreen’s combination with Alliance Boots, the biggest U.K.-based pharmacy. Walgreen has since tapped its option to acquire an equity stake in AmerisourceBergen.

As of last August, Walgreen had bought 11.5 million shares of AmerisourceBergen on the open market, giving it a stake of less than 5%, though it has an option to acquire 23%. McKesson followed suit, strengthening its generic-buying clout when it acquired a controlling stake in German drug distributor Celesio in January 2014 for $5.4 billion.

While analysts have awaited a similar move into Europe by Cardinal Health, the company has instead directed its international push into China. That piece of the business has grown from $1 billion a year to $2.6 billion since 2011. Sales in China are growing more than 30% a year, and account for over 10% of Cardinal Health’s total revenue.

Specialty Segment: On The Rise

Amerisource has been the leader in distributing specialty drugs, which is the fastest-growing segment of the industry. The company’s oral oncology, opthalmology and plasma revenue grew 11% to nearly $20 billion last year. Cardinal Health’s specialty segment has grown from $1 billion to $5 billion the past four years.

Because these high-priced drugs often require special handling and delivery mechanisms, and can be geared to smaller patient pools, they aren’t normally distributed through the standard drugstore channels. Specialty pharmacies sometimes source directly from the manufacturer, bypassing the distributors.

Read more: http://www.nasdaq.com/article/drug-distributors-build-strength-in-an-era-of-change-cm433710#ixzz3P5ku5S1c

Reference Pricing: Pharmacy Invoice Cost (ACTUAL) for Top Selling Generic and Brand Prescription Drugs

The costs shared below are what our pharmacy actually pays; not AWP, MAC or WAC. The bottom line; payers must have access to “reference pricing.” Apply this knowledge to hold PBMs accountable and lower plan expenditures for stakeholders.

Note: This document is updated weekly to reflect changing prices and new products. Did you know that pharmacies (and PBMs) often negotiate discounts on prescription drugs which aren’t reflected in AWP, WAC or MAC prices? The only way to be sure you’re receiving these discounts is to gain access to invoices.

Step #1: Obtain a price list for generic prescription drugs from your broker, TPA, ASO or PBM every month.

Step #2: In addition, request an electronic copy of all your prescription transactions (claims) for the billing cycle which coincides with the date of your price list.

Step #3: Compare approximately 10 to 20 prescription claims against the price list to confirm contract agreement. It’s impractical to verify all claims, but 10 is a sample size large enough to extract some good assumptions.

Step #4: Now take it one step further. Check what your organization has paid, for prescription drugs, against our pharmacy cost then determine if a problem exists. When there is a 5% or more price differential (paid versus actual cost) we consider this a problem.

When better pricing is discovered the contract language should stipulate the client be indemnified. Do not allow the PBM to limit the market check language to a similar size client, benefit design and/or drug utilization. In this case, the market check language is effectually meaningless.

Click here to register: “How To Slash the Cost of Your PBM Service, up to 50%, Without Changing Providers or Employee Benefit Levels.” [Free Webinar]

Prevent prescription drug monopolies

When the pharmacy told me how much the name-brand version of my daughter’s albuterol inhaler would cost, I inquired about the generic. I used to work in a traditional retail pharmacy, and remembered being able to obtain the generic version for about $2. The manager informed me that there was no longer a generic albuterol inhaler available.

A few years ago, pharmaceutical companies successfully lobbied the Food and Drug Administration ( to ban traditional inhalers over fears that the chlorofluorocarbon (CFC) used as a propellant was harmful to the ozone layer. The patents on those traditional inhalers had expired, so generic versions were readily available. The ban enabled drug makers to use new propellants, which could justify a new patent for the same drug. As a result, the price went from a few dollars per prescription to $60.

|

| Source: www.uspharmacist.com |

A new report in the New England Journal of Medicine highlights how big the problem of high-cost generic drugs is getting. Generic drugs to treat everything from intestinal parasites to high blood pressure to depression have increased 570 percent, 2,800 percent and 5,200 percent, respectively — sometimes in as little as one year.

In 2012, the McKesson Corporation paid out $151 million to 29 states over allegations that the company artificially raised Medicaid drug prices. McKesson is the country’s largest drug wholesaler, and it was alleged that they artificially drove up prices on 1,400 drugs from 2001 to 2009.

Going forward, it looks as if things will only get worse. Bryan Birch, the chief executive of Truveris, which analyzes prescription drug prices, recently spoke to Medscape Medical News about the “unprecedented levels of generic price increases” over the last two years. “The folks who benefit from it are the manufacturers of generic drugs, the wholesalers in the United States, and the…pharmacy benefits managers,” Birch said, adding that the costs are eventually passed on to consumers.

When there is a legitimate shortage of generic drugs, the FDA can usually work to expedite companies’ ability to produce the drug, or even deal with overseas manufacturers to import more of the drug. Compounding, when a pharmacist creates a customized medication on a case-by-case basis, is another alternative for patients who need drugs that are hard to find commercially.

But the FDA cannot do the same with a single manufacturer of a drug, according to the NEJM report. “U.S. antitrust laws protect consumers only from anticompetitive strategies such as price fixing among competitors,” the report notes. “Manufacturers of generic drugs that legally obtain a market monopoly are free to unilaterally raise the prices of their products.”

I’m not begrudging pharmaceutical companies making a profit. These companies provide drugs that save lives, and they should be able to make money doing it. But these companies have become adept at extending patents, which are supposed to expire after 20 years. And as long as a company holds a monopoly, it can charge whatever it wants for a drug.

It’s assumed that drug companies have to charge high prices to fund research and development of new drugs; however, 84 percent of worldwide funding for drug discovery research comes from government and public sources. And pharmaceutical companies spend 19 times more on marketing than they do on research.

The FDA and the Federal Trade Commission, both of which oversee the pharmaceutical industry, need to work together to promote competition and remove incentives for pharmaceutical companies to monopolize. The American people are used to having a choice when they buy goods and services, from cable TV to razor blades to air travel.

One would expect that in this era of choice, there would be similar competition for the over $300 billion dollars Americans spend every year on prescription drugs. But the big pharmaceutical companies are allowed to obtain and keep monopolies, preventing the free market from operating as it should.

by Bill Goble, PharmD, a licensed pharmacist and the general manager of Brown’s Compounding Center in Englewood.

Reference Pricing: Pharmacy Invoice Cost (ACTUAL) for Top Selling Generic and Brand Prescription Drugs

The costs shared below are what our pharmacy actually pays; not AWP, MAC or WAC. The bottom line; payers must have access to “reference pricing.” Apply this knowledge to hold PBMs accountable and lower plan expenditures for stakeholders.

Note: This document is updated weekly to reflect changing prices and new products. Did you know that pharmacies (and PBMs) often negotiate discounts on prescription drugs which aren’t reflected in AWP, WAC or MAC prices? The only way to be sure you’re receiving these discounts is to gain access to invoices.

Step #1: Obtain a price list for generic prescription drugs from your broker, TPA, ASO or PBM every month.

Step #2: In addition, request an electronic copy of all your prescription transactions (claims) for the billing cycle which coincides with the date of your price list.

Step #3: Compare approximately 10 to 20 prescription claims against the price list to confirm contract agreement. It’s impractical to verify all claims, but 10 is a sample size large enough to extract some good assumptions.

Step #4: Now take it one step further. Check what your organization has paid, for prescription drugs, against our pharmacy cost then determine if a problem exists. When there is a 5% or more price differential (paid versus actual cost) we consider this a problem.

When better pricing is discovered the contract language should stipulate the client be indemnified. Do not allow the PBM to limit the market check language to a similar size client, benefit design and/or drug utilization. In this case, the market check language is effectually meaningless.

Click here to register: “How To Slash the Cost of Your PBM Service, up to 50%, Without Changing Providers or Employee Benefit Levels.” [Free Webinar]

Specialty Drug Approvals: Review 2014 and a Forecast for 2015

| Click image to enlarge |

The impact of specialty drugs continues to increase in both drug utilization and spend. In 2012, specialty drug spend accounted for approximately $87 billion, or about 3.1% of national health spend in the United States. In 2020, the forecasted specialty drug spend is expected to be $400 billion, or about 9.1% of national health spend. In addition, within 4 years, analysts predict that 7 of the top 10 drugs in terms of sales will be specialty products.1 Given this expected growth, the specialty drug pipeline will be of particular interest to patients, prescribers, payers, and pharmacies.

New specialty drug approvals

As of December 3, 2014, FDA had approved 39 new molecular entities and new therapeutic biologics this year. While there is no universal definition of a specialty drug, approximately 19 of this year’s approvals fit commonly used definitions of specialty products (Table 1).6,7 Of these 19, oncology and rare diseases represented the majority of approvals, a trend that is expected to continue through 2015.2

Looking ahead to the remainder of 2014 and 2015, the pipeline is again forecasted to have the highest number of approvals in oncology, with approximately one dozen expected approvals for a variety of cancers (Table 2).3 Programmed cell death–1 (PD-1) drugs stand out as an especially promising class of therapy. Pembrolizumab (Keytruda—Merck) was the first of this class to earn FDA approval for the treatment of unresectable or metastatic melanoma. Pembrolizumab, along with fellow experimental PD-1 drug nivolumab (Opdivo—Bristol-Myers Squibb), have earned breakthrough designations from FDA and are likely to see success expanding into other indications.

Trials are currently under way with PD-1 agents for a number of cancers, including lung, liver, brain, and solid tumors. Other pipeline drugs are in late stages of development for the treatment of breast, melanoma, non–small cell lung, ovarian, and pancreatic cancers, as well as hematologic malignancies such as leukemia and multiple myeloma.

| Click image to enlarge |

Hepatitis C

Hepatitis C (HCV) continues to have one of the most intriguing pipelines of any disease state. Within the last year, the approvals of sofosbuvir (Sovaldi—Gilead) and simeprevir (Olysio—Janssen) as individual agents have led to major changes in the treatment of HCV. Gilead’s Harvoni, the combination of sofosbuvir and ledipasvir, was approved in October 2014. In addition, sofosbuvir and simeprevir used together was approved in November 2014. Both of these combination therapies show high sustained viral response rates and are interferon-free, oral regimens.

Competition should come from the AbbVie “3D” HCV combination therapy composed of ombitasvir, paritaprevir, and ritonavir (Viekirax) used in combination with dasabuvir (Exviera). An FDA decision for this combination is expected by December 22, 2014. In addition, Merck’s HCV combination of MK-5172 and MK-8742 is also showing good effectiveness in clinical trials.

Tough competition from fast-paced innovation in the HCV market has taken a toll on other pipeline agents. Faldaprevir, a late-stage drug from Boehringer Ingelheim, was abandoned. Bristol-Myers Squibb’s daclatasvir and asunaprevir, taken together as a two-drug combination therapy, was discontinued. However, studies continue with daclatasvir as a component of other drug combinations, including a three-drug combination of daclatasvir with asunaprevir and BMS-791325. A two-drug combination of daclatasvir paired with sofosbuvir is also being evaluated in clinical trials.3

Immunology

In the immunology pipeline, top agents of interest include the IL-17 class of drugs: secukinumab (Novartis), brodalumab (AstraZeneca, Amgen), and ixekizumab (Eli Lilly). These agents are showing promise particularly for the treatment of psoriasis. In clinical trials, some IL-17 inhibitors have demonstrated efficacy that is superior to etanercept (Enbrel—Amgen), a commonly used drug in the treatment of psoriasis. These drugs are also being investigated for the treatment of rheumatoid arthritis, ankylosing spondylitis, and psoriatic arthritis. Sarilumab (Sanofi—Regeneron) is an additional late-stage pipeline agent being evaluated for the treatment of rheumatoid arthritis.3

Rare diseases

Opportunities in an area with limited competition have made rare disease treatments an attractive category for many manufacturers. Examples of these types of products include the recently approved drugs for idiopathic pulmonary fibrosis, pirfenidone (Esbriet—InterMune) and nintedanib (Ofev—Boehringer Ingelheim), as well as the experimental drugs eteplirsen (Sarepta) and drisapersen (Prosensa), which are currently being studied for the treatment of Duchenne muscular dystrophy. These drugs treat diseases where currently available therapies are limited.

This trend toward the development of rare disease treatments is expected to continue growing. As of 2013, more than 450 drugs were in various stages of development for rare diseases.4 Further evidence of the growth in rare disease drug development is shown by the fact that in 2010, of the top 100 drugs in the United States, 23 were for the treatment of diseases with 100,000 or fewer patients. In 2014, that number of rare disease drugs had increased to 41. Meanwhile, drugs targeting diseases with higher patient populations became less popular. In 2010, of the top 100 drugs, 55 treated diseases with 500,000 or more patients. By 2014, that total was reduced to 35 drugs.5

The pipeline is stocked with exciting treatments for many disease states. While we can’t be certain how many of these agents will earn FDA approval, the possibility of bringing patients better treatments makes the drug pipeline worth watching.

References

- http://bit.ly/1A6KtAO

- www.fda.gov/Drugs/DevelopmentApprovalProcess/DrugInnovation/ucm20025676.htm

- www.infinata.com/biopharma-solution/by-product/biopharm-insight.html

- www.phrma.org/sites/default/files/pdf/Rare_Diseases_2013.pdf

- http://bit.ly/1A6Kzse

- www.fda.gov/Drugs/DevelopmentApprovalProcess/DrugInnovation/ucm20025676.htm

- www.centerwatch.com/drug-information/fda-approved-drugs/

Reference Pricing: Pharmacy Invoice Cost (ACTUAL) for Top Selling Generic and Brand Prescription Drugs

The costs shared below are what our pharmacy actually pays; not AWP, MAC or WAC. The bottom line; payers must have access to “reference pricing.” Apply this knowledge to hold PBMs accountable and lower plan expenditures for stakeholders.

Note: This document is updated weekly to reflect changing prices and new products. Did you know that pharmacies (and PBMs) often negotiate discounts on prescription drugs which aren’t reflected in AWP, WAC or MAC prices? The only way to be sure you’re receiving these discounts is to gain access to invoices.

Step #1: Obtain a price list for generic prescription drugs from your broker, TPA, ASO or PBM every month.

Step #2: In addition, request an electronic copy of all your prescription transactions (claims) for the billing cycle which coincides with the date of your price list.

Step #3: Compare approximately 10 to 20 prescription claims against the price list to confirm contract agreement. It’s impractical to verify all claims, but 10 is a sample size large enough to extract some good assumptions.

Step #4: Now take it one step further. Check what your organization has paid, for prescription drugs, against our pharmacy cost then determine if a problem exists. When there is a 5% or more price differential (paid versus actual cost) we consider this a problem.

When better pricing is discovered the contract language should stipulate the client be indemnified. Do not allow the PBM to limit the market check language to a similar size client, benefit design and/or drug utilization. In this case, the market check language is effectually meaningless.

Click here to register: “How To Slash the Cost of Your PBM Service, up to 50%, Without Changing Providers or Employee Benefit Levels.” [Free Webinar]

- Go to the previous page

- 1

- …

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- …

- 144

- Go to the next page

_1.jpg)

_1.jpg)

_1.jpg)

_1.jpg)

_1.jpg)