The primary reason an organization retains a PBM is to contain its pharmacy costs. PBMs do this in a variety of ways, including negotiating pharmacy discounts, pharmaceutical manufacturer contracting, drug utilization management and automating administrative services. Because PBMs offer varying degrees of transparency, some contain costs better than others. Here are eight considerations during an annual PBM review.

1. Network tightening, including removing a single large chain, can result in more aggressive savings on ingredient costs without any loss in access. The type of network a PBM is running (i.e. acquisition cost, pass-through etc.) is less important than knowing what exactly the pharmacy is being reimbursed. The difference between what a plan sponsor is billed for ingredient costs and the amount a PBM reimburses a pharmacy for the same claim is called the spread.

2. The best way for a plan sponsor to determine if they are paying a spread is to know what the pharmacy is being reimbursed for that same claim at the NDC level. The 835 Health Care Claim Payment and Remittance Advice is the tool you need for disclosure of this information and ultimately getting to lowest net cost. Two basic sources of information are needed to permit an audit of the spread on a series of prescription transactions: (1) employers’ line-item Rx transaction invoices received from PBMs each month and (2) dispensing pharmacies’ itemized list of Rx transactions received with PBMs monthly payments. Generic discounts are often priced in one of two ways: as an AWP discount or at Maximum Allowable Cost (MAC). A large price gap usually exists between these two pricing elements.

3. Does the PBM offer any programs to help offset the cost or manage specialty drugs that are paid on the medical benefit? Site of care optimization simply means having a strategy to seek out and promote the most economical and clinically effective place to deliver care for a particular patient. While this may prove bothersome to some patients and third party administrators, you can’t have it both ways. Whomever covers the largest share of the drug cost should have the most say in the locations from which these very expensive drugs are dispensed. I don’t walk into my friends’ homes go into the refrigerator and put my feet on their sofas. You know why? I don’t pay their mortgages. Site of care management is good for self-funded employers. Since you cover most of the drug costs, its only right you have the final say so in where high cost drugs are dispensed.

4. COVID-19 may have depressed your overall utilization. Health insurance carriers have reported in their earnings calls that utilization of outpatient care was down significantly for much of 2020. New starts for prescriptions were also down. Find out your plan’s utilization patterns and if you should expect an increase as states reopen.

5. Programs that utilize manufacturer copay coupons to offset specialty medication costs are gaining in popularity. For plan participants, these programs typically set a zero-dollar cost share for qualifying specialty medications. For plan sponsors, these programs may save up to 20%-25% of specialty spend.

6. Tweak your formulary with little to no member disruption. A formulary is a list of drugs favored by the PBM for their clinical effectiveness and cost savings. Manufacturers of specialty and branded drugs often promise financial incentives to have their drugs featured on the formulary. Drug formularies can be open, incented, closed or hybrid. There are five factors necessary for the makings of a good formulary. These factors include multiple enforcement mechanisms, a minimum five-tiered list of drugs, understanding of how the drugs are assessed, a firm dispute resolution process and an expedited appeal process. Each PBM has varying degrees of flexibility when it comes to formularies. A change may lead to lower net costs.

7. Human immunodeficiency virus (HIV) medications have recently become a hot topic in the pharmacy space. Per the Affordable Care Act (ACA), employer-sponsored health plans are required to cover the HIV specialty drugs Pruvada and Descovy at 100% beginning their first plan year following June 19, 2020. The requirement follows a United States Preventive Services Task Force (USPSTF) recommendation that health plans cover pre-exposure prophylaxis (PrEP) with effective antiretroviral therapy to persons who are at high risk of HIV acquisition. Across our book of business, we saw an increase in the usage of these medications. This caused the HIV class to jump up for many employers’ top therapeutic classes. Plans should budget for this trend to continue.

8. A 2020 drug trend report concluded specialty drug spending outweighed traditional drug spending for the first time ever. Commercial employers must engage all stakeholders and develop a pharmacy benefits management strategy which centers around high-cost ($15,000 or more per year) drug therapies. It goes without saying, any effort by a non-fiduciary PBM to protect its profit margins will start and end with specialty drugs. Understand PMPM by comparing your YOY trend and how it compares to relevant benchmarks. Put trend in context as percentages can be misleading.

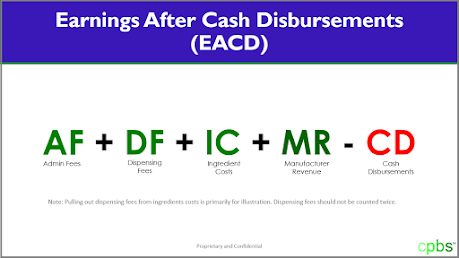

There are two things which should be non-starters for purchasers of PBM services. One, having full access to your own claims data free of charge. Second, knowing what you pay a PBM for the services it was hired to perform. Your PBMs management fee is hidden in the plan’s final cost. Alvin Toffler wrote, “The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn.” Education is the most logical and effective foundation for achieving extraordinary levels of efficiency in a pharmacy benefit program.