Alabama Gov. Kay Ivey for signed into law legislation (Act 2021-341) on May 6 which further regulates pharmacy benefits managers (PBMs) and helps ensure that reimbursement rates cover pharmacies’ costs of purchasing drugs.

The measure – sponsored by Republican State Sen. Tom Butler – becomes effective on July 1 and will apply to PBM contracts on and after October 1.

Specifically, the legislation states that PBMs may not “vary the amount a pharmacy benefits manager reimburses an entity for a drug, including each and every prescription medication that is eligible for specialty tier placement by the Centers for Medicare and Medicaid Services.”

Additionally, PBMs are prohibited from reimbursing an in-network pharmacy or pharmacist in the state an amount less than the amount that the pharmacy benefits manager reimburses a similarly situated PBM affiliate for pharmacist services for patients in the same health benefit plan.

Among other provisions, the measure also states that a PBM may not:

• Charge a pharmacist or pharmacy a point-of-sale or retroactive fee or otherwise recoup funds from a pharmacy in connection with claims for which the pharmacy has already been paid.

• Exclusively require the purchase of pharmacist services through a mail-order pharmacy or PBM affiliate.

• Impose a monetary advantage or penalty under a health benefit plan that would affect a patient’s choice of pharmacy.

• Deny a pharmacy or pharmacist the right to participate as a contract provider if they meet and agree to the terms and conditions of the PBM’s contract.

• Prohibit a pharmacist or pharmacy from informing a patient about a more affordable alternative prescription drug if one is available.

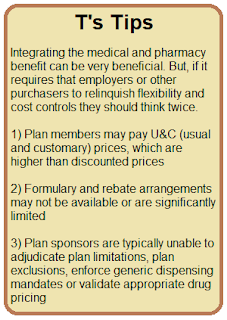

Tyrone’s Commentary:

Non-fiduciary PBMs have been planning for at least five years the day when they could be forced to provide more transparency. They knew most of their clients didn’t have the desire to do it themselves. Forgoing rebates in exchange for a medical administration credit, is just one example. It isn’t a better deal for you. It is a way for the non-fiduciary PBM to hide cash flow and to protect their profits. Vertically integrating their businesses is another example. It doesn’t lead to lower net costs for their clients. However, it does make for a very appealing marketing presentation. Keep a watchful eye out on your medical benefit drug claim costs. The non-fiduciary PBM will have to shift the cost somewhere, charge a PEPM fee north of $30 or a combination of the two.