|

| Click to Learn More |

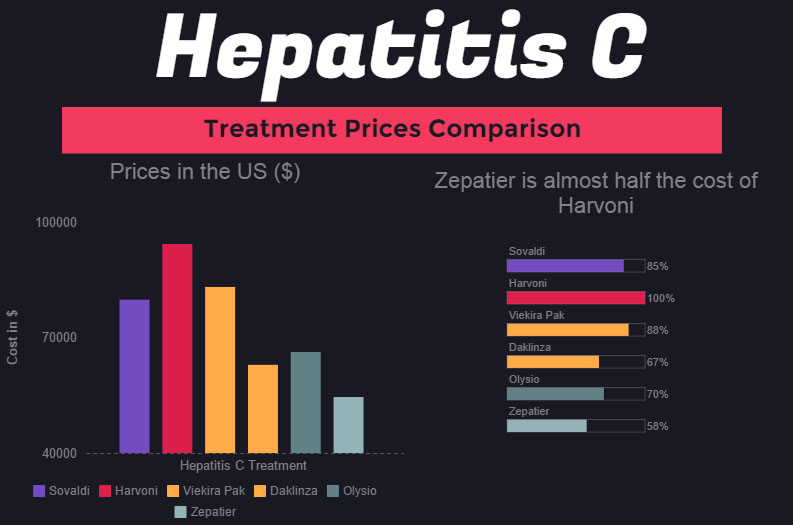

The cost of hepatitis C virus (HCV) antivirals has been at the forefront of health care spending conversations for years. Although it has slowed, spending on the blockbuster drugs remains high. Despite the curative ability of the treatments, it is likely that a significant need for antiviral drugs will remain into the foreseeable future due to the prevalence of undiagnosed HCV cases.

A recent Vizient Drug Price Forecast outlined the top drivers of specialty pharmacy spending, one of which being HCV. The cost of HCV drugs is projected to increase 2.02% in 2018, which is slower than the past few years due to increasing competition and lower-cost options.

Tyrone’s Commentary:

Rebates are not “free money” thus don’t justify the higher price tag compared to lower cost Hep C treatments which do not pay rebates. Because it essentially eliminates the PBM mark-up, AbbVie’s pricing strategy for its Hep C drug Mavyret is disruptive to the traditional PBM revenue model, for example. Instead of paying a rebate AbbVie prices it [rebate] back into the list price in the form of a significant list price discount. The same is true of forthcoming biosomilars and the result for plan sponsors is lower plan costs. That is if you don’t take the bait or rebate dollars.

Natco Pharma recently announced it filed an Abbreviated New Drug Application (ANDA) for sofosbuvir tablets, 400-mg, according to a press release.

Sofosbuvir is currently marketed by Gilead Sciences under the brand name Sovaldi. Sofosbuvir was the first blockbuster HCV drug to receive approval in December 2013, shortly followed by Gilead’s ledipasvir/sofosbuvir (Harvoni) in October 2014.

Natco said it is the first to have filed a complete ANDA and expects to receive 180 days of exclusivity after final approval.