Why HR Should Become Experts in Pharmacy Benefit Management

In the dynamic landscape of employee benefits, pharmacy benefit management (PBM) plays a pivotal role in both cost management and employee health outcomes. HR should become experts in pharmacy benefit management (PBM) because it is now essential, not optional. Here’s why:

1. Cost Control and Savings

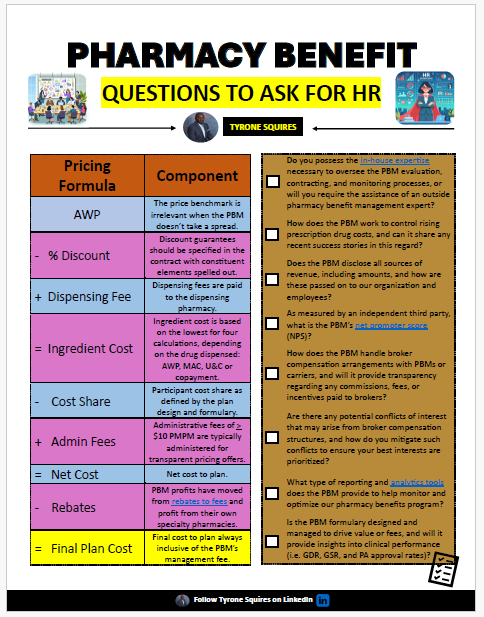

Pharmacy benefits can constitute a significant portion of overall healthcare expenses. By understanding the intricacies of PBM, HR professionals can make informed decisions that lead to substantial cost savings. This involves negotiating better terms with PBMs, understanding rebate structures, and implementing cost-effective formulary management strategies.

2. Fiduciary Responsibility

HR professionals have a fiduciary duty to act in the best interest of their employees and the organization. By becoming PBM experts, they can fulfill this responsibility more effectively. They can ensure that the PBM services chosen are truly beneficial and not just superficially attractive. This fiduciary approach builds trust with employees, knowing their best interests are being looked after.

3. Improved Employee Health and Productivity

An effective PBM strategy ensures employees have access to necessary medications without undue financial burden. When employees can afford their prescriptions, they are more likely to adhere to their medication regimens, leading to better health outcomes. Healthy employees are more productive, take fewer sick days, and contribute more effectively to the organization.

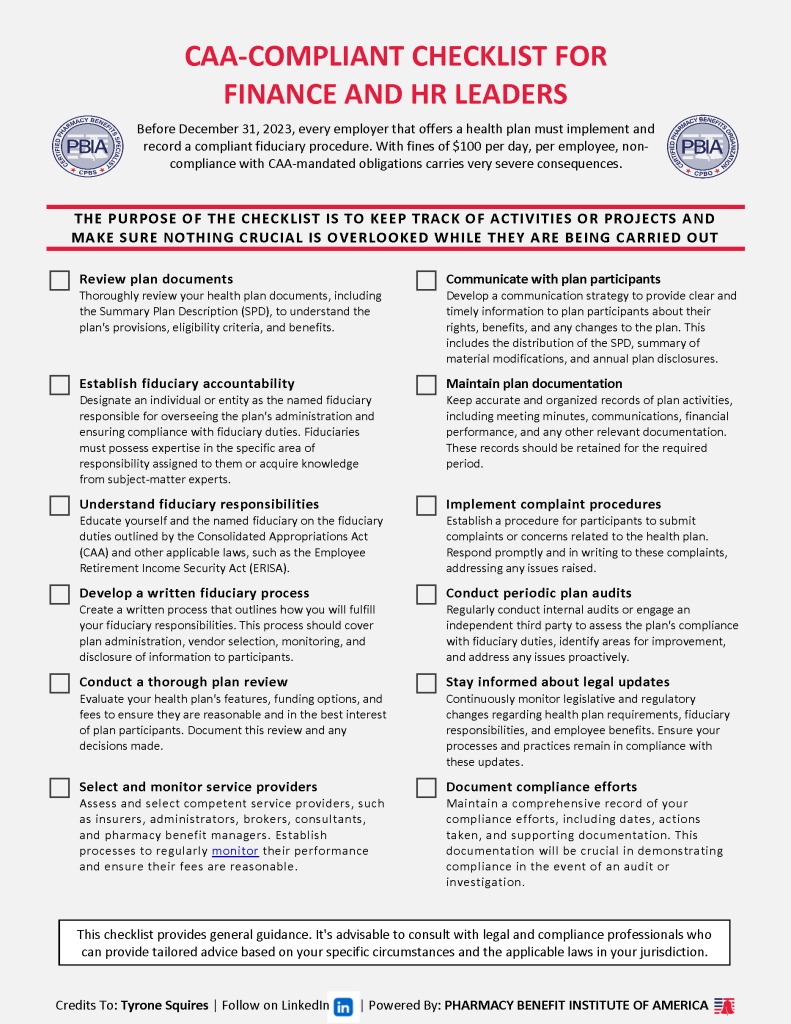

4. Navigating Regulatory Compliance

The healthcare sector is heavily regulated, with frequent updates that can impact pharmacy benefits. HR professionals who are well-versed in PBM can navigate these regulations effectively, ensuring compliance and avoiding costly penalties. Staying ahead of regulatory changes also positions the company as a responsible and compliant employer.

5. Leveraging Data Analytics

Advanced PBM systems generate a wealth of data that can provide insights into drug utilization patterns, costs, and employee health trends. HR professionals with PBM expertise can leverage this data to make strategic decisions, optimize benefit plans, and predict future healthcare needs.

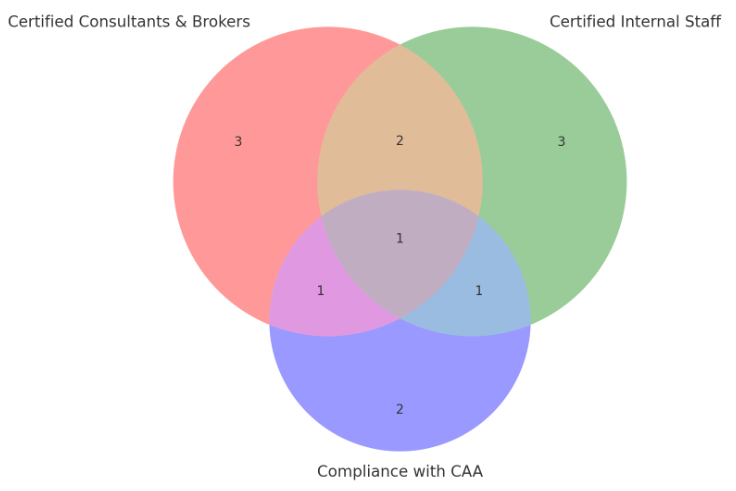

6. Bridge the Expectation Gap

Employee benefit brokers and PBCs (PBM consultants) often lack broad PBM expertise or maintain conflicts of interest, which can lead to suboptimal choices for organizations. HR professionals who are experts in PBM can bridge this expectation gap. By having a deep understanding of PBM, HR can critically evaluate the advice and services offered by brokers and consultants. This ensures that the organization’s PBM strategy is aligned with its goals and not influenced by potential conflicts of interest. Being informed enables HR to demand transparency and accountability, leading to better outcomes for both the organization and its employees.

7. Strategic Decision-Making

Knowledge beyond fundamental ideas and principles that underpin pharmacy benefits management empowers HR professionals to make more informed and strategic decisions about their organization’s healthcare plans. They can better evaluate PBM proposals, understand the implications of various contract terms, and choose the best options for their organization. This strategic oversight can lead to significant cost savings and improved employee satisfaction.

Conclusion

Becoming experts in pharmacy benefit management empowers HR professionals to drive significant value for their organizations. From cost savings and employee satisfaction to improved health outcomes and regulatory compliance, the benefits are multifaceted. As the role of HR continues to expand, so too should its expertise in critical areas like PBM, ensuring a holistic approach to managing employee benefits.

How to Become an Expert

The best way to gain expertise in pharmacy benefit management is to become a Certified Pharmacy Benefit Specialist (CPBS). The CPBS program provides comprehensive education on the intricacies of PBM, covering everything from cost management and regulatory compliance to strategic plan design and data analytics. By earning this certification, HR professionals can:

- Gain a deep understanding of PBM mechanisms and best practices.

- Enhance their ability to negotiate and manage PBM contracts effectively.

- Stay updated on the latest industry trends and regulatory changes.

- Improve their ability to design benefit plans that optimize costs and employee health outcomes.

Investing in CPBS certification not only equips HR professionals with the necessary skills and knowledge but also positions them as trusted advisors within their organizations. This expertise enables them to make informed decisions that benefit both the company and its employees, ultimately leading to a healthier, more satisfied workforce.

In the ever-evolving landscape of healthcare and employee benefits, becoming a CPBS-certified expert in pharmacy benefit management is a strategic move that can drive significant value and ensure long-term success.