Ohio Requesting Bids for Administrator to Oversee its Pharmacy Benefit Program

The Ohio Department of Medicaid on Thursday started the process of hiring a private administrator to oversee its $3 billion pharmacy benefit program. The department requested proposals for a pharmacy operational support vendor to help design its program and provide financial oversight once it’s up and running. Medicaid created the new post as part of a broader overhaul of its managed care program.

|

| Find Out More |

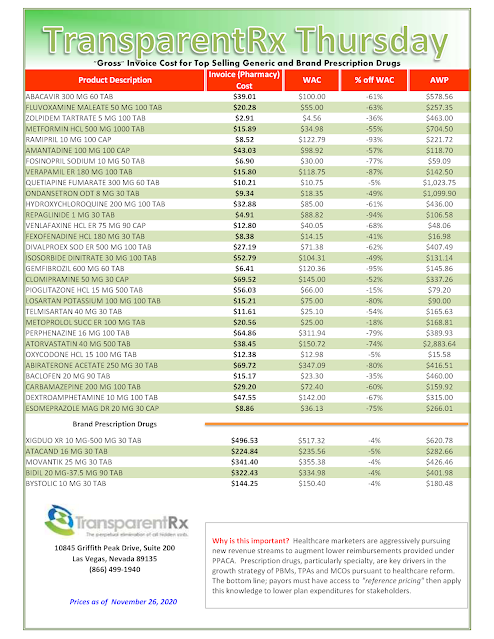

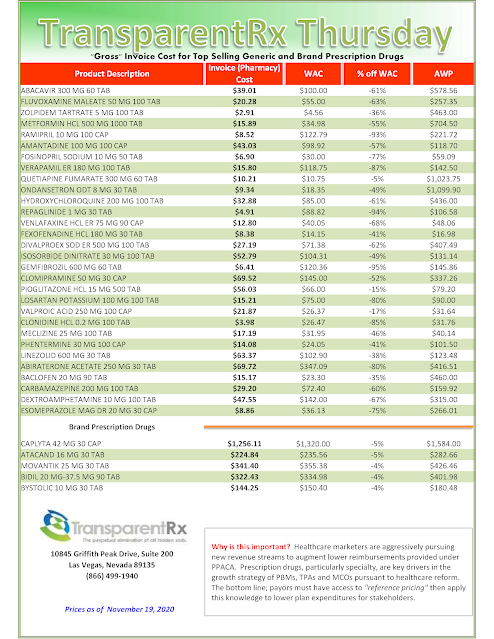

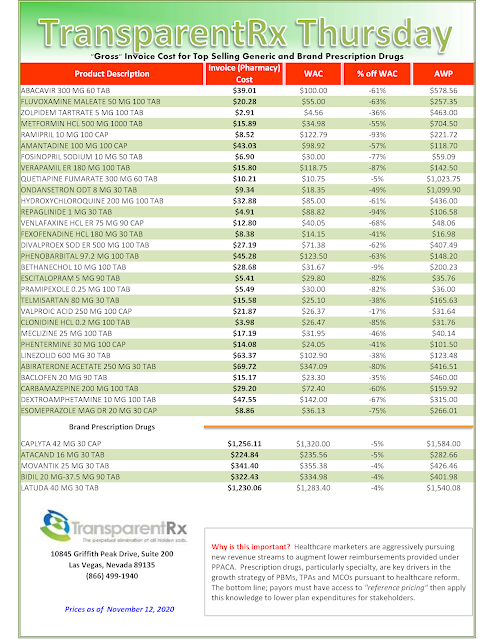

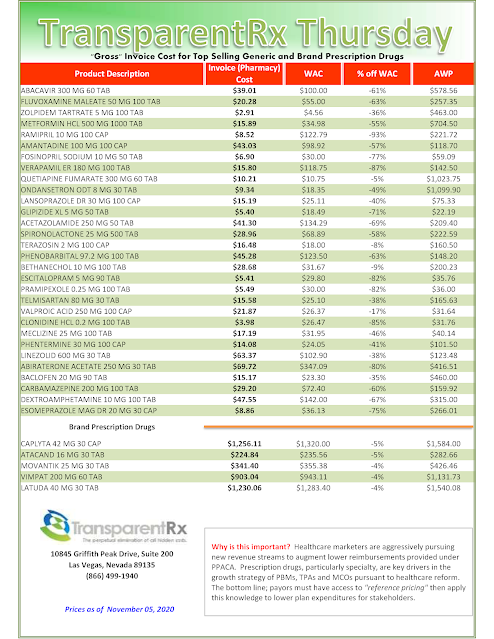

In addition to rebidding contracts with private managed care organizations that oversee the program, the state agency is also replacing five pharmacy benefit managers hired by those private organizations to process claims with one company hired by the state and monitored by the administrator. The added oversight comes after a report showed PBMs billed the state far more than they paid pharmacists and kept the difference, allowing them to receive $224 million in one year — an amount generated by PBMs charging three to six times the standard rate, according to an independent analysis.

Tyrone’s Commentary:

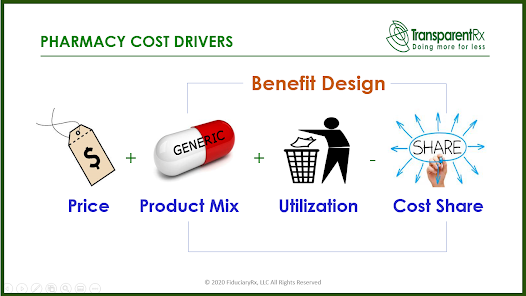

Your pharmacy benefit manager owes you nothing. In its most simplistic form it is merely a facilitator of goods and services. At best, it is your adviser offering suitable goods and services but not necessarily the best goods or services. To owe its client something, the PBM would have to act as a fiduciary. Have you noticed how often PBMs get sued but rarely lose in court? Employers believe that PBMs owe it something the courts say otherwise. You see non-fiduciary PBMs generally rely on the demands of its clients for how much cost savings they will provide. Moreover, non-fiduciary PBMs provide disclosure of important contract details to a level demanded by the competitive market. In other words, non-fiduciary PBMs have learned how to leverage the purchasing power of the unsophisticated plan sponsor to their financial advantage. The truth is most, if not all, of the excessive costs embedded in non-fiduciary PBM service agreements can be eliminated if stakeholders (HR execs, CFOs, benefits consultants, brokers etc…) concern themselves more with self-education and accountability and less with self-preservation. If I here one more time “no one has ever been fired for hiring Express Scripts”?. The state of Ohio was humbled and now has a plan to win full disclosure and eliminate overpayments to non-fiduciary PBMs. You could establish a POSV or just hire a fiduciary-model PBM and achieve two aims at once – eliminate PBM overpayments and do away with duplicative consulting fees. What is your pharmacy benefits management strategy?

“The POSV (pharmacy operational support vendor) will ensure monetary incentives are properly and fairly aligned, eliminate self-dealing and steering, and monitor and close potential pricing or rebate loopholes,” said Medicaid Director Maureen Corcoran. “In short, the POSV ensures that the fox is no longer guarding the chicken coop.” The administer will operate independently from the pharmacy benefit manager, providing oversight and ensuring pharmacists are paid accurately for the prescriptions they fill.