PBM 101 Webinar: How to Slash PBM Service Fees, up to 50%, Without Changing Vendors or Member Benefit Levels

Here is what some participants have said about the webinar:

“Thank you Tyrone. Nice job, good information.” David Stoots, AVP

“Thank you! Awesome presentation.” Mallory Nelson, PharmD

“Thank you Tyrone for this informative meeting.” David Wachtel, VP

“…Great presentation! I had our two partners on the presentation as well. Very informative.” Nolan Waterfall, Agent/Benefits Specialist

A snapshot of what you will learn during this 30-minute webinar:

- Hidden cash flows in the PBM Industry such as formulary steering, rebate masking, and differential pricing

- How to calculate the cost of pharmacy benefit manager services

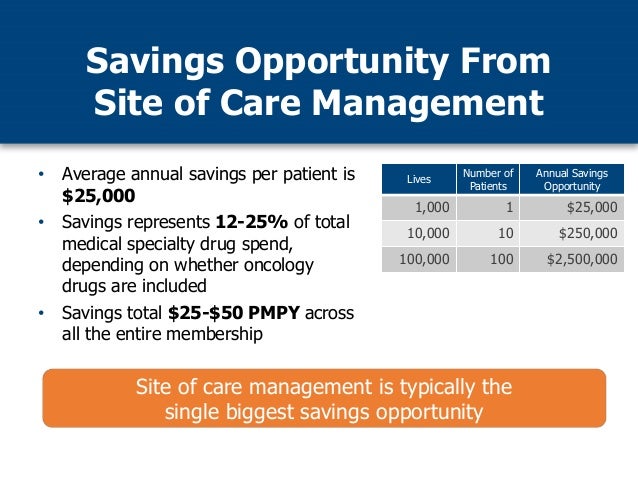

- Specialty pharmacy cost-containment strategies

- The financial impact of actual acquisition cost (AAC) vs. maximum allowable cost (MAC)

- Why mail-order and preferred pharmacy networks may not be the great deal you were sold

See you Tuesday, January 14 at 2 PM ET!

TransparentRx

Tyrone D. Squires, MBA

10845 Griffith Peak Drive, Suite 200

Las Vegas, NV 89135

866-499-1940 Ext. 201

P.S. Yes, it’s recorded. I know you’re busy … so register now and we’ll send you the link to the session recording as soon as it’s ready.