6 Payor Tactics to Control Drug Spending [Weekly Roundup]

6 Payor Tactics to Control Drug Spending and other notes from around the interweb:

- 6 Payor Tactics to Control Drug Spending. Pressure is building to shift to the medical benefit. Plans didn’t historically manage drugs on the medical benefit as strictly as the pharmacy benefit, but now there is increasing economic pressure to do so, Dr. Grant said. Payor strategies here include aggressive site-of-care optimization strategies directing patients to the most cost-effective location to receive medications, and requiring billing through specialty pharmacies, known as bagging strategies, where health systems and physician practices must accept bagged medications from pharmacies to administer to patients. The best option is gold bagging, in which a specialty pharmacy dispenses prescriptions to its own clinics for administration, she said. Some states and professional groups, such as the American Hospital Association, have banned or oppose bagging for its potential disruptions in care.

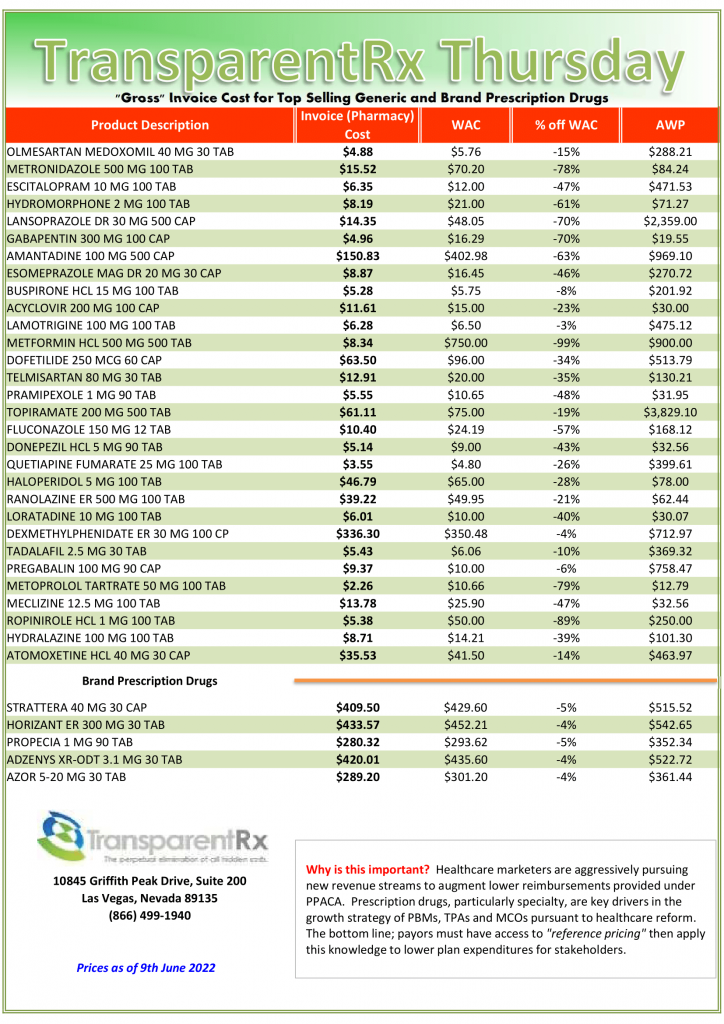

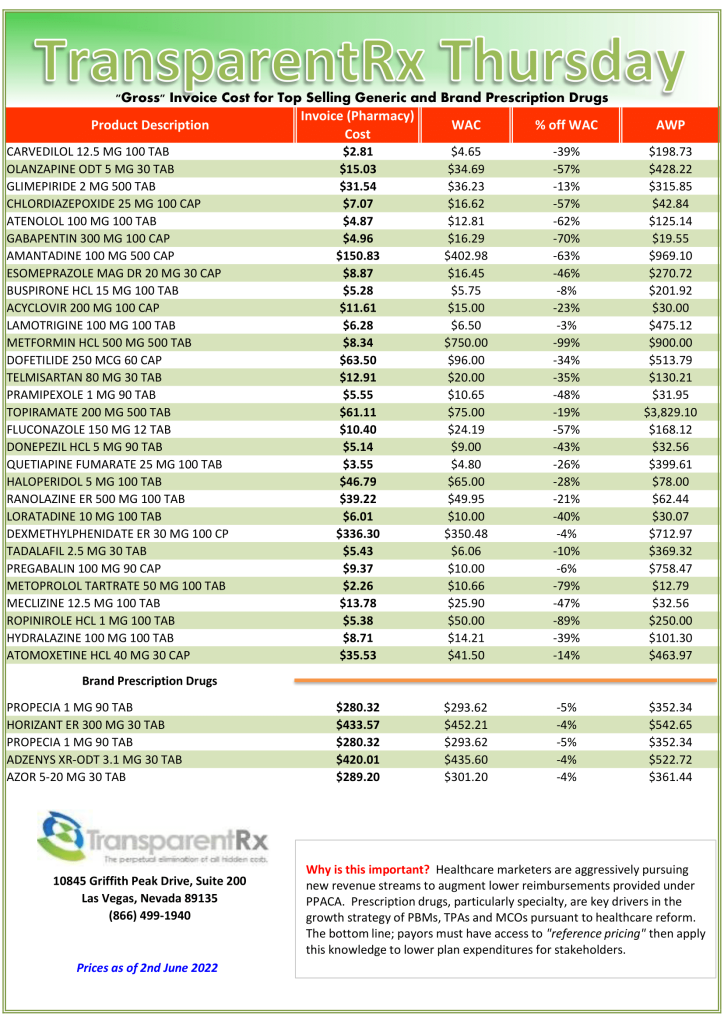

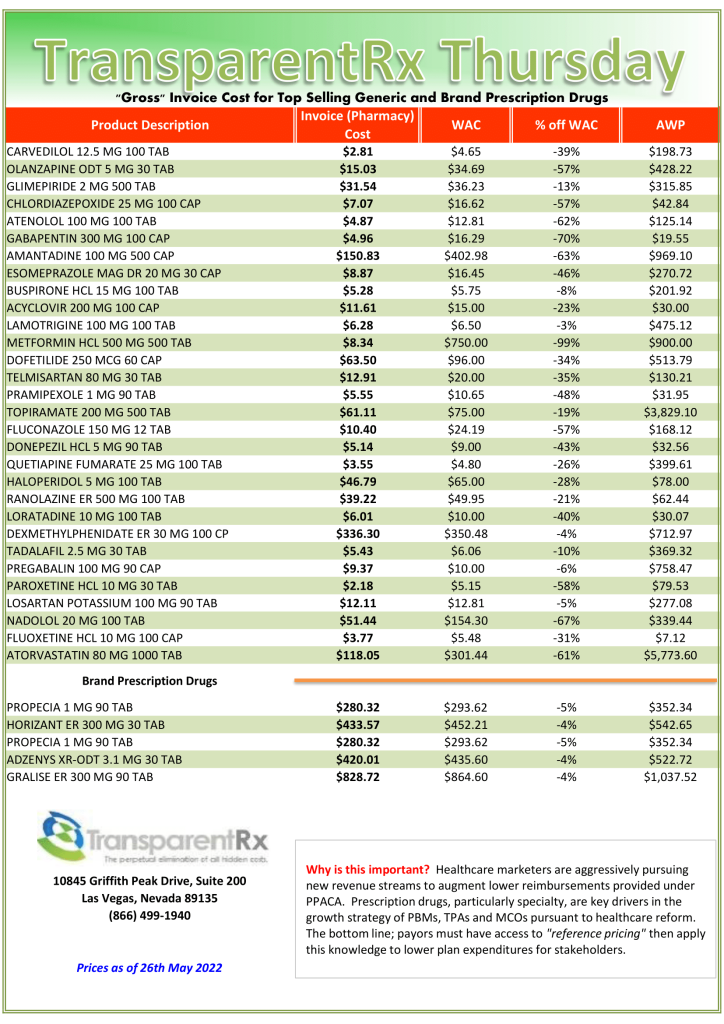

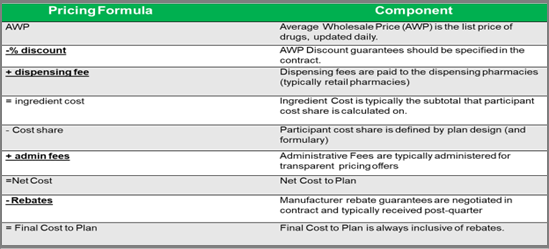

- PBMs pocketing savings from generic prescriptions, report says. The new report adds to a growing body of evidence showing that consumers overpay for generics, as “pharmacy benefit managers game opaque and arcane pricing practices to pad profits,” the white paper said. Generics make up more than 90% of prescriptions in the U.S. but just 18% of drug spending. By one estimate, the use of generic and biosimilar drugs in place of their branded equivalents saved the healthcare system $338 billion in 2020 alone. However, despite generics driving down prices relative to branded drugs, consumers are not benefiting from savings, the white paper said. “Generics are overlooked when we talk about drug pricing issues in this country,” said Erin Trish, co-director of the USC Schaeffer Center, in a statement. “But the same lack of transparency that is causing outrage over high and rising spending on branded drugs is also creating issues in the generic drug space.”

- How Pharmacy Benefit Managers (PBM) Make Money – PBM Accountability Project. PBMs derive much of their revenue from collecting a range of service fees and other charges from manufacturers, pharmacies, and other supply chain entities, ultimately driving up the cost of the prescription drugs. A new study by the PBM Accountability project shines a light on the PBM business model, often described as a “black box,” revealing the sources of growth in PBM gross profit between 2017 and 2019.

- Federal Trade Commission opens investigation into pharmacy benefit managers. The FTC will send orders to CVS Caremark, Express Scripts Inc., OptumRx Inc., Humana Inc., Prime Therapeutics LLC and MedImpact Healthcare Systems Inc. and will examine the “impact of vertically integrated pharmacy benefit managers on the affordability and accessibility of prescription drugs,” the agency said. According to the release, the inquiry will aim to closely investigate the role of pharmacy benefit managers in the U.S. pharmaceutical system, which may entail financial and policy involvement with drug manufacturers, health insurance companies and pharmacies. These functions are often clouded by “complicated, opaque contractual relationships that are difficult or impossible to understand for patients and independent businesses across the prescription drug system,” the release said.