A Big Three” PBM and the National Association of Chain Drug Stores (NACDS) part ways in a what seems to be a disagreement on the path forward. I can recall growing up when one kid who had the only basketball or baseball bat would storm off with his equipment when things didn’t go his way. The rest of us would be left empty-handed trying to figure out what to do next. It didn’t take us long to figure out we needed our own equipment.

When the selfish kid realized we didn’t need him anymore his attitude changed. He learned how to play fair and to stick around when things didn’t go his way. CVS Health is that selfish kid. CVS pharmacies made up almost a quarter of the nearly 40,000 pharmacies NACDS says it represents, and the CVS departure will also cost the trade group a nice chunk of change.

The National Association of Chain Drug Stores made announcements CVS Health didn’t agree with, so it decided to take its bat and ball (i.e. money) elsewhere.

- CVS Health reported paying $1.6 million in dues to NACDS last year, less than only its membership dues for America’s Health Insurance Plan, Better Medicare Alliance, and the Pharmaceutical Care Management Association.

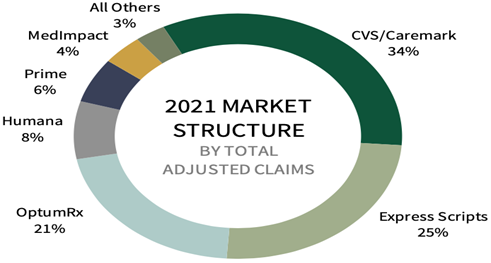

- CVS Caremark controls the largest chunk of the market among PBMs, one of six companies that controls 98 percent of the PBM market, according to Health Industries Research.

- NACDS has applauded state legislation to regulate PBMs and last month, it praised an announcement that the FTC would probe PBM practices as contributing to momentum for PBM reforms.

Conclusion – “Big Three” PBM and NACDS Part Ways

Congress has a fight on its hands as the large PBMs won’t tuck tail and run. They will put up a strong front to protect profit margins and to ensure the survival of their companies. Wikipedia defines a broker as a person or entity that recommends “suitable” products, not necessarily the best or most cost-effective, and then earns a commission or other transactional fees based upon those recommendations. A fiduciary adviser, on the other hand, must put clients’ interests before their own. They charge a fixed fee. Like NACDS, the timing is ripe to take on more of an adviser role. In other words, recommend to your clients or purchase for your members the best services not just suitable ones.

The cat is now out of the proverbial bag. John F. Kennedy said, “The greater our knowledge increases the more our ignorance unfolds.” Most self-insured employers, and their advisers, don’t know what they don’t know. Pharmacy Benefit Managers provide transparency and disclosure to a level demanded by the competitive market and generally rely on the demands of prospective clients for disclosure in negotiating their contracts. The best proponent of transparency is informed and sophisticated purchasers of PBM services.