Pharmacy Benefit Managers: History, Business Practices, Economics, and Policy [Weekly Roundup]

Pharmacy Benefit Managers: History, Business Practices, Economics, and Policy and other notes from around the interweb:

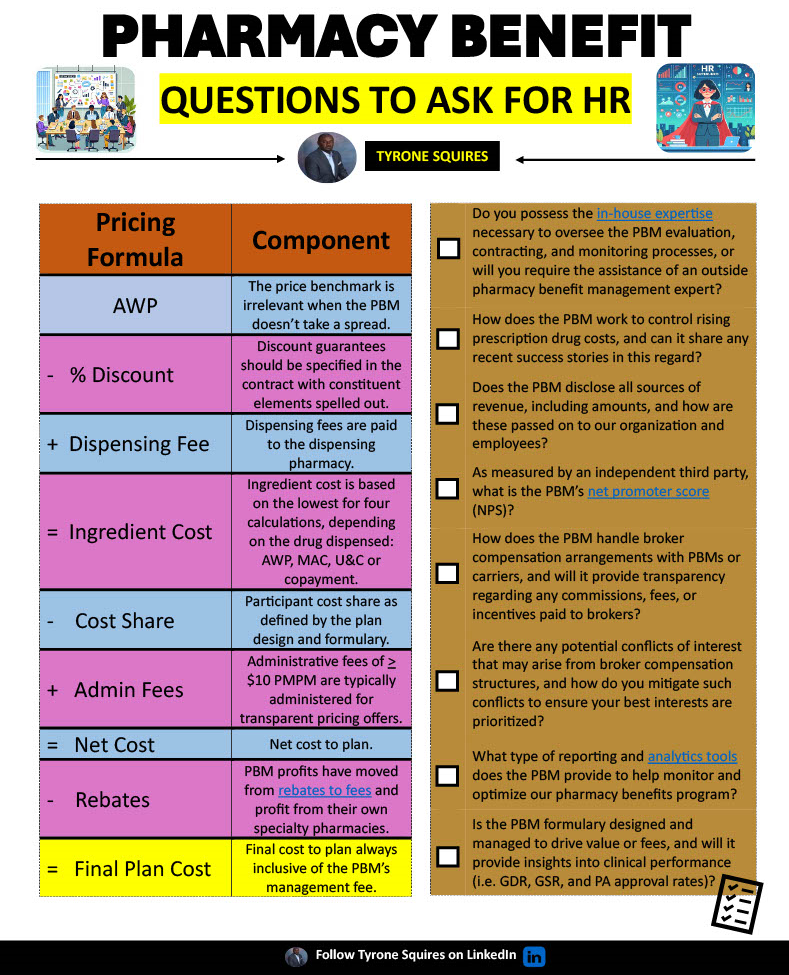

- Pharmacy Benefit Managers: History, Business Practices, Economics, and Policy. Pharmacy benefit managers evolved in parallel with the pharmaceutical manufacturing and health insurance industries. The evolution of the PBM industry has been characterized by horizontal and vertical integration and market concentration. The PBM provides key functions: formulary design, utilization management, price negotiation, pharmacy network formation, and mail order pharmacy services. Criticism of the PBM industry centers around the lack of competition, pricing, agency problems, and lack of transparency. Legislation to address these concerns has been introduced at the state and federal levels, but the potential for these policies to address concerns about PBMs is unknown and may be eclipsed by private sector responses.

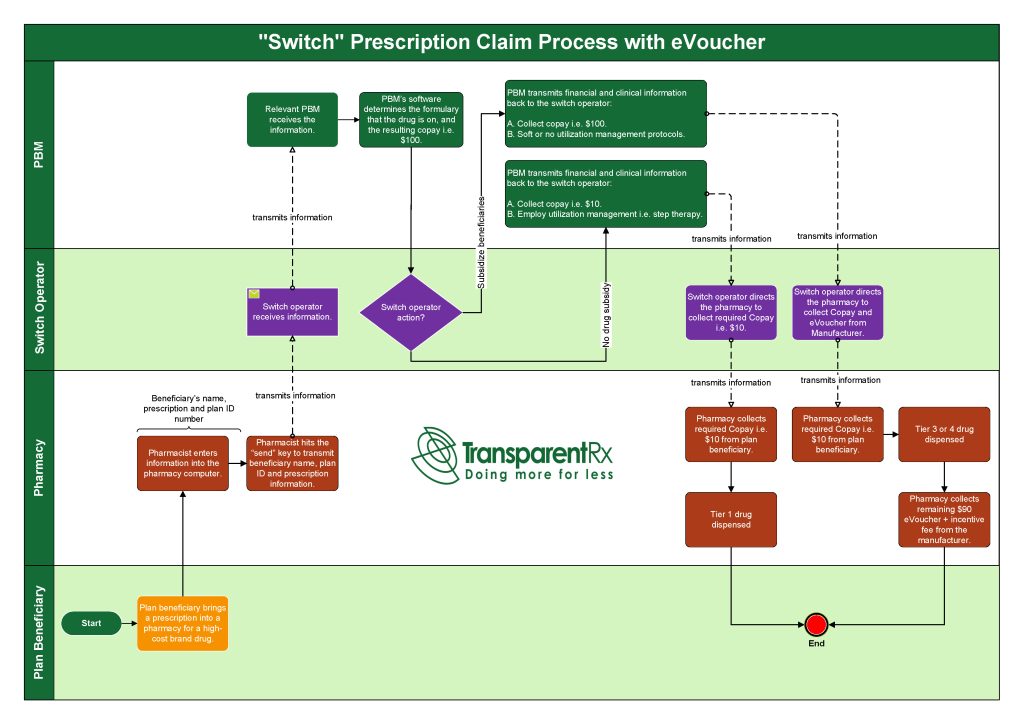

- Copay Accumulators: Implications for PBMs and Health Plans After Court Strikes Down HHS Rule. The striking down of the 2021 HHS rule on copay accumulators represents a significant development that necessitates adaptation from health plans and PBMs, who will need to adjust their operations on not just copay accumulator programs, but also copay maximizers and potentially alternative funding programs (the most recent evolution of these copay adjustment programs), to align with the reinstated federal rule. This may involve revising policies and procedures to ensure compliance and communicating the changes in copay accumulator policies to members to ensure transparency and clear communication so that members understand their cost-sharing responsibilities. Additionally, health plans and PBMs may need to reevaluate their formulary and benefit design to accommodate the new regulatory landscape while continuing to provide cost-effective and quality care to patients.

- Pharmacy Benefit Manager Pricing for High Utilization Generic Drugs. The practice by pharmacy benefit managers (PBMs) of spread pricing—charging the client (i.e. insurer) a higher amount than is reimbursed to the pharmacy—has garnered substantial attention from policymakers. The bipartisan proposals in the PBM Transparency Act and PBM Reform Act and numerous state laws prohibit spread pricing. However, others in the pharmaceutical supply chain, such as pharmacies and wholesalers, also rely on spread pricing to earn profits. The gross profit for each entity in the supply chain remains unexplored in the literature. Using Medicare Part D data, this study analyzed entity-level gross profit in the pharmaceutical supply chain for high-utilization generic drugs.

- Competition in Commercial PBM Markets and Vertical Integration of Health Insurers with PBMs: 2023 Update. Based on 2020 data and newly acquired 2021 data for people with a commercial drug benefit tied to a medical benefit and the PBMs used by insurers, the updated analysis presents market insight on five PBM services performed for insurers: rebate negotiation, retail network management, claim adjudication, formulary management, and benefit design. Insurers face a make-or-buy decision—they can perform these functions in-house or buy them from a PBM. The AMA Policy Research Perspectives report, “Competition in Commercial PBM Markets and Vertical Integration of Health Insurers with PBMs: 2023 Update”, found that insurers use a PBM for three of them—rebate negotiation, retail network management and claims adjudication—and therefore assessed market competition for those three product markets.