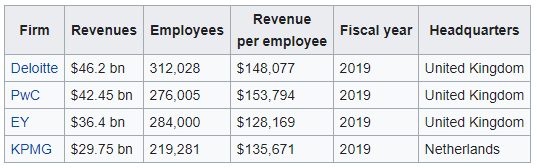

Tuesday Tip of the Week: Large non-fiduciary PBMs hire members of the Big Four consulting firms to help them identify ways to generate hidden cash flows

|

| Source: Wikipedia |

|

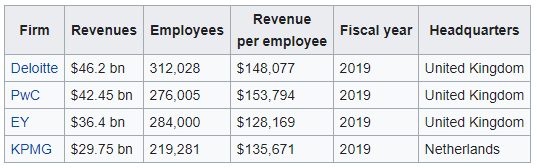

| Source: Wikipedia |

“Thank you! Awesome presentation.” Mallory Nelson, PharmD

“Thank you Tyrone for this informative meeting.” David Wachtel, VP

“…Great presentation! I had our two partners on the presentation as well. Very informative.” Nolan Waterfall, Agent/Benefits Specialist

A snapshot of what you will learn during this 30-minute webinar:

Sincerely,

TransparentRx

Tyrone D. Squires, MBA

10845 Griffith Peak Drive, Suite 200

Las Vegas, NV 89135

866-499-1940 Ext. 201

Always include a semi-annual market check in your PBM contract language. Market checks provide each payer the ability, during the contract, to determine if better pricing is available in the marketplace compared to what the client is currently receiving.

Always include a semi-annual market check in your PBM contract language. Market checks provide each payer the ability, during the contract, to determine if better pricing is available in the marketplace compared to what the client is currently receiving.

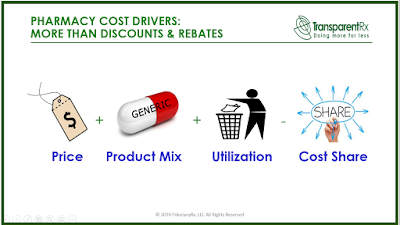

In less than two decades, transparent third-party prescription claims adjudication has evolved into the extremely profitable and opaque pharmacy benefit management industry of today. PBMs make most of the value decisions that plan sponsors are unqualified for or choose not to make. This wouldn’t be a problem except for the fact that most PBMs are non-fiduciary, which means their interests are not aligned to those of their clients.

Worse yet, non-fiduciary PBMs leverage the purchasing power of unsophisticated plan sponsors by negotiating with drugmakers and pharmacies for their financial benefit. Before non-fiduciary PBMs learned they could leverage the purchasing power of unsophisticated purchasers for their own financial gain, they focused on cost-efficiency or getting the best outcomes for the lowest cost. In many cases, the focus has shifted to promoting the products that are most profitable to the PBM.

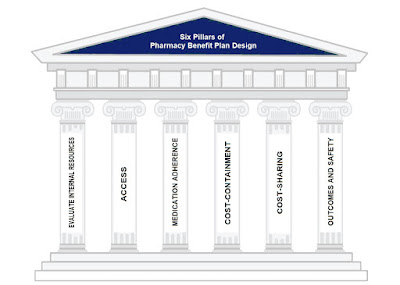

Smart purchasers of PBM services want more control over their plan design not less. If this is you, here are six pillars upon which to design your pharmacy benefit plan.

I. Evaluate your internal resources and pharmacy expertise

If you’re reading this and work for a self-funded employer never retain the services of a PBM or a PBM consultant who benefits when your pharmacy costs increase. Should you do so, never leave them completely to their own accord.

II. Access

A formulary is a list of medications for which a plan will provide reimbursement. When considering a formulary, access defines the basic aspects of a pharmacy benefit design which includes but is not limited to:

Managing a formulary and improving its efficiency involves an ongoing assessment of the drugs on the formulary as well as any new potential drug therapy treatments. Again, do not leave this responsibility solely in the hands of the PBM unless it has agreed to accept fiduciary responsibility. Lastly, plan design considerations must take into account DAW or dispense as written laws for each state.

III. Medication Adherence

Medication adherence is a large and growing issue that has an impact not only on patients’ health, but also on employer finances. Non-adherence to medications has been linked to 30-50% of treatment failures and 125,000 deaths each year, according to statistics gathered by the American College of Preventive Medicine.

Figure 1. Gap Between a Written Prescription and Actual Medication Use

IV. Cost-Containment

Major cost-containment elements of pharmacy benefit plan design are plan restrictions, limitations and exclusions. There are many types of limitations used in varying degrees but they often lack the oversight [human] necessary to be effective over the long-haul. These elements encourage members to utilize low(er) cost alternatives:

Step Therapy V. Cost-Sharing

Refers to the members out of pocket cost. There are three major types of cost-sharing: copayments, deductibles and coinsurance. When members receive a more costly alternative to a preferred product they are required to pay the higher copayment. When members receive a branded product which has an available generic equivalent, they are required to pay the additional costs associated with the branded.

According to the economic principles of demand, as price increases, demand tends to decrease. In the case of prescription drugs, price is the member’s OOP (out-of-pocket). As cost sharing increases, utilization decreases. However, it’s a catch twenty-two as there is a point of diminishing returns. You don’t want utilization to decrease so much that it causes an increase in hospitalizations or emergency room visits, for example.

VI. Outcomes and Safety

The sixth and final pillar does not provide or limits coverage for those products that do not improve or maintain the health of the members or have a tendency to be abused or overused. Some examples include:

|

| Click to Learn More |

|

Always include a semi-annual market check in your PBM contract language. Market checks provide each payer the ability, during the contract, to determine if better pricing is available in the marketplace compared to what the client is currently receiving.

Always include a semi-annual market check in your PBM contract language. Market checks provide each payer the ability, during the contract, to determine if better pricing is available in the marketplace compared to what the client is currently receiving.

When better pricing is discovered the contract language should stipulate the client be indemnified. Do not allow the PBM to limit the market check language to a similar size client, benefit design and/or drug utilization. In this case, the market check language is effectually meaningless.