The co-pay card debate simmers, as payers push back

Devised to shoulder some of the cost burden of prescription drugs, manufacturer co-pay card programs have been tied to improved adherence rates and reduced barriers to the discounted medications. At the same time, payers — insurers and PBMs alike — are crying foul.

While some industry veterans sing the praises of co-pay assistance programs, others are eager for a more evenhanded and efficient solution that will achieve the same degree of cost savings. In fact, the co-pay card appears to be stirring the controversy pot more than ever. Indeed, the question seems to have become: What will make it boil over?

UNHAPPY PAYERS

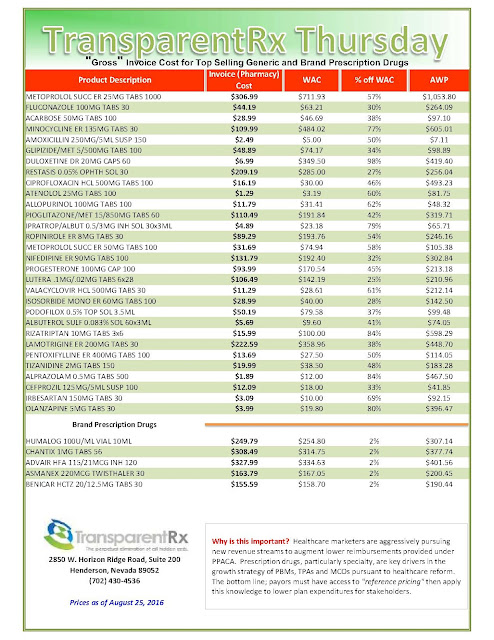

|

| Click to Enlarge |

But after more than a decade as an industry staple, the instant-rebate tactic has come under fire. Andrew Miller, VP of operations at pharmacy benefits manager MeridianRx, has grown increasingly concerned with the damaging effects of co-pay cards on payers. Consider insured patients who have been prescribed AbbVie’s Humira for their rheumatoid arthritis at $4,000 per month. After insurance and co-insurance kick in, they’re on the hook for $1,000 a month. But wait — the manufacturer just happens to have a co-pay coupon, which reduces the cost to zero.

What’s the problem, you ask? The insurer and the PBM didn’t get the memo. After six months of taking and paying for the medication, the PBM’s records show the patient paying $6,000 and capping out his out-of-pocket maximum — when, in fact, the patient has paid nothing — the drug company picked up the tab. “There needs to be collaboration to flag that a co-pay coupon has been used,” Miller stresses.

————————-

Tyrone’s comment: In the interest of full disclosure I know Andrew personally so my comments will not come as a shock to him. My position is that co-pay cards are a good thing for patients and plan sponsors but not so much for non-fiduciary PBMs.

Here’s a quick story.

A few months back my mom shared with me that she was not on speaking terms with my uncle so I asked why. They often have these disagreements and all is back to normal in a few days. Apparently, she hired my uncle to repair her washer. Something had gone wrong such that it wouldn’t turn. It was an old top loading washer; my mom is frugal like that and won’t spend money on anything new unless it’s the last resort.

They had agreed on a price of $100 plus parts. Turns out my uncle looked at the back of the machine adjusted some sort of wire and the job was done in 30 seconds! My mom believed she overpaid and didn’t want to fork over the $100. She is wrong just like Andrew and here’s why.

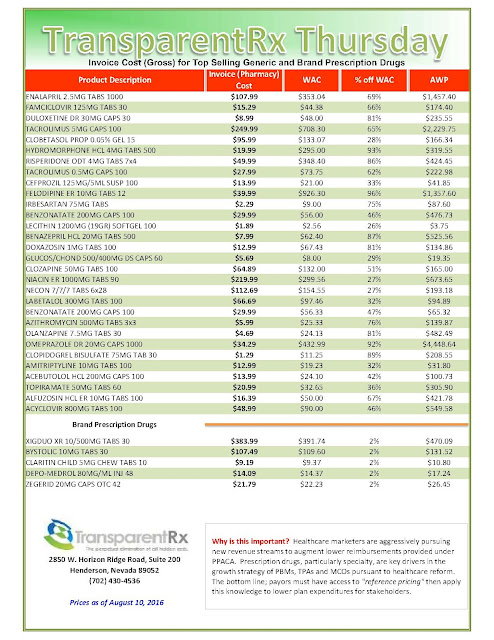

1) The payer has agreed to its share of the cost so why be concerned with how the patient delivers their end of the bargain hence the washer story. Payers need to be more concerned about the manufacturer revenue PBMs are earning [and not passing back] than the assistance patients are receiving for drugs which don’t qualify for rebates in the first place. This leads me to bullet number two.

2) This is more about the rebate dollars PBMs aren’t getting. Manufacturers offer incentives (rebates, fees, discounts, expenses etc..) in exchange for market share (preferred formulary tier) and when they don’t get market share they don’t pay rebates or not nearly as much. So when a patient is prescribed a non-preferred medication it is likely in lieu of one that is preferred which means the PBM gets zero or less rebate dollars. Instead of paying the money (rebates) to PBMs, manufacturers are reallocating it to patients in the form of lower out-of-pocket costs to boost market share.

3) Insurers will say they are still paying the same high prices with co-pay cards. The truth is they aren’t paying the same high prices because the tier determines their cost share. Tier 1 might be 80% cost to the insurer while Tier 3 is 50%, for example. If a plan sponsor’s formulary isn’t at least four tiers that is the problem not the co-pay cards. It is true rebates reduce net plan costs. But, so too do lower cost shares.

4) The less money patients pay out-of-pocket the less likely they’re to be non-adherent which theoretically means reduced physician and hospital costs for the plan sponsor.

As a fiduciary PBM, I could care less if a manufacturer is willing to fork over $1000, on a patients behalf, for a product we didn’t prefer or left completely off the formulary. We manage our formularies for outcomes and cost-effectiveness not for profit. Any revenue we receive from a manufacturer is passed back 100% to the plan sponsor which ultimately reduces net plan costs.

When two parties enter into an agreement one shouldn’t get upset how the other lives up to their end of the bargain provided it is done ethically and legally. Plan sponsors who don’t like co-pay cards probably agree with my mother’s initial reaction and have been influenced, either directly or indirectly, by non-fiduciary PBMs. My mom eventually paid the $100 now her and my uncle are again on good terms at least for now.

————————-

THE ROCKY BACKGROUND

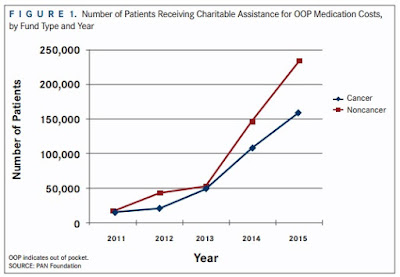

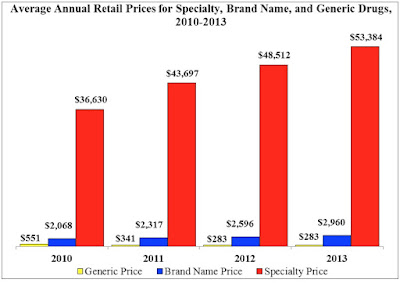

As prescription drug prices skyrocket, most notably for specialty medications, some consumers have simply been priced out of certain treatments. In theory, the co-pay card seems the perfect fix, lowering out-of-pocket expenses for commercially insured or cash-paying patients and, in doing so, expanding their treatment options.

“Adherence to doctor’s orders is one of the biggest challenges in the industry,” says Mike Boken, managing partner at BioCentric. And cost is arguably one of the biggest barriers to medication adherence. In fact, 27% of insured patients report a medication’s cost as the main reason for not filling a prescription, according to a Kaiser Family Foundation tracking poll.

It’s difficult to measure just how much cost affects a patient’s ability — or willingness — to follow through with a prescribed medication. According to Boken, cost may be a major influence, but it’s not the only driver affecting adherence rates. “Sometimes adverse events can affect the numbers. Sometimes a patient simply doesn’t like taking a medication,” he says.

Either way, medication cost is an issue for providers, too. Physicians often factor in the depth of a patient’s pockets when prescribing a new medication — and therefore they have been among the biggest and most vocal supporters of co-pay coverage programs. In a CMI/Compas study of promotional preferences, physicians surveyed across nine specialties placed a higher value on patient assistance programs than sample and voucher programs.

Millennial physicians, in particular, are hardwired to think about pricing and often pepper sales reps with questions about coverage and patient costs. “Younger docs grew up with these programs,” Boken says. “They’re still trained to use generics first, but they’re open to co-pay programs.”

But Boken stresses that cost is neither a singular nor an isolated driver. “Newer products usually have some points of differentiation from the generic older products, but the clinical benefit has to be there,” he adds. “Sometimes when we talk about co-pays and payer issues, we lose sight of that.”

Bob Hastings, VP of marketing at co-pay program provider TrialCard, counters that co-pay cards give physicians more flexibility in treatment options. “Physicians are trained to be the experts. We prefer they make a therapeutic choice on behalf of a patient rather than on the formulary’s wishes.”

Read more >>