10 Pharmacy Benefits Terms Everyone Should Know

Pharmacy benefits management is full of technical terms that can obscure critical details about pricing, utilization, and outcomes. For Benefits Leaders, understanding the right terminology is essential to managing risk, identifying hidden costs, and ensuring value for employees. Here are 10 Pharmacy Benefits Terms Everyone Should Know.

1. MAC Effective Rate (MER)

The Maximum Allowable Cost (MAC) list sets the reimbursement limit for generics. The MAC Effective Rate reflects the blended reimbursement across all MAC lists a PBM uses. Because PBMs can manipulate these lists to pad margins, monitoring your plan’s MER ensures you’re paying fair and predictable prices for generics. Many PBMs advertise extremely aggressive MAC Effective Rates (such as AWP minus 80% or more).

What they often fail to disclose is that these rates are tied to a narrow MAC list that covers only a small subset of generics most commonly dispensed to members. For the remainder of generic drugs, those excluded from the list, the PBM charges the plan sponsor at much weaker discounts (for example, AWP minus 15–20%). This practice significantly increases spread revenue for the PBM while making the “headline” MAC rate misleading.

2. Generic Substitution Rate (GSR)

This measures how often brand-name prescriptions are replaced with clinically equivalent generics. A high substitution rate is critical for cost control and should be 98% or better. For plan sponsors, tracking this metric shows whether cost-saving opportunities are being maximized or if employees are being steered toward more expensive options.

3. Medication Possession Ratio (MPR)

A key measure of medication adherence, MPR calculates the proportion of time a patient has access to their medication. An effective plan should target an MPR of 80% or better. Strong adherence reduces hospitalizations and overall healthcare costs.

Adherence rate is the single most important metric to determine if a pharmacy benefit manager is truly delivering value. High adherence indicates that patients are staying on therapy, which improves outcomes and lowers total medical spend.

Poor adherence rates, however, are a red flag. They often signal that the PBM is prioritizing claims processing over clinical outcomes, focusing on transactions rather than patient health. For Benefits Directors, tracking MPR alongside other metrics helps reveal whether your PBM is aligned with long-term organizational goals or simply moving claims through the system.

4. Rebate Yield

Rebate yield is the percentage of rebates retained relative to total drug spend. It should be at least 20% of brand drug spend. Monitoring rebate yield is critical for determining whether your PBM contract aligns with your organization’s financial goals.

5. Prior Authorization Approval Rate

This metric measures how often prior authorization (PA) requests are approved by the PBM. While the benchmark should generally be below 65%, the approval rate itself tells a deeper story about how the PA program is functioning.

High approval rates (e.g., 75% or higher) may indicate that:

- Overly broad PA requirements are in place, forcing prescribers to submit unnecessary paperwork for therapies that are ultimately approved anyway. This creates administrative burden without meaningful cost containment.

- The PBM may be using PA as a “speed bump” to generate revenue from administrative fees rather than as a clinical safeguard.

- The PA criteria could be poorly aligned with evidence-based guidelines, resulting in friction but little actual clinical or financial value.

Low approval rates (e.g., below 50%) may indicate that:

- The PBM is using PA too aggressively, potentially denying access to therapies that are medically necessary. This can frustrate patients and prescribers, lead to delays in treatment, and increase overall healthcare costs if patients deteriorate clinically.

- The criteria for approval may be misaligned with current standards of care, forcing appeals or switches that add unnecessary complexity.

- Denials may be used to steer patients toward preferred therapies or PBM-owned specialty pharmacies, prioritizing revenue over patient outcomes.

Balanced approval rates (ideally in the 50–60% range) suggest that:

- The PA process is being applied selectively to high-cost or high-risk therapies where clinical oversight is warranted.

- The criteria are evidence-based and designed to ensure safety, efficacy, and value without overburdening providers or patients.

- The PA program is contributing to cost containment and care quality rather than serving as a profit lever.

6. Medication Therapy Management (MTM)

MTM programs ensure patients, especially those with multiple chronic conditions, are on the right medications and taking them correctly. Features of a good MTM program include:

- Comprehensive medication reviews

- Personalized action plans for patients

- Drug interaction and duplication checks

- Follow-up interventions to ensure adherence

- Coordination with prescribers and pharmacists

For employers, MTM translates into lower claims, healthier employees, and fewer avoidable medical costs.

7. Specialty Dispensing Rate

Specialty drugs account for the majority of pharmacy spend. The specialty dispensing rate measures (as a percentage) how often prescriptions for these high-cost drugs are filled by PBM-owned or preferred specialty pharmacies. Since PBMs often mark up these fills, plan sponsors must monitor this rate to ensure that utilization is clinically necessary and cost-efficient.

It is also critical to pay close attention to how the PBM defines a “specialty drug.” Some PBMs use overly broad or vague definitions, which gives them the ability to classify almost any medication as “specialty.” This practice inflates costs and funnels prescriptions into higher-priced dispensing channels. A well-structured contract should limit the definition of specialty drugs to those that truly warrant the classification, based on cost, complexity, or storage/handling requirements.

8. Back-Billing

Back-billing occurs when PBMs withhold reimbursement to the pharmacy after the point of sale and keep those dollars without disclosing or sharing them with the plan sponsor. This hidden practice inflates PBM profits while reducing transparency. Benefits leaders should ensure their contracts prohibit back-billing and require disclosure of all revenue streams.

9. Pharmacogenomics (PGx)

The study of how a person’s genes influence drug effectiveness and safety. Pharmacogenomic testing has the potential to reduce trial-and-error prescribing, improve patient outcomes, and lower costs by avoiding ineffective medications. While adoption is still growing, it is a trend worth watching. A good pharmacogenomics program for self-insured employers is built on clinical integration, employee engagement, strong data management, measurable outcomes, and fiduciary alignment.

Testing should follow evidence-based guidelines such as CPIC and FDA labeling, with results incorporated directly into prescribing workflows so that physicians, pharmacists, and care managers can act on them in real time. The program should focus on drug classes with the highest risk for gene–drug interactions, such as antidepressants, opioids, oncology, cardiovascular, and pain management therapies. Equally important is making the program accessible and meaningful for employees.

10. Total Cost of Pharmacy Care (TCoPC)

This term looks beyond the unit cost of prescriptions and considers the full impact of pharmacy care on the health plan. TCoPC includes every dollar spent associated with offering a pharmacy benefit program including but not limited to ingredient costs, claims management services, clinical services, medical costs avoided such as hospitalizations, and overall patient outcomes. For Directors of Benefits, this is an most important measure because it shows whether your pharmacy strategy is reducing total health spend, not just shifting costs.

👉 Takeaway for Benefits Leaders: You don’t need to be a pharmacist to oversee your PBM effectively, but you do need fluency in its language. Knowing these terms equips you to ask sharper questions, identify misaligned incentives, and ensure your organization’s pharmacy benefit dollars are working for your employees, not your PBM.

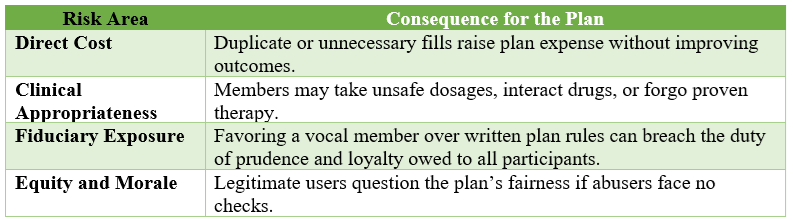

When pharmacy benefit managers operate without fiduciary responsibility, it’s employees and their families who suffer. Non-fiduciary PBMs often hide revenue streams, inflate drug costs, and steer members toward therapies that maximize their own profits rather than improve patient outcomes. The result? Higher out-of-pocket costs, barriers to cost-effective medications, and worse health outcomes for your workforce.

TransparentRx is different. As a fiduciary PBM, we are contractually bound to put your organization and your employees first. We eliminate conflicts of interest, disclose every dollar, and focus on driving true adherence and better health. Because when your employees can afford and access the medications they need, your company wins with healthier, more productive people.

Protect your employees from the hidden harm of non-fiduciary PBMs. 👉 Partner with TransparentRx and ensure your pharmacy benefits strategy delivers value where it matters most—at the point of care.