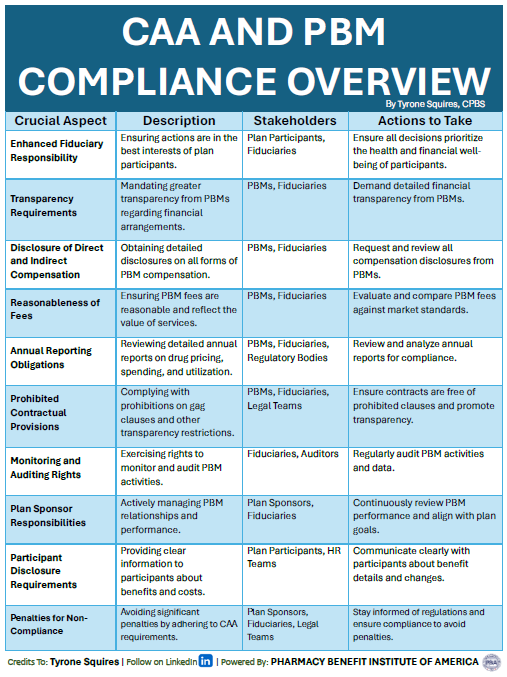

As a CHRO, it’s crucial to stay informed about the impact of the CAA on your fiduciary responsibilities in managing pharmacy benefits. Here are ten key aspects in understanding the Consolidated Appropriations Act (CAA) for pharmacy benefit management:

- Enhanced Fiduciary Responsibility: Prioritize the best interests of plan participants.

- Transparency Requirements: Demand greater financial transparency from PBMs.

- Disclosure of Direct and Indirect Compensation: Obtain detailed disclosures on all PBM compensation.

- Reasonableness of Fees: Ensure PBM fees are reasonable and reflect service value.

- Annual Reporting Obligations: Review detailed annual reports on drug pricing and utilization.

- Prohibited Contractual Provisions: Comply with prohibitions on gag clauses and other restrictions.

- Monitoring and Auditing Rights: Regularly audit PBM activities and data.

- Plan Sponsor Responsibilities: Actively manage PBM relationships and performance.

- Participant Disclosure Requirements: Provide clear information to participants about benefits and costs.

- Penalties for Non-Compliance: Avoid penalties by adhering to CAA requirements.

? Continuous Learning is Key ?

Engage in ongoing education and training to stay updated on regulatory changes and industry best practices. This will ensure you are well-equipped to navigate the complexities of the CAA and maintain compliance, ultimately protecting the interests of your plan participants and organization. Understanding the Consolidated Appropriations Act (CAA) for pharmacy benefit management is a key aspect of plan fiduciary responsibility.

Health plan sponsors must manage plan assets wisely and solely for the benefit of participants and beneficiaries. Fiduciaries are expected to possess expertise in their field or to seek guidance from subject-matter experts. The standard they must meet is that of a prudent expert, not just a well-intentioned layperson. Merely making a good faith effort does not suffice.