Federal and State governments are now keenly aware of the self-dealing which takes place in PBM arrangements. Ohio’s Attorney General, Dave Yost, is continuing to wage war on non-fiduciary PBMs or pharmacy benefit managers. You might remember him from an earlier blog post when he served as Ohio’s State Auditor.

AG Yost just announced a four-part proposal and called for quick action from the state’s legislature to shine a bright light on PBM contracts and cut down on hidden cash flows. Yost’s proposal calls for:

- Drug purchases in the state to be conducted under a master PBM contract that is administered by a single contact point

- Ohio’s Auditor of State to have full power to review all PBM contracts, purchases and payments

- PBMs to operate as fiduciaries, uh-oh!

- The state to prohibit nondisclosure agreements on drug pricing.

Last summer, in his previous role as state auditor, Yost learned PBMs earned nearly $225 million through spread pricing between April 2017 and March 2018 while operating in Ohio Medicaid. As a result, the state canceled all PBM contracts in Medicaid that used spread pricing.

2. Power is Consolidated

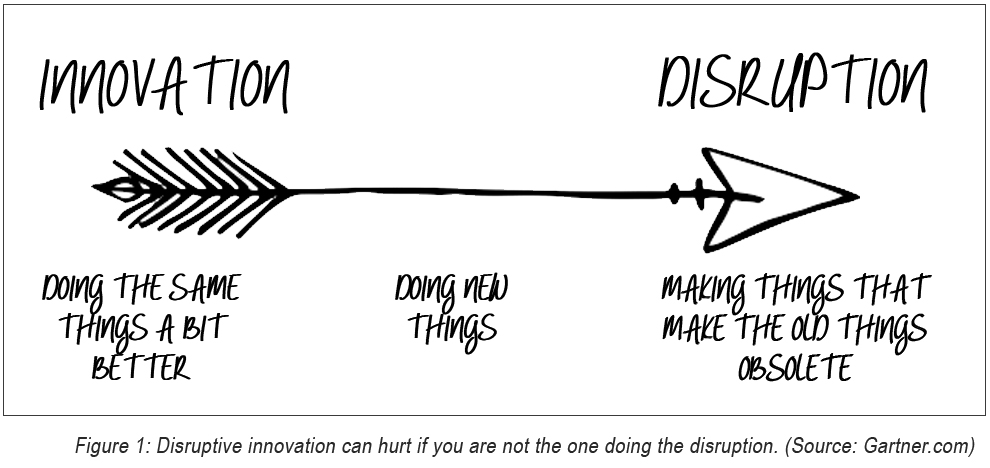

One of the important signs that an industry could be disrupted is imbalance, or dominance by one side of the economic equation. Oligopolies, where a few companies have consolidated vast amounts of the market share either on the supply or demand side, are often good candidates. Make no mistake about it ESI, Caremark and Optum is an oligopoly.

3. Business Practices aren’t Changing—Despite Negative Consumer Sentiment

The car rental industry is universally panned. Car Rental has a net promoter score of 23. (Just to give you a benchmark if you’re unfamiliar with the NPS, Apple has a net promoter above 80). Basically less than 1 in 4 rental car customers in the US would recommend these brands to a friend.

Enter Silvercar. They are working to create a simplified experience for renting a car. Something that might not be for everyone. But for the right person—say, a business traveler—it would feel like a godsend.

Despite the sentiments reflected above, car rental companies did very little to improve the overall experience—either because they didn’t want to, or simply couldn’t due to the complexity of their systems and operating models. The same is true for non-fiduciary PBM models and like the rental car industry purchasers have better options.

4. The Research Backs Me Up

I always recommend that people spend a lot of time, and even a lot of money, getting educated and doing research on the PBM industry. Why? Because education and research breeds confidence. Confidence in your procurement, monitoring and evaluation of PBM performance just works.

5. Established PBM Firms are Bogged Down in Their Own Infrastructures

Nimble startups developing alternative approaches to pharmacy benefits management are able to disrupt dominant incumbents in the self-insured market, particularly where the infrastructure of entrenched players hampers their own ability to innovate. Legacy PBMs can’t offer radical transparency and keep the lights on at the same time. So they “recruit” brokers pay them a handsome commission to keep the cash cow producing, for example. What self-insured employers don’t know is that those rebates you forgo for a lower admin fee are costing you millions! Large PBMs are finding it more feasible to partner with or buy out more nimble startups who are educating self-insured employers on these types of facts.

6. Customers Have to Work at Managing Their Costs

Another signal for disruption is that cost models are difficult to understand for customers. This is often the situation when the PBM profits by keeping customers heads in the sand. A good example, TransparentRx educates brokers, HR executives and CFOs to be better stewards of the pharmacy benefit. This greatly improves the results for purchasers of PBM services, most of whom don’t really know if what they are being told is the truth – “head in the sand.”

7. Inertia

Generally, the more established people’s habits, the higher the inertia, meaning they’re less motivated to consider alternative choices. Many PBM customers, for example, say that they dislike their PBM service costs and would be delighted to switch. But, the prospect of disrupting the member experience and attending implementation meetings is so overwhelming that it’s easier to just stay where they are. Wherever customers feel trapped by inertia in a situation they find less than desirable is where I find tension. Opportunities are being created to either break or leverage that inertia with self-insured employers who act out of habit.

Source: https://www.zdnet.com/article/5-reasons-the-financial-industry-is-ripe-for-disruption/

Source: https://sloanreview.mit.edu/article/three-signals-your-industry-is-about-to-be-disrupted/