Over the last several years, I’ve had conversations with brokers and PBM consultants around how to lower pharmacy costs. In these conversations, I always stress the importance of PBM contract language. That the language (transparency or lack thereof) in the contract will have the biggest impact on PBM performance is clear. More specifically, whether or not a plan sponsor has entered into a fair deal or bad deal with a pharmacy benefits manager.

If you still believe spreadsheeting is the best way to evaluate PBM proposals, then I’ve probably lost you already. Using spreadsheets as the primary tool in evaluating PBM proposals is like buying a car without ever looking under the hood! It is the equivalent of signing the sales agreement only to find out later the price didn’t include an engine.

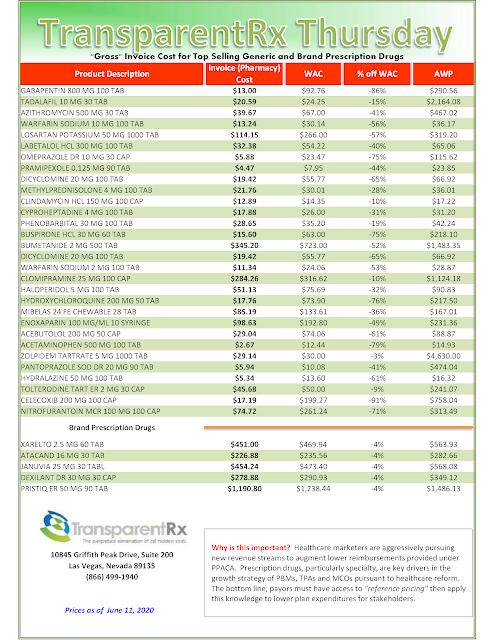

Spreadsheets are just easy and what most evaluators of PBM proposals are most comfortable with. They are numbers so it is simple to rank the results. Far too often the “lowest” cost wins and the better or more transparent deal is left in the cold. The truth is non-fiduciary PBMs have learned how to leverage the purchasing power of unsophisticated plan sponsors to their financial advantage. In other words, they give you the optics or what you want to see in exchange for what essentially equates to a blank check.

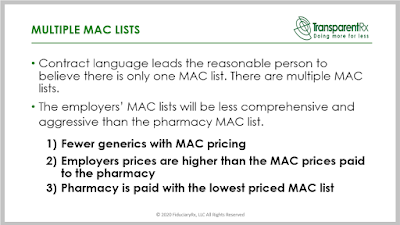

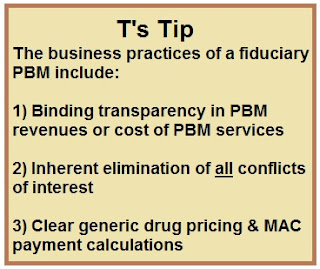

PBM contract language gives the purchaser a peek into the future as to what is really going to happen. Proposals with opaque contract language should de discounted. Conversely, proposals with radically transparent contract language should be given a premium. Make sure your broker or consultant is an expert at scoring PBM contracts. Ask for samples of their contract scorecards and the methodology. That is step one. Step two is to make sure your consultant maintains a PBM contract management system.

Many of those conversations I mentioned at the beginning, uncovered the broker or PBM consultant didn’t know where their clients’ contracts were located. Even more scary is they didn’t know if the PBM would give them a copy. In our personal lives contracts reign supreme but when it comes to pharmacy benefits some stakeholders can’t even find the darn thing.

With so much at stake it belies professionalism. It’s no wonder 90% of plan sponsors are overpaying to provide a pharmacy benefit to their employees. The one thing which matters most is being placed at the back of the line. This is as bad as it gets.