How Accumulator Programs Exploit Patients and Drive-Up Medical Costs [News Roundup]

How Accumulator Programs Exploit Patients and Drive-Up Medical Costs and other notes from around the interweb:

- How Accumulator Programs Exploit Patients and Drive Up Medical Costs. Accumulator programs collect the maximum amount of patient copay assistance at the start of a year, to exclude it from the patient’s annual cost-sharing limits. They target unsuspecting patients and send them hefty, unanticipated medical costs later in the plan year. A California woman with stage 4 lung cancer, the named plaintiff, sued after Blue Cross Blue Shield (BCBS) blocked her from accessing AstraZeneca’s co-pay assistance for Tagrisso, an expensive specialty medication. AstraZeneca provides co-pay assistance to commercially insured patients like her, but the lawsuit claims BCBS’s involvement in SaveOnSP deprived her of this benefit, forcing her to shoulder excessive healthcare expenses.

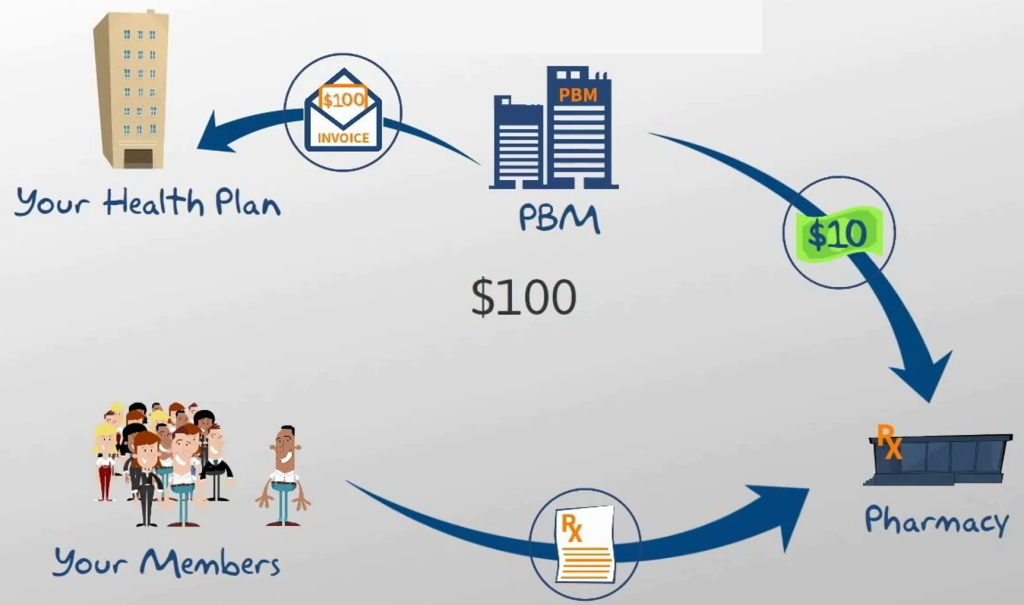

- Drugmakers paid pharmacy benefit managers to avoid restricting opioid prescriptions. There have been many entities accused of being the culprits of the spread of opioid abuse across the country during the last few years. One group had not been held accountable — until a recent New York Times investigation exposed how Big Pharma incentivized pharmacy benefit managers not to restrict painkiller prescriptions. This information has added a new layer of blame to a convoluted crisis. For years, pharmacy benefit managers “took payments from opioid manufacturers,” including Purdue Pharma, in return for “not restricting the flow of pills,” The New York Times said in its exposé. As tens of thousands of Americans succumbed to overdoses and the opioid crisis raged on, “the middlemen collected billions of dollars in payments.” The benefit managers “exert extraordinary control over what drugs people can receive and at what price,” the Times said.

- How a Duty To Spend Wisely on Worker Benefits Could Loosen PBMs’ Grip on Drug Prices. Ann Lewandowski knows all about pharmacy benefit managers, or PBMs, the companies that shape the U.S. drug market. Her job, as a policy advocate at drugmaker Johnson & Johnson, was to tell patient and physician groups about the PBMs’ role in high drug prices. Armed with that knowledge, Lewandowski filed a potentially groundbreaking lawsuit in February. Rather than targeting the PBMs, however, she went after a big company that uses one — her own employer, Johnson & Johnson. Lewandowski charges in her lawsuit that by contracting with the PBM Express Scripts, which is part of the insurance giant Cigna, Johnson & Johnson — which fired her in April — failed in its duty to ensure reasonable drug prices for its more than 50,000 U.S. employees.

- PBM Contracting and Administration: What Are the Rules of the Road for Self-Insured Employers? Recently, PBMs have faced growing scrutiny, especially for their role in drug pricing and lack of transparency. Less attention has been given to the misuse of drug formularies—the foundation of drug benefits, listing medications covered by health insurance. While some argue formularies’ purpose has remained consistent over 30 years, others disagree. Initially, a pharmacy and therapeutics committee within a PBM, health plan, or other organization developed drug formularies. Clinicians and other experts on the committee determined the drug’s safety, efficacy, and unique clinical aspects. If the drug met their standards, they placed it on the formulary.

Why TransparentRx Is Your Trusted Partner for Smarter Pharmacy Benefits

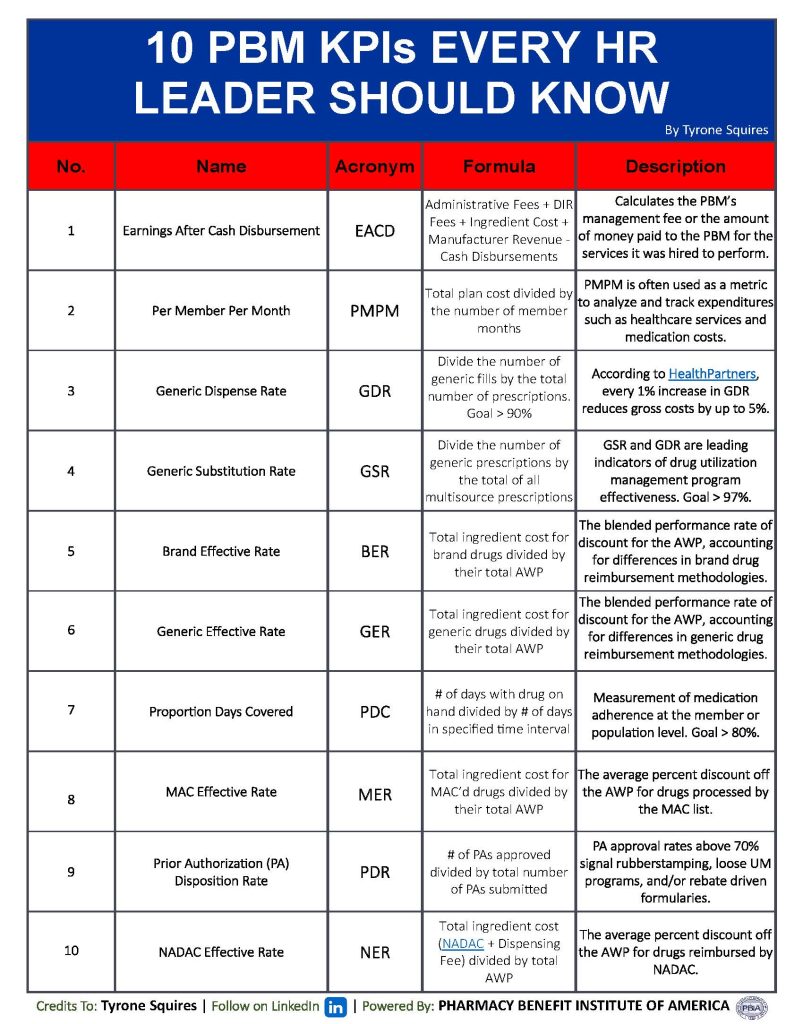

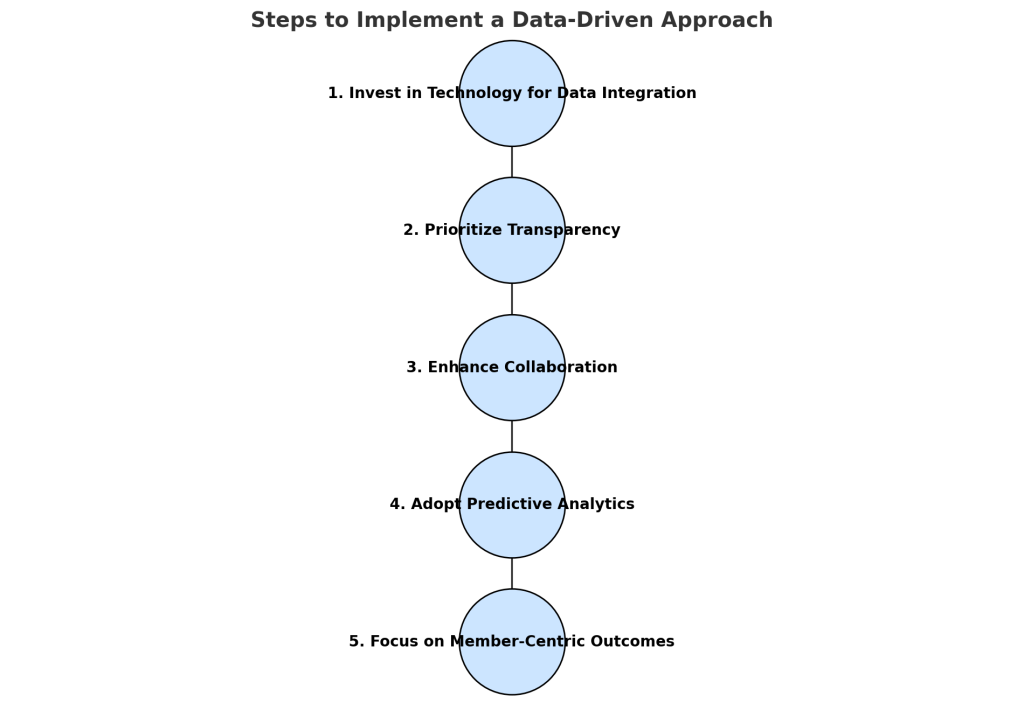

At TransparentRx, we specialize in delivering fiduciary pharmacy benefit management services that prioritize transparency, cost containment, and optimal patient outcomes. Our unique approach helps self-funded employers, benefits consultants, and health plan sponsors navigate the complexities of pharmacy benefits while reducing costs and enhancing care.

If you’re ready to take control of your pharmacy benefit strategy and eliminate hidden fees, contact TransparentRx today for a consultation. Let us help you achieve smarter, more effective benefits management.