Is self-funding the solution to growing medical and drug costs? [Weekly Roundup]

Is self-funding the solution to growing medical and drug costs and other notes from around the interweb:

- Is self-funding the solution to growing medical and drug costs? So, is self-funding the solution? First, let’s debunk the myths about self-funding and examine its advantages and disadvantages to determine whether it is right for your organization. Self-funding, especially for smaller organizations, is more common than most employers think. According to Kaiser Family Foundation, in 2020, 23% of employers with two to 199 plan participants were self-funded. From 100 – 199 plan participants, the percentage of employers that were self-funded grew significantly and from 200 – 1,000 participants, nearly 60% of employers were self-funded. Still, many smaller organizations with fewer than 200 employees believe they can’t self-fund because they don’t have a large enough group. Employers with at least 100 participants typically have enough data to make educated decisions around their funding and can have more opportunities for savings.

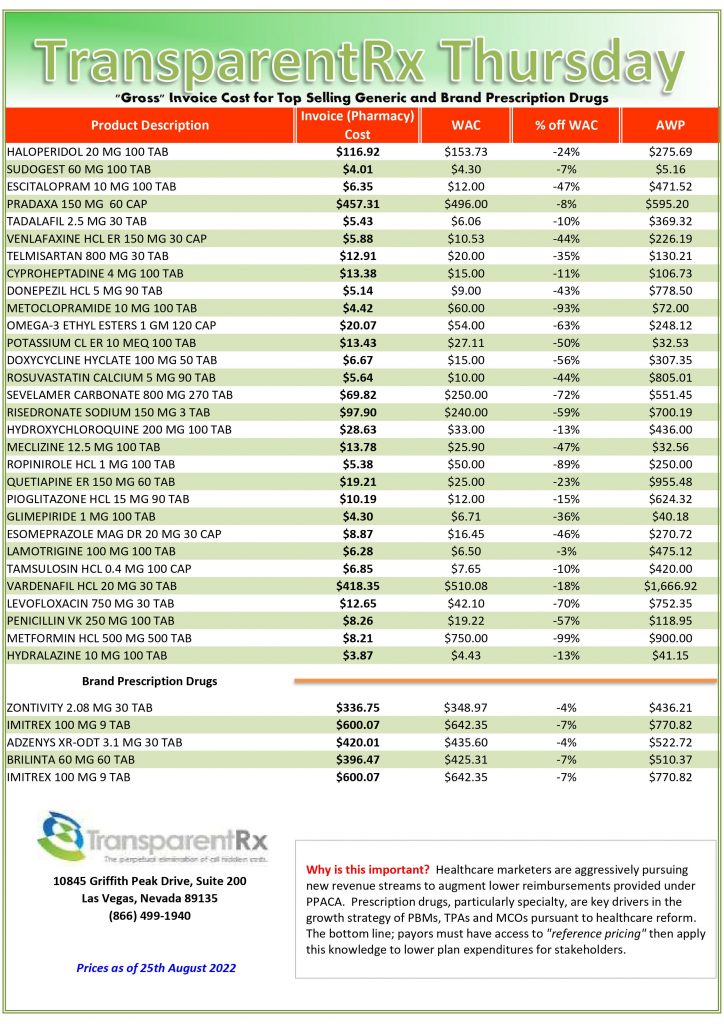

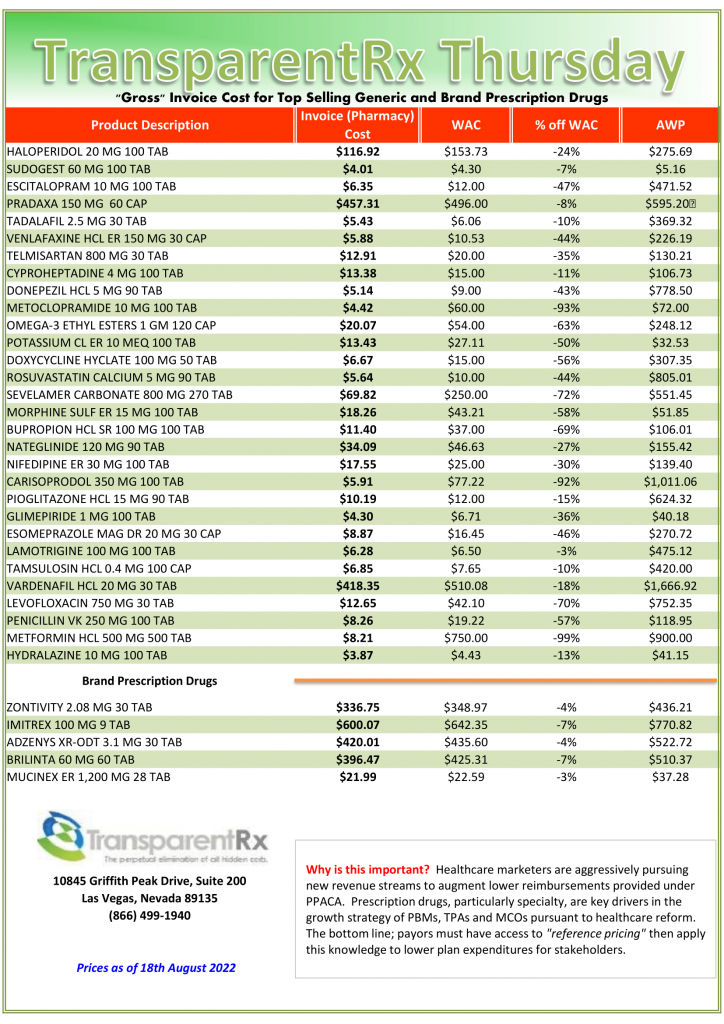

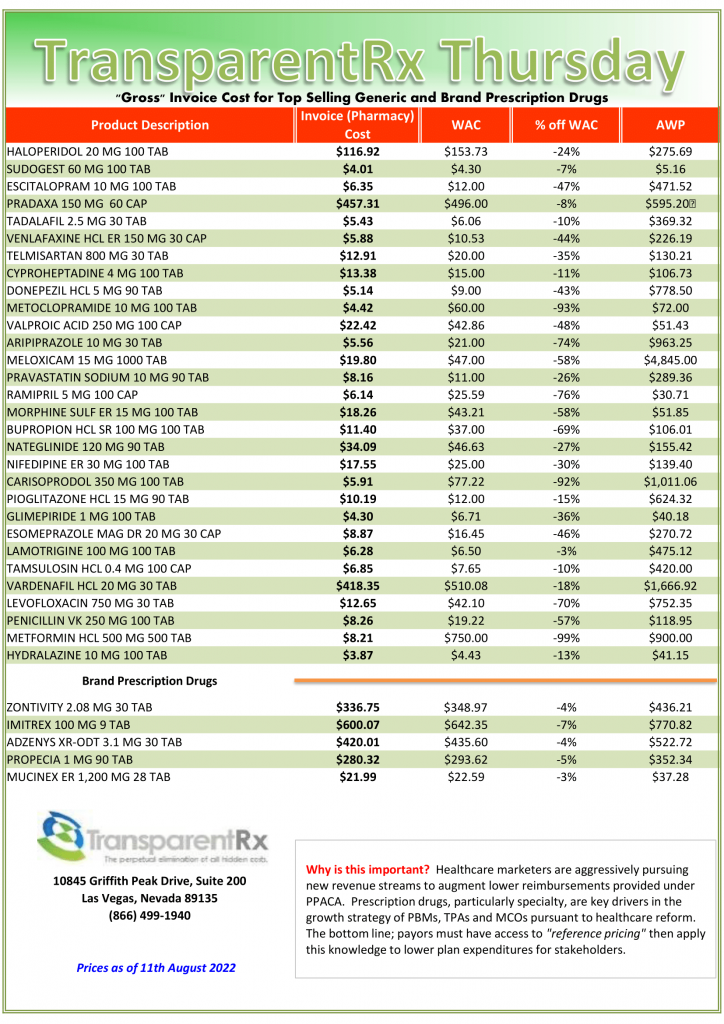

- Six Things to Look Out for Within the Rebates Section of Your Pharmacy Benefit Management Contract. Prior to signing your Pharmacy Benefit Management (PBM) contract, it’s essential to pay particularly close attention to the pharmacy services that provide cost-containment strategies. One vital component you should focus on is the rebate administration. Today, we are sharing six areas within the rebate section of your PBM contract, to help you maximize savings and mitigate risk.

- How specialty drug ‘solution stacking’ can rein in pharmacy benefit costs. Brokers and employer groups alike know that 5% to 10% percent of insured workers and their dependents drive 50% to 60% of the cost of pharmacy claims. A few members with prescriptions for a specialty drug with a five-figure price tag can easily represent most of an entire group’s pharmacy spend. These drugs are often lifesaving or provide a dramatic quality of life improvement for those who take them. No one would question the necessity of using them. But when a group can mitigate some of the cost without affecting the clinical outcome, it can be a game changer. The broker who unlocks these savings becomes a trusted ally.

- Newly launched U.S. drugs head toward record-high prices in 2022. Drugmakers are launching new medicines at record-high prices this year, a Reuters analysis has found. The median annual price of 13 novel drugs approved for chronic conditions by the U.S. Food and Drug Administration so far this year is $257,000, Reuters found. They were in good company: seven other newly launched drugs were priced above $200,000. Three other drugs launched in 2022 are used only intermittently and were not included in the calculation. Last year, the median annual price rose to $180,000 for the 30 drugs first marketed through mid-July 2021, according to a study published recently in JAMA. While the Reuters tally does not completely replicate the work of that study, it shows that the direction of new drug prices continues to be on the rise.