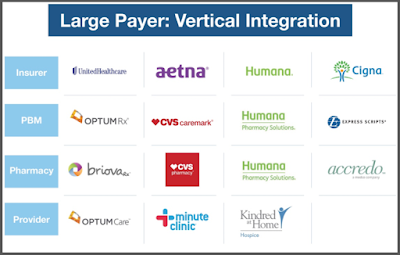

Tuesday Tip of the Week: Vertically Integrated Insurers Pivot to Protect Drug Manufacturer Revenue

|

| Click to Learn More |

Humana Inc. has agreed to join a purchasing group run by rival Cigna Corp. in a move that the health insurer says will help drive down its drug costs for its commercial members. Beginning April 1, Humana will join a Cigna purchasing organization called Ascent Health Services to give it access to greater discounts from drugmakers, the companies confirmed to Bloomberg News. Ascent manages commercial rebates, the payments that drugmakers make to health plans. The agreement covers drug contracting and negotiations for Humana’s commercial business.

“This arrangement will help us leverage scale and buying power to extract deeper price discounts from drug manufacturers and advance affordability for our customers while at the same time preserve our ability to address their specific clinical needs,” Humana spokeswoman Kelley M. Murphy said in an email.

Tyrone’s Commentary:

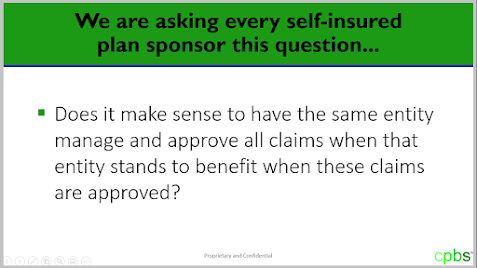

This move and others like it are a play to hold on to the undisclosed cash flows non-fiduciary PBMs generate from drug manufacturers for rebates. In place of rebate disguising, non-fiduciary PBMs charge manufacturers fees as part of the GPO or group purchasing organization. This arrangement technically (by passing through all manufacturer revenue less GPO fees to plan sponsors) allows non-fiduciary PBMs to be in compliance with the new regulations being placed on us by departments of insurance across the country. Radical transparency requires that plan sponsors are able to verify the fees earned by PBMs in these GPO arrangements.

Cigna and Humana both sell health insurance and other medical services, including pharmacy benefits. Cigna has expanded its footprint in the pharmacy business since its 2018 acquisition of Express Scripts. In 2019, Cigna announced a three-year deal to work with Prime Therapeutics LLC, a pharmacy-benefit manager owned by Blue Cross and Blue Shield plans. Cigna executives have described how working with outside partners like Prime can increase purchasing leverage with drugmakers.